We’re one week into 2018, OSFI’s new mortgage stress test is live and the earth is still spinning on its axis.

We’re one week into 2018, OSFI’s new mortgage stress test is live and the earth is still spinning on its axis.

But that axis is now tilted…in credit unions’ favour.

If you’re a mortgage shopper who’s been turned down by a bank—courtesy of the aforementioned new mortgage rules—then credit unions want to talk to you.

Credit unions aren’t bound by OSFI’s game-changing “stress test” (which applies to borrowers with 20%+ equity). Instead of forcing you to prove you can afford a rate that’s two-plus points higher, some CUs qualify you on (i.e., measure your ability to afford) the contract rate you actually pay. That flexibility has industry-folk projecting a 5% to 20% surge in CU mortgage volumes this year.

As we speak, credit unions are being inundated with requests from mortgage brokers to get on their approved broker lists. OSFI’s rule change is destined to solidify brokers as the go-to source for borrowers turned down by banks. Why? Because brokers can compare multiple credit unions to find betters deals for more indebted Canadians.

But there are two very important points to note:

A) Only a minority of credit unions have competitive rates and qualify borrowers at the contract rate

B) Only a minority of brokers deal with multiple credit unions who qualify borrowers at the contract rate and have competitive rates.

Therefore, if you’ve stress tested yourself and discovered that you need a bigger mortgage than a bank will give you, you may want to:

1) Call the credit unions with the lowest rates and ask if they’ll qualify you at their 5-year fixed contract rate.

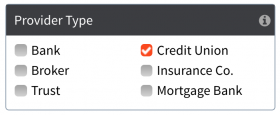

Tip: To find CUs with the best mortgage rates, check “Credit Union” in the Spy’s “Provider Type” box on any rate page.

2) Contact a reputable experienced broker and ask for his/her lender recommendation.

Doing the above can net you about 18% more buying power than you can get at a bank. And you’ll receive a more reasonable rate by shopping around.

On the topic of rates, most CUs who permit contract rate qualifications charge at least 1/4 point more than the lowest rates for more qualified borrowers. Many then charge an additional 10+ bps if you want a 30-year amortization.

log in

log in

25 Comments

While the big 5 banks all offer 30-year amortizations, you might not get that option at a credit union.

https://www.provincialemployees.com/Home/ProductsAndServices/YourFinancing/Mortgages/

@Ralph, You’re right. And some credit unions that offer 30-year amortizations make you qualify at a 25-year amortization.

Not all CU rates are 25 bps higher and other lenders including the big 5 are adding premiums to 30 year am’s not just cu’s

@Mike

Regarding the 25 bps premium, compare 5-fixed rates at the CUs who qualify at the contract rate to the lowest available 5-fixed rates.

The lowest available 5-fixed rate is presently 2.71%. Are you aware of CUs who qualify at the contract rate, and offer 2.95% or less?

Regarding 30-year amortization premiums, there was no mention that these premiums apply only at CUs. That last sentence was just a friendly reminder that, despite qualifying at the contract rate, “many” credit unions also upcharge for longer amortizations.

Cheers

Is it plausible that credit unions could become overwhelmed with demand given the surge of borrowers who are expected to fail the stress test? Do they then tighten their own qualification standards as a result?

It will be interesting to see how this all plays out.

@Tara

Credit unions with broker channels and contract-rate qualifying will see a noticeable surge in applications. I don’t think it will be overwhelming and I don’t think it will lead many to tighten qualification standards. But the added demand could definitely lead to additional rate premiums (at some CUs).

If borrowers can’t qualify at the new standard then maybe they should rethink their purchase. I applaud the government for setting stricter regulations. We need to avoid what happened in the US ten years ago with the housing crash. I applaud the feds for being proactive.

@Eric

Thanks for the comment. B-20 always makes for an interesting debate.

Most people agree that:

1) Mortgagors must be sure they can afford higher rates.

2) The government was right to make sure of that through regulation.

What many people disagree on is the amount of stress testing that was appropriate.

Is 200+ bps the right number? To answer that one has to consider (among other things):

* The risk of rising rates over the term of the mortgage

* Income growth over the term of the mortgage

* Rising home values over the term of the mortgage (homes appreciate at the rate of inflation, or higher, over the long term)

* The risk of short-term drops in home values during the term of the mortgage

* The alternatives borrowers will choose if they can’t qualify at the contract rate + 200-plus bps (many of which create personal and systemic risk, e.g. gravitating to higher priced alternative lenders, unregulated lenders, carrying high-cost credit card debt, etc.)

