—The Mortgage Report: July 7—

- Price Expectations vs. Reality: “…Consumer expectations for house price growth in Canada dropped to zero,” according to a BoC survey released yesterday. But the data is about a month and a half old. Since then, home prices in the Greater Toronto Area have broken their 2017 record high. Imagine where prices would be if employment and immigration were running full tilt. Montreal was strong too, while Vancouver prices were mostly flat versus May. Unfortunately, not all markets are doing as well (e.g., Calgary and Saskatoon). As for listings, they’re still well below year-ago levels. Only when supply builds and is back above normal (later this year or next) will we know if demand is strong enough to: (a) continue depleting limited inventories, (b) counter high unemployment and (c) offset potential fall selling—triggered by the end of mortgage deferrals.

- Deferrals Do End: Here’s another reminder that six-month mortgage payment deferrals are not guaranteed. This man needed a deferral extension but was declined. The story…

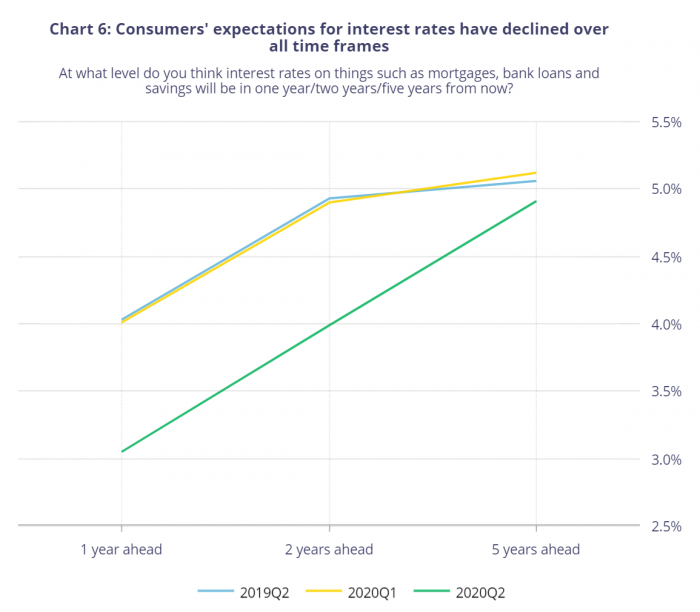

- Perceived Rate Risk: Five years from now, most Canadians think mortgage and other interest rates will be far higher (250+ bps higher) than they are today. There’s little basis for that thinking given the weak inflation and employment outlook, but regardless, it helps explain why people are overwhelmingly choosing fixed rates. Rate expectations are falling, however, as this chart shows.

Survey of Consumer Expectations

- NBC Cuts: National Bank of Canada became just the latest major lender to trim its “special” fixed rates. These are the rates it cut.

- 4yr: 2.84% to 2.54%

- 5yr: 2.89% to 2.59%

The big banks are advertising similar rates for uninsured 5-year mortgages nowadays (2.57% to 2.59%), albeit their hidden discretionary rates are much better, as usual. The typical Big 6 bank discretionary 5-year fixed rate is now 20+ basis points less at 2.39% or lower.

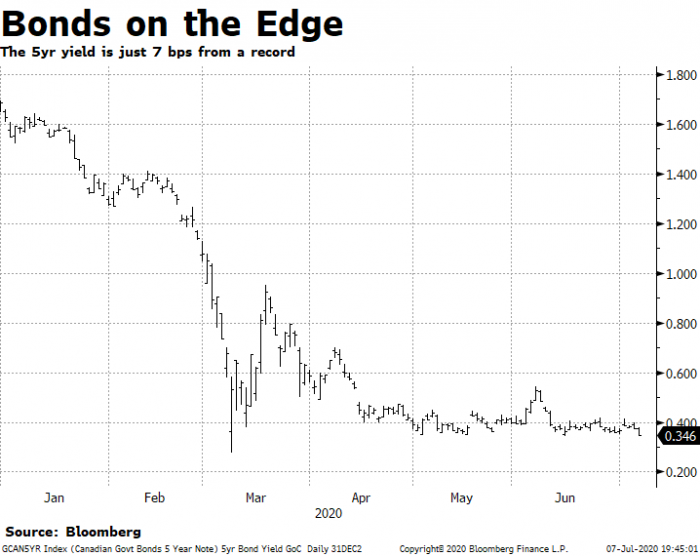

- The Floor Could Give: Bond yields influence fixed mortgage rates, which is why this chart below matters. Yields have had major trouble getting lift and are now just 7 bps from a record low. The path of least resistance may be down for the time being. We’re not far from zero, and when you have a target that big, the market often hits it. If Canada did sink to 0% on its 5-year yield, 5-year fixed rates would likely drop to 1.99% or less across most of the industry. And the lowest 5-year fixed rates—particularly for default-insured mortgages—would ultimately slip into the 1.60% to 1.75% zone, maybe lower.

