It got sort of ugly out there this week. Oil prices sank to dozen-year lows, swap rates (which guide fixed mortgage rates) fell to record depths and stocks tanked, before eventually recovering.

It got sort of ugly out there this week. Oil prices sank to dozen-year lows, swap rates (which guide fixed mortgage rates) fell to record depths and stocks tanked, before eventually recovering.

Often times, market action like this leads to cheaper mortgages. But these days lenders aren’t about to drop their pants on rates. They have other problems. Investors are getting scared.

Check out this measure of credit risk in the interest rate market (see chart). The market is forcing even creditworthy borrowers to pay more for capital, and Canadian banks aren’t immune. Banks also face the prospect of lower rates in general (the lower rates go, the less banks make) and higher government-imposed costs related to mortgages.

In fact, banks—which fund most of Canada’s mortgage market—have profit threats coming from every direction. Few of us are inclined to shed a tear for their earnings plight, but we have to acknowledge that market conditions are not as lender-friendly as they used to be. That’s why, in spite of the downtrend in global interest rates, the best fixed mortgage rates have dropped just 0.10 to 0.15 percentage points (pp) from their winter highs.

On a cheerier note (for borrowers, not the economy), we may indeed see more discounting headed into the notoriously competitive March market. At this moment, mortgage margins are big enough to give a little back to consumers. Take the spread (difference) between a typical 5-year fixed rate and the 5-year government bond yield, for example. Right now it’s 2.10 pp. “Normal” is closer to 1.75 pp (note, that “normal” has risen 0.30+ pp in the last few years). Note: “Discounting” in this context means lenders may mark up mortgages less, not necessarily that rates will fall. There’s a difference.

Nevertheless, with today’s best 5-year fixed rates just 0.07 to 0.15 pp off their all-time lows, mortgage shoppers so inclined can confidently lock in without fear of what they might be leaving on the table come March.

Ever-Changing Rate Forecasts

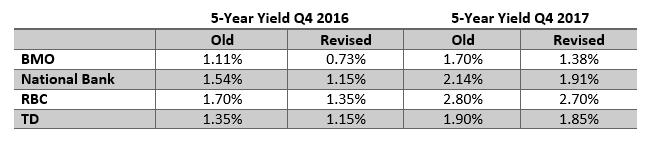

From the FWIW file, Big Banks have once again reset their crystal ball for interest rates.

“We admit to sounding like a broken record when saying that we’ve once again downgraded our near-term bond yield forecasts,” said CIBC World Markets recently. Really? I’d say they sound more like a punctured tire than a broken record. But that’s just me.

The consensus now among Canada’s big banks is for the Bank of Canada’s (BoC’s) key rate to end 2016 unchanged at 0.50%, and then tick up just 0.25 to 0.50 pp in 2017. If they’re right (this time), that implies a https://www.ratespy.com/prime-rate-canadaprime rate no higher than 3.20% in a few years.

But BMO, for one, has other ideas. “After likely cutting rates in April [to 0.25%], we look for the Bank to remain on hold until deep into 2017,” it wrote, adding its expects puny economic growth of just 1.0% in 2016.

