Five-year Canadian yields are down 60 basis points in two months.

Average 5-year fixed mortgage rates are down a measly 4 basis points.*

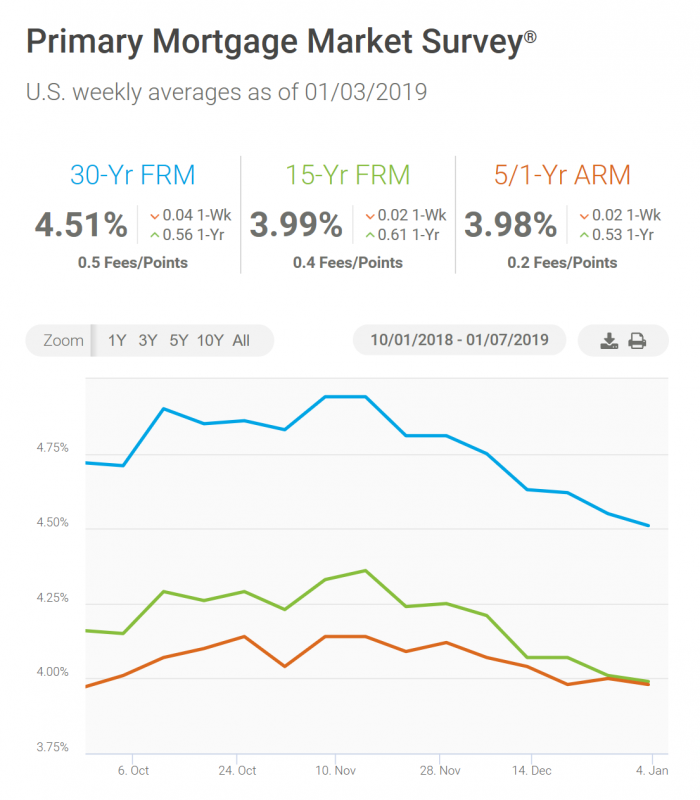

Meanwhile south of the border, where they have this thing called mortgage competition, 5-year yields are down 54 bps and average 5-year fixed rates have fallen 16 bps so far. Average rates on the most popular U.S. mortgage, the 30-year fixed, are down 43 bps.

Average US Rates, Source: Freddie Mac

Do you think the stickiness of Canadian rates has something to do with the fact that 9 out of 10 Canadian prime mortgages are funded directly or indirectly by our six megabanks?

It certainly bolsters the case for government backing of mortgage competition, which Ottawa does (albeit less than it used to) by guaranteeing securitization for low-risk mortgages at bank competitors.

Canada has one domestic bank for every ~1.05 million people. The U.S. has one bank for every ~69,000 people.

Canada’s tight-knit, closely regulated oligopoly “makes for a sclerotic market that likely imposes costs on Canadian borrowers in the form of limited financing options and higher interest rates,” as Texas Tech professor Andrew Young puts it.

Now, don’t get us wrong, we have respect for the money-factories that are the Canadian banks. But can they seriously not even throw debt-strapped Canadians a bone? Can they not even find it in their Bay Street hearts to trim widely advertised rates a puny 5 basis points amid surging profit margins?

We reached out to prominent attorney Jackie Chiles for his take on the matter. Asked about the banks’ adamant refusal to pass through rate savings to Canadian borrowers, he replied simply, “It’s outrageous, egregious, preposterous.”

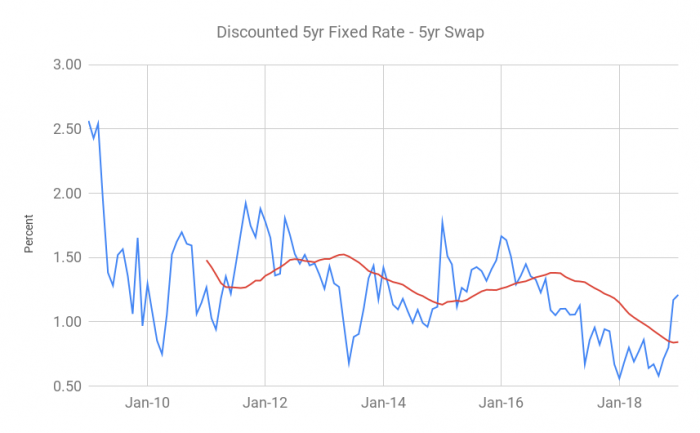

True, it is. But before we let Chiles rile us up, consider that while mortgage spreads (the blue line in the chart below) are well above the 2-year average (the red line in the chart below), they’re not exorbitant from a longer-term perspective.

Indeed, banks are trying to bring them closer to their 10-year average while riding out volatility in the capital markets. (Note: 5-year swaps are a rough proxy for banks’ base funding costs. That spike in 2009 was thanks to the financial crisis and is abnormal.)

The takeaway is that fixed-rate interest margins are still in a long-term downtrend. Volatility never lasts and, oligopoly or not, banks will not be able to keep spreads permanently inflated. That’s the good news.

The bad news is, banks still have the power to make us wait a few months for mortgage rates to drop.

* A simple average of all discounted 5-year fixed rates advertised in Canada (prime lenders only).

log in

log in

3 Comments

Maybe they were waiting for the BoC meeting to pass, to avoid any potential surprises? Now it’s a clear runway for some mortgage rate cuts.

5 year bond rates are .6% lower since November. That gives them lots of room to absorb surprises.

Oshawa mortage holders are going to feel it when GM shuts down and the Domino effect on the other business that will see lest money spent for there economy,