The latest mortgage rate intel…

- Variable rates. The fix is in?: Variable rates have gone vertical, ramping up 25-35 basis points in a matter of weeks. It seems like every 6-7 days we’re hearing banks cut discounts from prime by another 5 bps or so. This week was no exception. Sure, the banks have faced an array of funding cost pressures, but nothing seemingly explained their continued relentless variable-rate hikes. That is, until this morning’s news. Ottawa just announced policies that should make it more expensive for lenders to securitize mortgages (resell them to investors) and hold mortgages on their balance sheets. These moves will increase lenders’ costs further, which is why they may be building in a buffer by hiking rates. They may also be front-running further Bank of Canada (BoC) rate cuts, which would squeeze their profits even more.

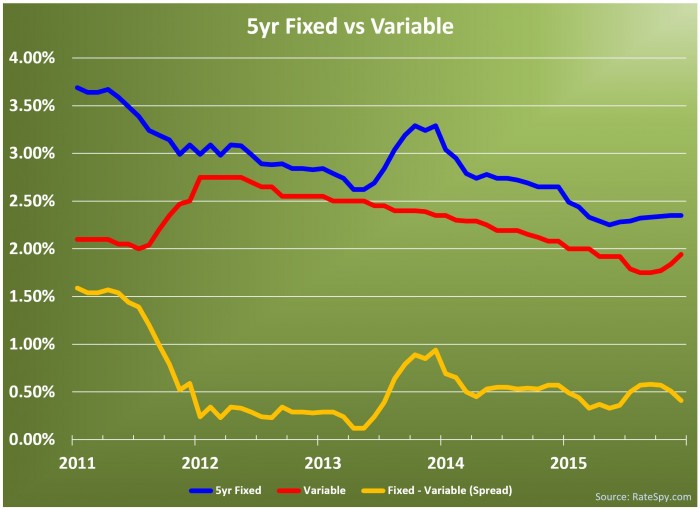

- Fixed vs. Variable: The difference between them (a.k.a., the “spread”) ain’t what it used to be. While we’re not quite back to 2013 levels, the fixed-variable mortgage spread grows narrower by the week. It now stands at just 45 bps, give or take. For many borrowers, that small reward—in exchange for borrowing cost uncertainty—removes the incentive to go variable. After all, even if the BoC cuts another half point, variable-rate holders would be lucky to see prime rate fall by even half that.

- What’s driving rates: On Tuesday, MoneySense ran a story on what’s pushing up mortgage rates. In it, I note that the mortgage policies imposed by Ottawa will “keep rates higher for years to come.” That doesn’t mean that rates can’t drop further. Quite the opposite. Mortgage rates can still (and eventually will) make fresh record lows. But regulatory measures are making it more expensive for lenders to lend, which will keep rates higher than they otherwise would have been.

- Crude on sale: The price of oil is now down in the mid-thirties, almost 30% below where it was when the Bank of Canada cut last July. An extended stay at these levels could wreak havoc on business investment and grease the way down for rates. There’s so much chatter about Canadian rates following the U.S. Fed higher. Well, be prepared for an epic rate divergence if oil heads further south. It’s already started (this chart shows U.S. and Canadian 5-year bond yields over the last month). Back in July, the Bank of Canada expressed concern about plunging oil’s disinflationary effect, but nonetheless optimistically predicted that growth would “begin to exceed potential again in the fourth quarter.” That optimism has now turned to pessimism because Q4 GDP will likely disappoint, potentially paving the way for a lower prime rate in 2016.

- Canada Fights the Fed: It’s certainly possible that fixed mortgage rates spurt up for a while after the Federal Reserve moves U.S. rates higher (which the market expects next week). But that’s no reason to lock in. Those who predict Canadian mortgage rates have bottomed long-term are sniffing the wrong type of glue. Our central bank is clearly articulating the possibility of lower rates and is now prepared to go negative. That’s right, for the first time ever the Bank of Canada has admitted that its key rate could drop to a previously unthinkable minus 50 basis points (-0.50%). That won’t happen soon, but Poloz predicts, “There are going to be…more times in the future when central banks find themselves driven to the lower bound” of interest rates. If that doesn’t scream “go variable!” I’m not sure what does. (Disclaimer: Floating rates are not suitable for everyone. Get advice before taking a variable.)