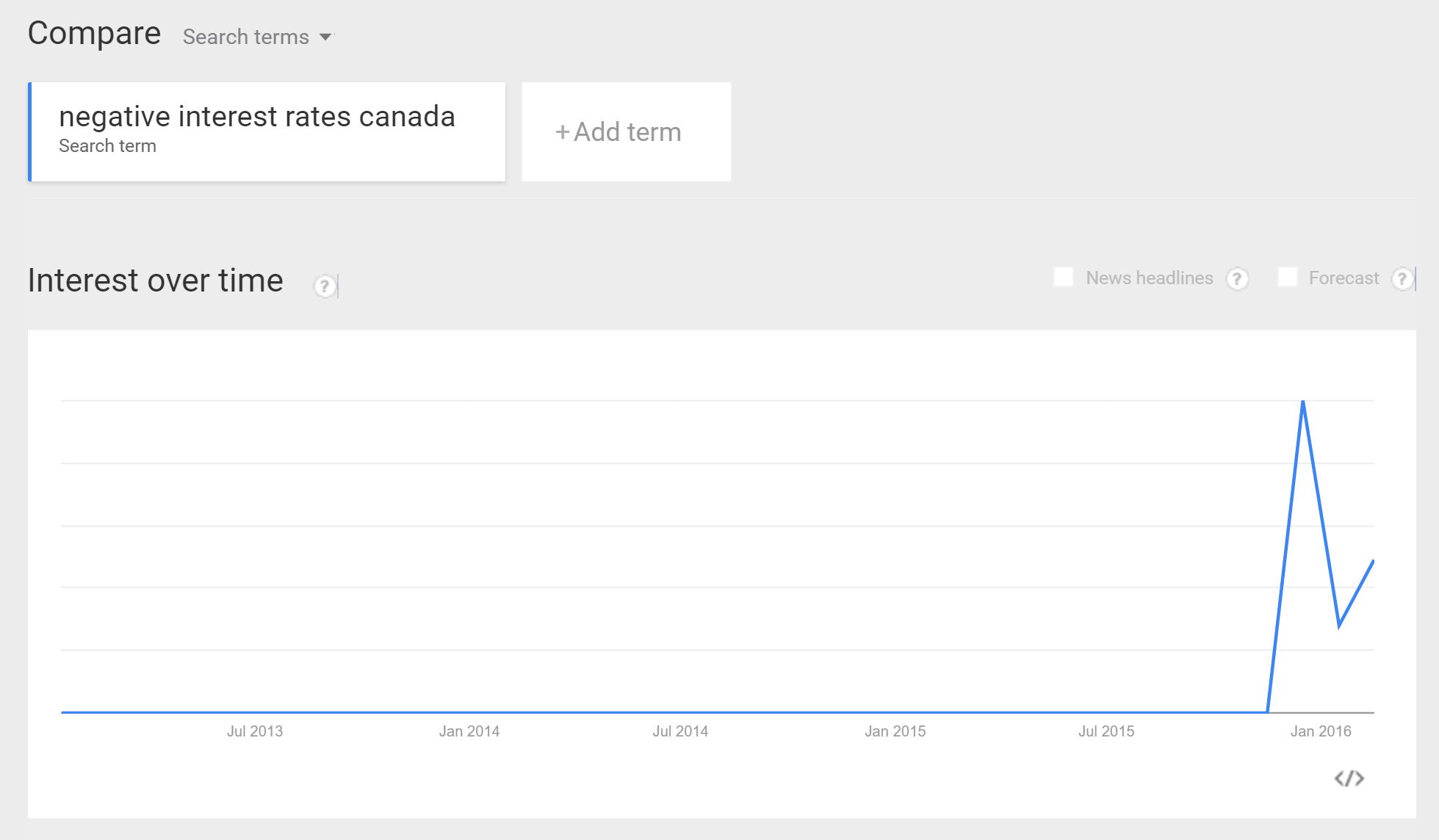

Citi economist Ebrahim Rahbari is even less optimistic. He’s thinking Canada could introduce negative rates within two years, per the Financial Post. By the way, this is one of dozens of negative interest rates stories since December. As this Google Trends report illustrates, all of a sudden, people can’t stop talking about sub-zero interest rates.

We can’t help but wonder if all this negative interest rate talk might actually be a self-fulfilling prophecy. As a big investor, why not jump on 1/2% yields today “before they’re gone?” As a big corporation, why invest in growth (and issue debt at today’s “high” rates) given such gloom. There’s more than a modicum of that logic in today’s market, which could push down rates further.

Against this context, banks have again slashed 5-year government bond yield predictions (like swap rates, government yields lead 5-year fixed mortgage rates). Here’s where economists are throwing their darts now:

U.S. & Canadian Rates Take the Fork in the Road

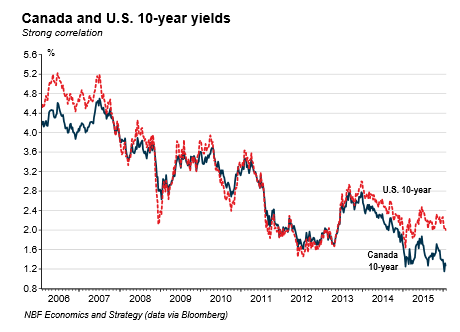

With our economy stuck in first gear, and with a risk of it sliding into reverse, North American rates have taken different paths. (Canadian rates are normally highly correlated with U.S. rates.)

This U.S./Canadian yield comparison illustrates that divergence clearly.

Despite all the Yellen-isms about “gradual” rate hikes south of the border, that medicine (if administered by the BoC) would only make Canada’s economy sicker.

The Takeaway

Despite our perpetually optimistic central bank governor, and despite all the rate hike chatter coming from the U.S. Federal Reserve, until the 5-year Canadian yield closes definitively above 1.20%, we likely won’t be joining the “rates can’t stay this low” chorus.

For as far as the eye can see—which admittedly isn’t that far—there are no inflation boogeymen to haunt us long-term. Short-term, maybe (see Cauliflower prices). Long-term, no.