* How much we want to negatively impact home prices (given the impact on jobs, consumption and the fact that 68% own homes, most relying on their home equity)

* The borrower’s ability to mitigate rising rates (by refinancing, re-amortizing, using readvanceable mortgages, etc.)

One can argue both ways, but none of the above can be focused on in isolation.

In fact, the answer is simple only for people who don’t realize (or don’t care) how the answer impacts the lives of individual families and the economy as a whole.

Our position, factoring in all of the above, is that:

* The government made a mistake in its stress test threshold. 200+ bps is not the right number for everyone.

* The government made a mistake in applying the new stress test across the board to all borrowers (even renewers who present zero risk to the system).

* The government made a mistake in letting lenders qualify borrowers with > 25-year amortizations (this creates an un-level playing field between big banks and their competitors, and defeats much of the purpose of a 200 bps stress test).

The repercussions will take time to bear out but they will bear out in higher delinquencies, loss of competition in the federally regulated lending space, large rent increases in our major cities, lost jobs, and more. It’ll be fun to revisit this in a few years and see how smart or short-sighted regulators really were.

If I want to go for variable closed or 2 year fixed, what qualifying criteria do credit unions follow? Is it same as major banks (4.99%)?

Hey Dave,

Some use the Bank of Canada posted 5-year fixed rate (5.14% currently).

Some credit unions apply the new OSFI rule (contract rate + 200 bps or Bank of Canada posted 5-year fixed, whichever is higher).

Some use their discounted 5-year fixed rate (as low as 3.15%)

A minority use other rates.

Hey Dave,

Thank you for this information.

The dilemma my wife and I face is we do not succeed in the stress test as according to traditional mortgage lenders (chartered banks) solely due to our OSAP student loan debt. Can you speak to how we can navigate the mortgage landscape with this type of debt creating a challenge to owning a home.

If you have 20% down go to a credit union that doesn’t use OSFI’s stupid rule and get a 30-year amortization.

Thanks for your reply Mike. The trouble is coming up with 20% is a challenge while manage student debt. It’s balancing act to reserve savings toward the goal of a house, but trying to make substantial payments to bring the student loan down, especial in light of the challenge that this loan creates in the banks identifying us as being suitable for a house loan. Housing prices are much higher than a few years and so is 20%. One can say use your savings to pay off the loan, which in fact will only pay 50% between my wife and myself and will require a few more years to pay off the rest, and only then we can start saving toward house. At that point we will be closer to 40 yrs old. Based on that scenario we hope to go with the initial thought of saving and managing our OSAP debt with sacrificing our savings but find alternative ways to access a mortgage. My question is, is it at all possible and what are the other options. I would say an average home for a family size of 5 would be above 450,000 in the GTA, 20% in that case seems very daunting to achieve. I’m just looking for some hope.

What if you do not have 20% down? Will CU still potentially approve you?

Hi Emily, They will, but you’ll be stress tested at the mortgage qualifying rate, which is 5.14% today.

Are credit unions actually following the OSFI rules?

They’re apparently exempt from them and you would think that they would want the increased business of those turned away from the big 5.

Do most CU’s adhere to 25-yr amortizations or do they do 30?

Hi Jason, We haven’t researched the ratio of credit unions who employ OSFI’s stress test on uninsured borrowers but many do. CU’s biggest challenge with expansion is a shortage of low-cost lending capital.

Almost all permit 30-year amortizations.

Which credit union in ontario does not invoke the stress test.thanks

Thanks you all for the comments

Meridian Credit Union is the biggest lender not to use OSFI’s stress test.

Hi, Any credit union that still not using OSFI stress test for qualifying mortgages. Some people told Meridian, any other?

DUCA

we purchase another home for, 498,000 and we have not sold our current home listed for 499,000,closing date is soon, we have 200,000 to put down on new house and wold like to rent this house out for 2,400 a month and make a little extra money however bank will not give us a mortgage for new house,we have excellent credit, no other payments or loans, could this be done through credit union ?

Hi Kevin,

Assuming no issues with your income, it sounds like your debt ratios may be a little high for this lender’s liking. You might need a lender with a better qualifying rate and rental income policy. Call a broker and they can run some numbers and assess your options quickly.

Cheers,

Melanie

Melanie McLister | Broker

intelliMortgage Inc. | FSCO #: 12326

Kevin you can always access private lending as well