And that’s as the government intended.

And that’s as the government intended.

Albeit, the deceleration may be less pronounced than some might expect, given all the recent headlines about this year’s real estate slowdown and mortgage rule tightening.

Here are fresh new mortgage stats from CMHC and Equifax (as of second quarter of 2018):

- Number of active mortgages: 5.98 million

- This number essentially stayed the same versus Q1, which is not typical

- Normally the mortgage count grows in Q2

- By comparison, last year saw mortgages grow by 32,000 in Q2’17 vs Q1’17

- Mortgage originations in Q2: 205,000

- Down 11.9% year-over-year

- Average mortgage size for new mortgages in Q2: $276,310

- That was a $5,860 drop versus the prior quarter

- This $276,310 figure includes all purchases, refinances and switches (but not renewals with the same lender)

- The average mortgage size for all existing mortgages is much lower: $205,980

- Total outstanding mortgages (by value): $1.232 trillion

- That’s up 5% year-over-year, despite the slowdown in mortgage units.

Here are some individual mortgage metrics:

- Average scheduled monthly mortgage payment: $1,260

- Up 4.1% year-over-year

- For new mortgages in Q2, the number was $1,420, up 3.9% year-over-year

- Share of new mortgages with a low credit score: <1%

- The average credit score (“Equifax Risk Score” score) for mortgage holders was 754

- Number of mortgages written off by lenders in Q2: 5,820

- Down a very notable 14.7% year-over-year and in keeping with the improvement in prime mortgage quality

- Unfortunately this says little about the quality of the fast-growing non-prime mortgage segment, since many of these loans are not tracked by Equifax

- Percentage of mortgagors with very good (700-749) / Excellent (750+) credit scores: 18.9% / 62.5%

- In all, 81.4% of Canadian mortgage holders are above the 700 credit score threshold

- The minimum score to get the best rates is usually 680, but lenders are increasingly looking for 700 or 720

Mortgage Share Drops

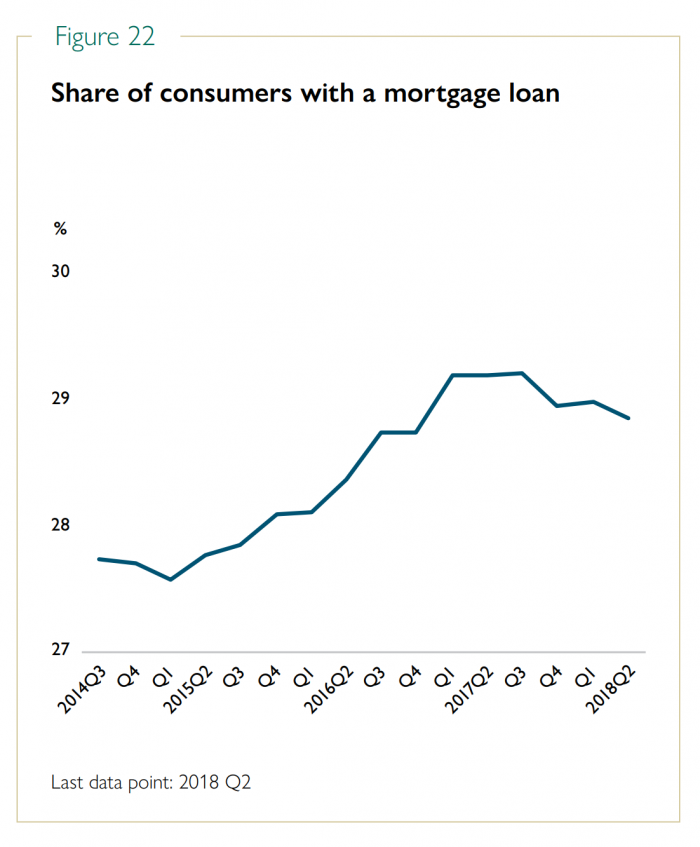

Here’s a chart that won’t surprise anyone, given tougher mortgage stress testing, higher home prices and rising rates. All these factors affect borrower qualifications and mortgage demand. And, of course, the harder mortgage approvals become, the fewer people that get them.

