Quick takes from Mortgageland…

Most 5-year Fixed Rates Now in the High 2’s

If you’re out there mortgage shopping, you can thank Trump’s tariff madness for saving you some basis points. Trade uncertainty is pounding bond yields and fixed rates are slowly following (key word being “slowly”). Multiple big banks are now quoting sub-3% rates (non-publicly) for well-qualified borrowers. If yields stay below 1.40% this coming week, expect further fixed rate cuts on the way. Here’s where you can find the lowest 5-year fixed rates as of this moment:

If you’re out there mortgage shopping, you can thank Trump’s tariff madness for saving you some basis points. Trade uncertainty is pounding bond yields and fixed rates are slowly following (key word being “slowly”). Multiple big banks are now quoting sub-3% rates (non-publicly) for well-qualified borrowers. If yields stay below 1.40% this coming week, expect further fixed rate cuts on the way. Here’s where you can find the lowest 5-year fixed rates as of this moment:

- High-ratio mortgages: online brokers (as low as 2.62%)

- Low-ratio mortgages: online brokers & HSBC (<= 2.84%)

- Refinances: online brokers & HSBC (2.94% or less)

- Auto-readvanceables: major banks (3.04% or less)

There’s still no action on 5-year posted rates, which affect how much mortgagors can get approved for (because of the stress test). It’s now been over a year since banks collectively moved their 5-year posted rates, and 2.75 years since the minimum qualifying rate last fell.

BMO Fined $200,000 for HELOCs

The Financial Consumer Agency of Canada (FCAC) nailed BMO with a $200k fine for failing to make proper disclosures about the cost of borrowing for HELOCs. If you’re wondering how severe that fine is, it’s about 0.0037% of the bank’s 2018 profit. “The number of customers that have been impacted for the period of January 2010 to December 2016 is estimated at 136,075. The violations have not resulted in financial harm to impacted customers,” wrote the FCAC. Interesting how this ruling happened nine months ago and was just made public this week. More from the Globe (subscription).

The Financial Consumer Agency of Canada (FCAC) nailed BMO with a $200k fine for failing to make proper disclosures about the cost of borrowing for HELOCs. If you’re wondering how severe that fine is, it’s about 0.0037% of the bank’s 2018 profit. “The number of customers that have been impacted for the period of January 2010 to December 2016 is estimated at 136,075. The violations have not resulted in financial harm to impacted customers,” wrote the FCAC. Interesting how this ruling happened nine months ago and was just made public this week. More from the Globe (subscription).

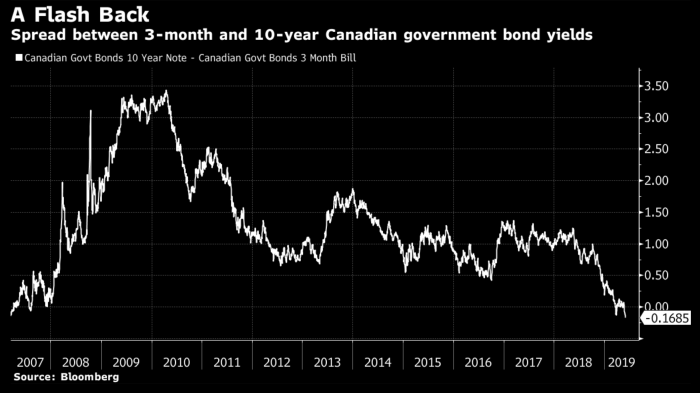

Respect the Curve, Warns Morgan Stanley

The yield on Canada’s 3-month note now exceeds that of 10-year bonds by the most since 2007. That’s an ominous economic signal that the Bank of Canada is taking seriously. It’s even more worrisome given that rates effectively inverted long before this spring, says investment bank Morgan Stanley. It warns, “…The U.S. economic slowdown and rising recession risk is happening regardless of the trade outcome.” (Bloomberg, ZeroHedge)

Can-USA Yields Stay Parallel

The BoC is trying hard to stick to its domestic economic turnaround story. Unfortunately, Canada could easily be “caught in the crossfire” in Trump’s cold war on trade, suggests senior deputy governor Carolyn Wilkins. “It feels like [Trump has] no plan, like anything could happen,” CNBC commentator Jim Cramer says, “And that’s a bad feeling because the markets hate uncertainty.” That uncertainty will discourage business investment, undermine GDP and may continue weighing on North American interest rates.

The BoC is trying hard to stick to its domestic economic turnaround story. Unfortunately, Canada could easily be “caught in the crossfire” in Trump’s cold war on trade, suggests senior deputy governor Carolyn Wilkins. “It feels like [Trump has] no plan, like anything could happen,” CNBC commentator Jim Cramer says, “And that’s a bad feeling because the markets hate uncertainty.” That uncertainty will discourage business investment, undermine GDP and may continue weighing on North American interest rates.

More Rate & Housing Reads

- Vancouver/Toronto cater to top 1%/10% of income earners (Financial Post)

- Overpricing your home isn’t good strategy in an online market (Redfin)

- “…Inversions should…occur more frequently and…[be] less informative”—Bank of Canada (Financial Post)

- Some experts doubt that yield inversion means recession. They’ve been wrong before. (Axios)

- Traders are pricing in three 25-bps rate cuts in the U.S. by the end of 2020. (Bloomberg)

- On average, recessions arrive 311 days after the yield curve inverts (Bianco Research)

- Some think the recent rate collapse is overdone and yields will bounce (CNBC)

- Tariffs are short-term inflationary but as growth slows, they’re medium-term disinflationary

- “The inverted yield curve has been an almost perfect predictor of a recession since WWII.”—Moody’s (Forbes)

- Rates are global and German bonds just hit record sub-zero territory (Bloomberg)

log in

log in

2 Comments

Off the topic but First National bank just updated their rates. 5 years fixed is now 3.09

Several lenders cut rates today including big banks. Most are under 3% now for 5 year fixed mortgages.

BTW, not to nitpick but First National is not a bank. 🙂