So, what does all this mean for mortgage term selection? It means that well-qualified borrowers should continue to find outperformance in shorter contracts.

With that in mind, below is the Spy’s take on each mortgage term…in two lines or less :

- 1-year fixed: Love ’em. The lowest rates in the market. Just be sure your mortgage is big enough to justify the switching costs if your one-year fixed lender gives you a crummy renewal offer in 12 months.

- 2-year fixed: Still have delicious rates, with less renewal hassle than a one-year. The best deuces feature no-fee blending and extending (in case you see a long-term fixed rate that you just can’t resist).

- 3-year fixed: You won’t find a better compromise between interest savings and security today.

- 4-year fixed: Quads are garbagio at today’s rates. They offer little value over 3- and 5-year rates.

- 5-year fixed: If you crave rate certainty and snare a deal (e.g., a 5-year under 2.50%), they’re a satisfactory conservative play. But think in terms of “breakeven rate.” If you pay 0.50 to 0.60 pp more than a 3-year, that’s probably too expensive.

- 7-year fixed: Don’t be silly.

- 10-year fixed: Don’t be sillier.

- 3-year variable: Cheaper than a 5-year variable. If you’re dead set on going variable, why pay more? Variable discounts are cyclical and will hopefully improve when people renew in three years.

- 5-year variable: At major bank rates, the risk/reward is so-so at best—especially since we can’t expect any more prime rate love from the Big 6. But if you can find a variable at prime – 0.60% or better (I’ll give you one hint where to look), and it’s got just a 3-month interest penalty, that’s not so bad.

- HELOCs: Unless you have no better option, don’t borrow from a revolving line of credit unless you plan to pay it off in less than a year.

- Hybrid: Hybrids used to steal our hearts, but what started as a love affair has ended in divorce. It’s mainly big lenders who offer them, and big lenders have pushed hybrid rates above most 5-year fixeds. So what’s the point?

log in

log in

9 Comments

Some of those forecasts still look optimistic in my opinion. I think we’ll be in this low rate environment for longer than anyone cares to guess.

Just closed on a 2 year fixed with Scotiabank for an investment property near Halifax. Collateral charge, 80% LTV, 655 beacon, 2.39%, down from their first offer of 2.49.

p.s their 1yr offer was 2.84.

Home Trust was 2.24% on a 2yr but required 25% down.

Interesting. Lenders often tack on premiums for rental pricing. But more importantly, when it comes to discretionary bank rates, they often depend on which mortgage specialist the customer is fortunate enough to deal with. Like with brokers, not all bankers go the extra mile on discounting.

“HELOCs: Unless you have no better option, don’t borrow from a revolving line of credit unless you plan to pay it off in less than a year.”

Is there a better vehicle to borrow against the equity in your home on the market? Or do you mean in lieu of refinancing at a lower interest rate to access additional cash?

@Sherman,

That’s definitely a question worth expanding on, so thank you.

What that statement means is that the interest cost differential between a HELOC (which typically has rate of 3.20%) and an amortizing mortgage (as low as 1.69%) is too large.

Whatever borrowing you’re not going to pay off in one year (actually, it can be as low as 6-7 months) is better done in a closed mortgage. Even if you take out equity in a closed mortgage and pay it off before that mortgage matures, the lender’s prepayment penalty is typically much less than the extra interest cost of the HELOC.

HELOCs are best suited for short-term borrowing and certain leveraged investing strategies. They’re not mean to be places where you carry a balance for 5+ years. But surprisingly, many folks get on the “never-never” plan and do just that!

Thanks for this. Our mortgage matures April 1, so we’re looking at moving to a 1yr fixed vs. our more typical 5 yr variable this time around. 1.69% seems to good to pass up!

We also need access to some cash from the equity in our property and had been considering a HELOC vs refinancing. The delta in interest rates had already got me thinking, but this advice really resonates.

Thanks!

Had no idea HELOCS are best used for short-term borrowing. Glad to have had this eyeopener before undergoing a debt consolidation (looking at at least a 5 year payback)

From an interest-expense standpoint, definitely. Although, that’s not to say folks don’t use HELOCs in other ways. Some borrow from HELOCs because they want a lower interest-only payment (despite the higher overall cost).

For instance, if you take out $100,000 of your equity in:

* A 25-year-amortized mortgage at 2.49%, you’ll pay $447.47 a month

* An interest-only HELOC at 3.20%, you’ll pay just $264.91 a month.

But, the extra interest you’ll fork out with an interest-only HELOC is steep, assuming you can’t write it off. We’re talking $4,400 per $100,000 borrowed per five years, using the above example.

So, while low HELOC payments help the budget short-term, they often hurt one’s budget long-term.