Would you rather have the lowest mortgage rate or the lowest borrowing cost?

If you picked the latter, good for you. You’re mortgage savvy, and you’re in the minority.

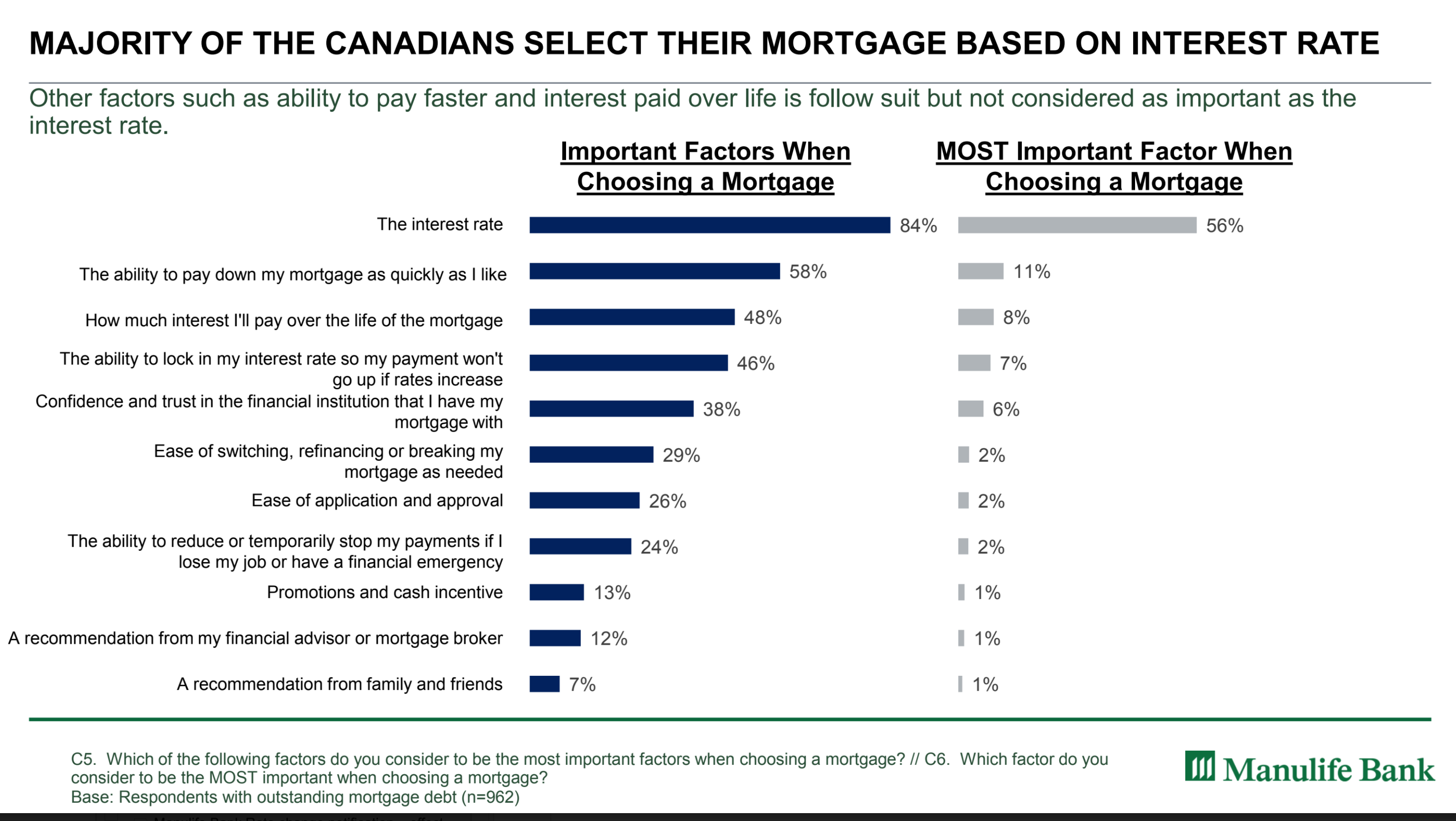

Check out this chart from a recent Manulife survey. Its findings show that the “interest rate” dominates all other factors when consumers pick a mortgage. That’s great news for a rate comparison site like this one, but it’s not great news for borrowers.

According to respondents, “how much interest I’ll pay over the life of the mortgage” is far less important than the rate. That’s like judging the fastest sports car by horsepower alone. One metric doesn’t tell the whole story.

The interest rate reflects but one component of mortgage cost (the regular interest expense). It doesn’t reveal the other ways lenders “get ya” in the pocketbook.

The reason the interest rate is such a dominant consideration for borrowers is because most people can’t quantify what else a mortgage lender might charge them.

