—The Mortgage Report: July 29—

- Decade Rates at All-time Lows: In Ontario, folks can now enjoy borrowing cost certainty for a tenth of a century, at effective rates as low as 2.59% through brokers. 10-year fixed rates have literally never been lower. Most borrowers wouldn’t think of paying 50+ basis points more (on top of a 5-year fixed) to get a 10-year term. But with long-term fixed rates approaching two and a half percent, conservative borrowers are increasingly taking notice. So are investors, particularly those with plenty of equity who want to buy property or stocks with tax-deductible borrowed money. At the moment, they can get a HELOC on their primary residence at just 2.95% — i.e., prime + 0.50% — or less. Compare that option, which entails risk if prime rate increases, to securing investment capital at a 10-year guaranteed rate of just 2.59%.

(Note: This is not a recommendation to invest with borrowed money. Get proper financial advice before contemplating such a strategy. Also, due to high penalties in the first half of a 10-year term, borrowers should avoid them like the plague if there’s a reasonable chance they’ll break the mortgage before its five-year anniversary.)

- Getting Back on Their Feet: Folks worried about mass defaults from higher-risk borrowers can take some solace from this stat. Equitable Bank, a bellwether non-prime lender, reports that its percentage of non-prime mortgagors deferring their payments has dropped from a peak of 34% post-crisis to 9% more recently.

- Fencing Off the Cliff: Many lenders say six months of payment deferrals are not “sufficient,” reports the Financial Post. As the “deferral cliff” approaches, CMHC is now looking at “new tools” to help lenders and borrowers. That story…

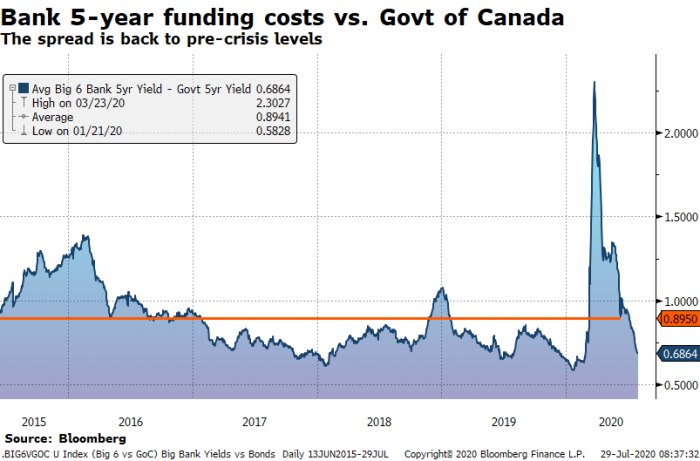

- The Shock Appears Over: Banks’ 5-year funding costs in the bond market are back below pre-crisis levels. That’s good news for borrowers. It implies that smaller risk premiums will now be priced into mortgage rates. Or to put it another way, banks have more room to discount mortgages today than they did a few months ago. Unfortunately for mortgage shoppers, and notwithstanding the elevated default risk ahead, banks are still being a touch stingy on pricing. As we speak, 5-year fixed mortgages are running about 28 bps more expensive than average.*

* As measured by the difference between the lowest nationally available 5-year fixed rate and the 5-year swap rate (a rough proxy for the base costs of funding a 5-year fixed mortgage). We then compare today’s reading for this “spread” (133 bps) to its five-year average (105 bps).

log in

log in

3 Comments

Hi Spy – Newbie question here as I’m preparing for the first renewal of my mortgage. I’m looking at the 10 year fixed rate option. I’ve been variable at P – 0.85% for the past five years. What’s the easy math for how much higher would rates need to go in years six through ten for the 10 year fixed rate to make sense (versus current 5 year fixed rates). Thanks!

Hi Steve T,

Here’s a rough rule of thumb given today’s rates:

If your renewal rate in five years is over 1.4%-pts higher, you’d lose by not taking the 10-year fixed (based on interest cost alone).

Of course, another key consideration is the massive penalty you might pay in a 10-year fixed if you broke the mortgage before it’s fifth anniversary. (After five years, the most a lender can charge you for early termination is 3-months’ interest.)

Thanks Spy – that’s a great reminder on the heavy penalties in years one through five. Crazy to think that 4.0% mortgage rate in 2026 seems unlikely given long term historical trends…