Relying on Credit

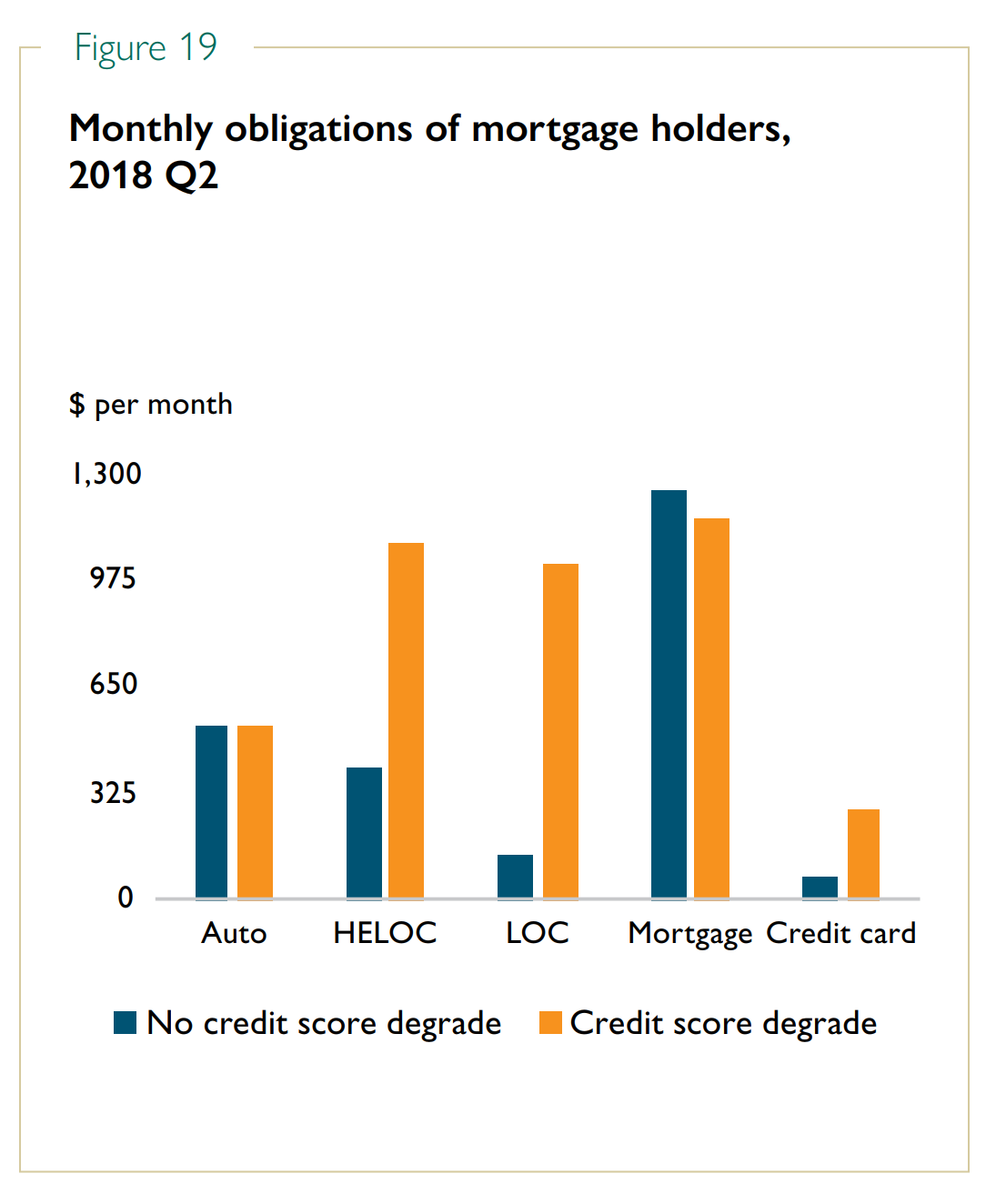

Here’s another chart that screams intuitive logic. Check out how much more people borrow when their credit is deteriorating. Is it any wonder that lenders often raise credit line interest rates on borrowers with falling credit scores and surging credit utilization?

But that doesn’t tell the whole story. As CMHC notes, “Credit score degradation can be the result of various factors, such as recently incurred additional debt or late payments to an existing account.”

When it comes to HELOCs, these numbers may be a bit skewed. The reason: a credit-worthy borrower can get a brand new HELOC and see his/her score tumble overnight. That sometimes happens because Equifax’s scoring algorithm deems them to have a worrisome increase in credit utilization, even though their HELOC is simply a mortgage substitute.

One of this author’s clients recently saw his credit score plunge almost 60 points after getting a new HELOC. The client had no other credit changes. He simply preferred an open HELOC instead of a regular mortgage, and it cost him from a credit standpoint.

Story data sources: CMHC & Equifax

log in

log in

2 Comments

I’ve been saying since last December that the credit cycle peaked in mid 2017 and has been contracting since. Although this may appear to be a policy driven contraction there are some suggestions that the market was rolling over naturally. People borrowing at the limits of their affordability suddenly found that it was becoming harder to keep up with their debt obligations at higher interest rates. A large group of other borrowers no longer saw an incentive in purchasing assets that had stop appreciating in value. After all, getting involved in bidding wars when the underlying asset price plateaus or drops just becomes a competition to see who’s willing to pay the most in interest charges to a bank. However this may be a short live contraction if interest rates stop rising or if mortgage regulation are walked back (very possible). The other scenario is a little more complicated. It was alluded to in an earlier article that the banks reported near microscopic growth in their YoY net interest margins during the last reporting period. But why was that the case given the 4 rates hikes by the BoC over the past year? Hint: look at the yield curve. More importantly, what does that imply for the banks willingness to increase funding for mortgages going forward?

Thanks for the comment, Yolo. The credit contraction can’t be attributed to one change, but the stress test was a big one. It joined a host of other factors including stretched valuations (as you note), rising qualifying rates (as you note), new real estate-related taxation, the negative sentiment that resulted, stricter documentation rules, etc.

On your point about the yield curve (which is a good one), it’ll also be interesting to watch how deposit competition impacts NIMs: https://ca.reuters.com/article/topNews/idCAKCN1NU0PF-OCATP

The same thing happening in mortgages is happening in deposits: consumers are getting wiser to noncompetitive rates, thanks to that wonderful invention called the interweb.

Will banks be able to hold out paying garbage rates while competitors electronically steal the deposits of their millennial customers? I think not. There’s going to be a whole new hunt for efficiency at banks, so banks can afford to be competitive and still hit their estimates each quarter. For banks to do that, they’re ultimately going to have to focus as much on controlling the top of the funnel (real estate listing sites, rate sites, etc.) as they focus on managing the yield curve.