- Wait for It: Things could get dicey for the economy in August, says the world’s “most accurate” economist. That story…

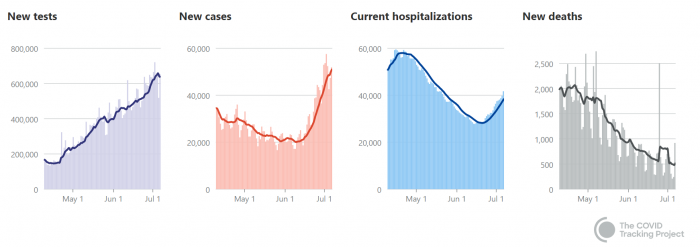

- Stat Check: COVID testing has surged in North America, which is part of the reason more new cases are being reported. But death rates have fallen meaningfully. That’s prompted many to think we won’t get another major economic shutdown, something that would be supportive for interest rates.

- BoC on Deck: Next Wednesday, Bank of Canada Governor Tiff Macklem will officially preside over his first Bank of Canada rate decision. Markets are pricing in virtually no chance of a rate change at that meeting.

- Senior Lending: Here’s a quick comparison of Canada’s two reverse mortgage companies, via rates.ca.

log in

log in

11 Comments

The COVID case increase is not due to increased testing because the positive rate has gone up, not down.

Deaths lag cases. You can see on the chart you posted that cases turned up, then hospitalizations turned up, and deaths will turn up next

Leo, Increased testing clearly isn’t the only reason. But it’s a meaningful one. There are now 600,000 tests a day in the US versus 100,000 in early spring. Naturally, more testing inflates the case count, particularly of those with mild or no symptoms. Of course, the death count will rise temporarily — but hopefully at a slower rate than new cases (if CDC trends are to be believed). The data from people tested 4+ weeks ago — usually enough time to die from the virus — clearly show a smaller percentage of those infected are dying. And yes, the positives count is up from 8.1% in week 25 to 8.7% in week 26, says the CDC. Governments will take action if it gets much higher but it’s hard to envision a full scale national lockdown at this point. The takeaway is, no one knows how this thing will play out but there is hope. And if financial markets recognize that optimism it has rate implications.

The 5 year bond will probably hit zero by end of the summer. How banks react is the question. They still have rising arrears to look forward to so I expect them to be very slow in lowering rates below 2%.

There’s a 50% false positive rate with C-19 testing. The majority in society will contract C-19, legitimately test positive, but will also possess the antibodies. Thus the reason for not having a symptoms. That’s how the immune system works. The metric that offers any potential value is the number of ICU cases and subsequent deaths. These metrics are in rapid decline.

I’d be surprised if rates were 1% higher in five years. 2.5% is probably fantasy. Where is inflation going to come from when unemployment will still be higher than before the pandemic?

There’s a big differential between new houses and used ones that’s very indicative of where the market is heading. The tightening of CMHC only fueled the FOMO and pitting people with money vs those how rely on debt. I’ve heard that Ottawa’s market is on fire, I don’t like hear-say so I won’t repeat the craziness I heard, but that doesnt sound too far-fetched.

Thanks for all the great research. Just signed 5yr fixed at 2.19% with TD.

Wow. That is a great rate from TD. They are quoting us 2.34%.

“price expectation vs reality” … how come you don’t mention that the mortgage deferrals are obscurring the picture because there should be people defaulting on their mortgages and thus supply coming online. They aren’t defaulting because the government is spending $300 billion on companies and people who didn’t budget properly. This is crazy.

Because people “didn’t budget properly???”

What a ridiculous statement. People are losing their livelihoods because the whole economy is shut down! No one ever could have envisioned or planned for this because it has never happened before!

Have you even attempted to calculate the cost of letting millions of people go bankrupt? Of course you haven’t. I love it when people talk out of their behinds with no consideration of how half baked laissez faire proposals would affect the rest of us.

Frank you sound like someone who just wants to get a better price on their house with no concern for anyone else.

Would it make sense to take a shorter term say 2 years and bet on rates still being low and then take a 5 year term upon refinancing?