In recent weeks, lenders’ funding costs for variable-rate mortgages have jumped up to one-tenth of a percentage point. That’s largely due to higher-perceived credit risk in the overall financial markets.

Being the profit-seeking enterprises they are, lenders have passed along that bump-up in costs to new borrowers. That means you’ll now pay roughly prime — 0.75% to prime — 0.85% for the most competitive variable rates in the market.

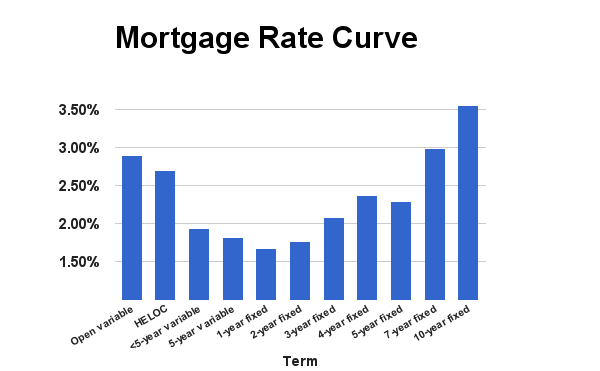

It also means that 2-year fixed rates in the 1.80s and 1.90s have suddenly become all-the-more compelling to risk-tolerant borrowers. In fact, two-year terms are arguably the best short-term value in the market today. One-year rates are decent too, but they require you to renew again in less than 12 months (which may entail fees and hassle), and they don’t afford as much rate-hike protection.

In the 5-year fixed segment, the most competitive rates have either held steady since our last update, or risen 0.05% to 0.10%-points, depending on the lender. You can still get tremendous long-term fixed values, however, at just 2.44% to 2.59%, or less.

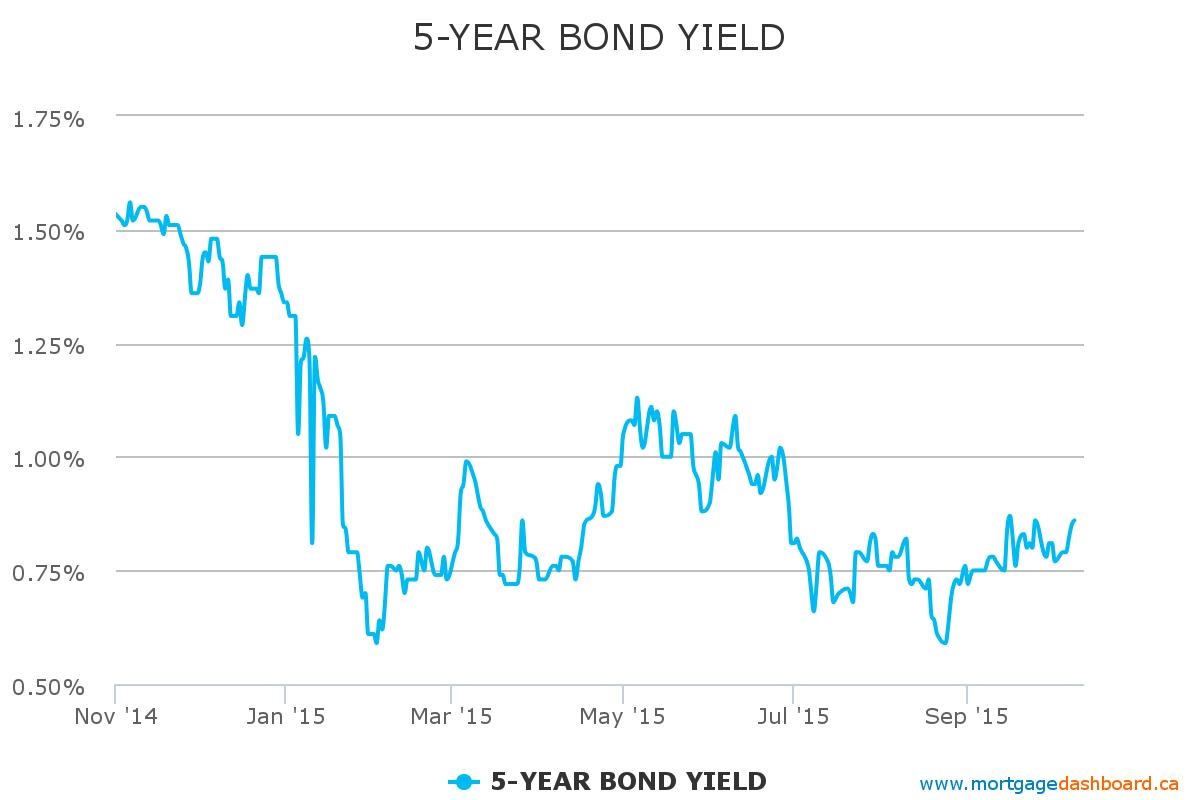

As usual, fixed rates are at the mercy of the bond market, which has been trading sideways for a month and a half. Financial traders are waiting for a convincing breakout above 1.00% or a breakdown below 0.70% on the 5-year government yield. Until then, fixed rates likely won’t budge (much).

The chart below shows the average best rates for each mortgage term on RateSpy.com. It paints a good picture of the rate premium you’ll pay for the security of a fixed rate and/or longer term.

log in

log in

7 Comments

What type of impact will the change in government have on rates, if any?

Hi TF, The economic analysis we’ve seen thus far estimates that rates could bump up anywhere from 1/10th to 2/10ths of a percentage point. i.e., not huge, but still meaningful to personal finances.

The impact would largely reflect the expected Liberal budgetary deficit and the slightly higher inflation risk that results from fiscal stimulus.

I expect any inflationary pressures to be offset by even lower oil prices once sanctions are lifted and Iran adds half a million barrels per day to their exports.

I also expect the insanely cheap natural gas prices (<US$2.50/mmbtu) to eventually filter through to consumers, starting with lower winter heating bills. Eventually retail electricity rates should come down as well, as wholesale rates have been holding around 2.5c/kWh (see pjm.com)

Hey there Ralph, Your call on oil & gas could certainly pan out. If it does, the potential disinflationary effect would make today’s cheap 1-year, 2-year and variable rates quite cost-effective.

Are we nearing the end of the hay days for variable rates do you think? Three months ago I was seriously considering switching to a variable rate when my mortgage comes up for renewal in March. But now the safety of a fixed rate is starting to look good again.

Variables aren’t dead yet, albeit we won’t see prime – 0.95% again for a while.

At the moment, you still have lots of options at 1.89% to 1.99%. We can quibble about 10th’s of a per cent, but prime – 0.75% or better (at today’s level of prime) still gets you a damn good rate in a low-inflation environment.

Agreed! I’m old enough to remember holding a mortgage in the 80s and I’ll take today’s rates any day – fixed or variable!