Almost every public statement the Bank of Canada makes is scripted.

Case in point was the speech today from the Bank of Canada’s Senior Deputy Governor in Winnipeg. She came with prepared remarks that were broadcast all over the Internet. Her (and the BoC’s) mission is clearly to get people thinking about rate hikes—more specifically, that rates will rise before they fall.

That’s the motivation behind messages like this:

“As growth continues and, ideally, broadens further, [the Bank of Canada] will be assessing whether all of the considerable monetary policy stimulus presently in place is still required…“

—Bank of Canada Senior Deputy Governor, Carolyn Wilkins, June 12, 2017

That’s far more hawkish than the BoC’s widely reported statement in January, which was:

“Yes, a rate cut remains on the table…“

—Bank of Canada Governor, Stephen Poloz, January 18, 2017

But Wait…

Before we start the debate about locking in mortgages, some perspective is in order:

- Remember that the Bank of Canada is no economic psychic. Following the recession, whenever it has prognosticated higher growth it’s usually had to revise those estimates lower. In truth, its forecasts are reactionary (i.e., at the mercy of the latest data), just like the forecasts of any other economist.

- Despite Wilkins’ reassuring words that the recessionary effect of cheap oil is “largely behind us,” that could change in an instant. If/when oil dips below $40, the BoC’s bullishness could turn to bearishness overnight. A bad trade deal with the U.S. could engender a similar effect.

- Inflation is the #1 rate driver in any case. And although inflation is a lagging indicator, it’s still incredibly suppressed at just 1.4% (the average BoC core reading). For rate hikes to be a real threat, the BoC has to believe inflation could pole vault to roughly 2.5% or more within about 18 months or so. And it doesn’t seem to believe that, at least not yet. It wants to see more positive data first.

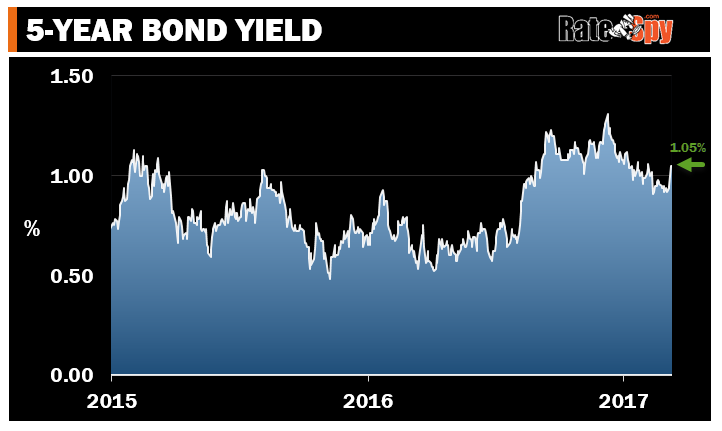

Either way, bond traders didn’t like what they heard from the BoC today. They dumped 5-year bonds like last week’s garbage. That drove up bond yields 11 bps, the most in almost two years. As regular readers know, bond yields move inversely with bond prices, and are a key driver of fixed mortgage rates.

Bond market derivatives (overnight index swaps) now imply more than a 50% chance of a BoC rate hike by December.

That’s a big sudden sentiment shift and it could potentially trigger a mini uptrend in fixed mortgage rates. Potentially.

Until the 5-year yield pierces 1.33%, the most we’ll see fixed rates pop is probably 10-20 bps.

On the variable side, prime rate is cemented at 2.70% and should remain so until the Bank of Canada’s next rate move. It hasn’t hiked rates in seven years and nobody expects it to near-term, certainly not at its next meeting on July 12.

The takeaway: While the BoC has started telegraphing its rate-tightening bias, it’ll take further robust economic numbers before rate hikes are imminent. We’ll let you know if that happens.

log in

log in

Almost every public statement the

Almost every public statement the

6 Comments

And yields are still rising today!

Do you think this is just a temporary pop or are we heading higher from here?

Hi Nervous,

Some of the lowest fixed rates are definitely headed higher. We’ve already seen the first few lenders announce 0.10%-pt fixed-rate hikes on Tuesday.

It’s hard to say how much follow-through there will be, but here’s what we know:

1) The Bank of Canada has stuck its neck out by telegraphing higher rates and values its credibility.

2) More often than not, the BoC does ultimately hike rates when they provide this sort of guidance.

3) Bond traders with billions on the line are betting on a BoC hike later this year. The 2-year government yield, which is a leading indicator of BoC moves, says it all: http://bigcharts.marketwatch.com/quickchart/quickchart.asp?symb=TMBMKCA-02Y&insttype=&freq=2&show=&time=10

For well-qualified borrowers with a great rate already, none of this is a cue to lock in. For less qualified borrowers with rate-related sleep deficiency, there have been worse times to lock in.

I’m about to be a first time buyer, well qualified 20% down. I was sure I was going to go for a 2 yr fixed (ie, get the lowest rate I can possibly get with all the features). Would you say this is still a good idea? Would more ppl be chosing 5 yr fixed rates now?

Hey there Catherine, If you can financially and mentally handle a potential 1.50%-pt+ bump in rates at renewal in two years, a full-featured 2-year is a solid choice. To break even with a 5-year fixed, you’ll just need to find a rate of ~ 2.90% or less when you renew in 24 months.

There are some incredible deals on 2-year terms right now, but they might not stick around that long, especially if the 2-year yield makes a new high: http://bigcharts.marketwatch.com/quickchart/quickchart.asp?symb=TMBMKCA-02Y&insttype=&freq=1&show=&time=8 .

I’m in the same boat as Catherine and am also thinking of signing a 2 year fixed full featured mortgage. Just so I understand your post, would a rate of ~2.90% or less when I renew in 24 months be necessary to break even if there was an actual bump of 1.50% in rates?

Re: “…Would a rate of ~2.90% or less when I renew in 24 months be necessary to break even if there was an actual bump of 1.50% in rates?”

That should have been made clearer. Apologies.

2.90% is the approximate rate you have to obtain in years 3, 4 and 5 for a 1.95% 2-year fixed to break even with today’s typical five-year fixed (~2.49%), assuming equal payments and a 25-year amortization.