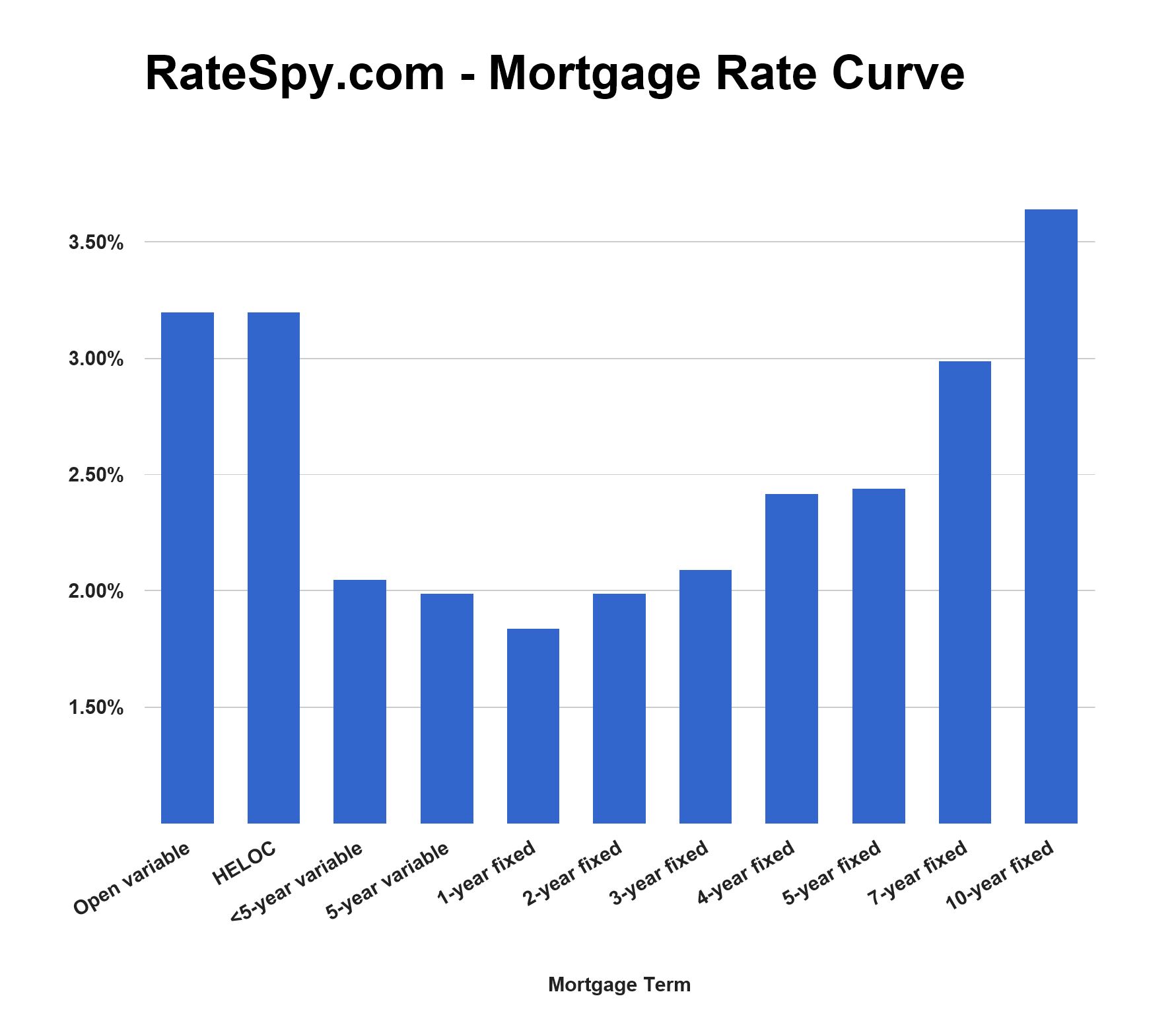

- Rates Across the Curve: Below is the latest mortgage rate curve, showing average best rates across the country. Some of the absolute lowest rates have major restrictions so we exclude those from the chart. If you’re well qualified and looking for value, one-year rates at a prime – 0.91% equivalent (i.e., 1.79%) are a tremendous alternative to rising variable rates.

log in

log in

1 Comment

The problem with variable rates for peope with modest income is qualifying at the 4.64% 5yr rate.