In fact, there’s a laundry list of extra costs. Many lenders, for example, have:

- High mortgage penalties for refinancing or terminating early

- High rates when existing customers try to refinance before maturity

- High rates when existing customers try to convert a variable to a fixed

- High rates when existing customers try to renew

- Tight restrictions on how long you can port with no penalty

- Penalties if you need to increase your mortgage before maturity

- Prepayment restrictions

- No ability to renew early (a potential problem in a rising rate environment)

- More costly compounding on floating-rate mortgages

- High discharge fees, reinvestment fees, and,

- Less favourable registration methods — e.g., collateral charge mortgages, which are inappropriate for many.

If drawbacks like these never affect you, then selecting the lowest rate (for the most suitable term) will save you the most money. But the odds are against you not needing flexibility.

The statistical reality is that most people change their mortgage sooner than every five years. And that’s where the fine print in a lender’s contract can easily cost you the equivalent of 0.10% to 0.50% extra interest per year.

Unfortunately, it’s not easy to quantify the benefit of mortgage flexibility. In theory, if you wanted to evaluate the true “best” mortgage, you’d have to:

- make assumptions about what changes you might make to the mortgage

- predict when you might make those changes

- estimate future interest rates

- calculate the expected borrowing cost of each mortgage given these factors

- objectively compare all this information.

In practice, that’s near impossible for most consumers, and even for most bankers and brokers.

This is why so many borrowers focus on the rate instead of what they may actually pay.

At the Spy we’re developing technology to make this analysis process easier for you. It’s a ginormous programming undertaking, but it’s coming and we’ll keep you posted.

In the meantime, don’t be afraid to pay a little extra for a highly flexible mortgage, especially if you’re locking into a 5-year fixed rate. Five basis points more on the rate could save you 20 after closing. True fact.

log in

log in

7 Comments

As much as you like to gripe about the new B-20 rules, it will mean no more borrowers choosing a 5yr fixed term because it is the only way to qualify.

5yr variables have just 3 months interest for penalties. If you have to terminate a 2yr fixed early the IRD will be no more than 3 months interest, while with 5yr fixed the IRD penalty is often 2-3x higher.

Good to hear this reminder about the quality/flexibility of the mortgage product vs. the lowest rate. So many people fail to look at the bigger picture and take the time to determine the best rate for their situation. Your last paragraph summarizes this perfectly

@Ralph

If people with higher debt ratios take a shorter term to qualify, and that exposes them to greater rate risk at renewal, how is that better? That sounds like a legitimate gripe to me.

As for “If you have to terminate a 2yr fixed early the IRD will be no more than 3 months interest”, that is a false statement.

If you get a big bank 2 year mortgage and rates drop, you could easily pay the IRD. It may not be as big as the IRD on a 5-year fixed but it’s still more than 3 months interest.

@GTA Broker

I have yet to see any evidence that taking a 2yr fixed exposes a borrower to greater risk at renewal than a 5yr fixed. Have you?

As for IRD, how about you post the numbers comparing a 2 & 5 year fixed cancelling after 1 year. I’d use Scotia since they have the larges broker market share. Then everyone can see just how huge the penalties are on the 5yr. And as for your boogeyman of dropping rates, run the numbers on a 1% drop in rates if you really want to prove my point of how bad the penalties can be with a 5 year fixed.

@Ralph

Evidence? Isn’t it just common sense?

If you get a 2 year fixed and rates go up 2% by maturity, you’re paying more interest than if you had a 5 year fixed AND you have less equity as a buffer for refinancing.

As for IRD, I never said the 2yr IRD was bigger than a 5 year IRD. I said it was bigger than a variable 3 month interest penalty.

You can do the math for yourself here: http://cgi.scotiabank.com/mortgage/Scotia_Prepayment.html

By the way, almost no one breaks a 5 year fixed after the first year so your premise is flawed.

@GTA Broker

Common sense or common stupidity? If you get a 2yr fixed, you are paying less than a 5yr fixed, and rates could also go down at maturity. Rob and others have looked at the numbers to show how 90+% of the time borrowers are better off with a 5yr variable vs 5 year fixed. The same analysis can be done on 2yr vs 5yr fixed. It’s based on historical rate data, but you probably have your own “alternative facts” to justify your “common sense”.

You need to stop using straw man arguments, and I need to stop feeding trolls…

@Ralph

I understand that nescience breeds defensiveness so I’ll ignore your insults.

A person is guaranteed to pay less with a 2 year term only for the first two years.

If someone takes a 2 year fixed at 2.50% instead of a 5 year fixed at 3.00% and rates increase even .9% by maturity, that 2 year fixed decision will cost them. People with high debt-to-income cannot afford to pay more. That is the point. Choosing a term is an exercise in risk management. I don’t know how else to explain that to you.

I might add, the law in Ontario requires brokers to recommend suitable mortgages. FSCO tells us to document why we make specific recommendations. I can tell you that historical performance alone is not reason enough to put highly leveraged clients in a short term mortgage. That is all the more true with Canada in an economic expansion where the Bank of Canada is predicting further rate increases.