A new 5-year fixed will cost you more today than it did last month, but not as much as normal.

Canada’s biggest banks have been boosting their advertised mortgage rates following a 1/4-point pop in their funding costs over the last two weeks.

Let’s go to the charts…

The following graph shows what’s been happening. It’s a picture of Canada’s 5-year swap rate, which is a rough proxy for base 5-year fixed funding costs at Canada’s big lenders.

As the chart depicts, rates (funding costs) have come off the bottom significantly since September (up about 40 basis points). That’s thanks partly to trade optimism and strong jobs numbers, among other things.

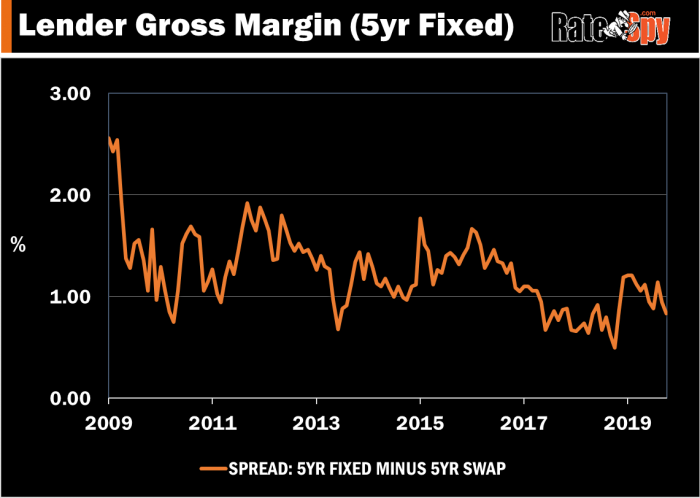

But that’s not the whole story. Lenders are fighting harder for your business in general, amid what’s been one of the slower prime mortgage markets in years. A good view of that is the following chart, which shows the difference between what lenders are selling discounted mortgages for and what those mortgages actually cost them (excluding personnel, compensation, marketing and misc./overhead costs).

The typical Big-6 Bank, for example, is selling at considerably smaller margins than at the beginning of this year. As we speak, they’re quoting discretionary rates in the 2.84% to 2.94% range for 5-year money.

That means they’re settling for roughly 35-bps less profit per 5-year fixed mortgage, compared to January 1. And 40-bps less profit versus their long-term (10-year) average.

Another way of looking at it is that you’re saving an additional $1,500+ per $100,000 of mortgage over five years, solely thanks to today’s more competitive discounts.

If you need an insured 5-year fixed, lenders will shave even more off the bone (even major banks), typically knocking another 10+ bps off their best rates.

Demand What You Deserve: A Better Rate

If you absolutely must have a big-bank mortgage, for example, (and don’t mind big bank mortgage penalties) shop the lender’s offer against the rates you see at the Spy.

If you absolutely must have a big-bank mortgage, for example, (and don’t mind big bank mortgage penalties) shop the lender’s offer against the rates you see at the Spy.

If you’re well-qualified and your banker quotes higher than other big bank mortgage rates, tell him/her three things:

- “I’m shopping for a much better-than-average rate and would need at least 10 bps off your ‘floor rate’ (the lowest rate a mortgage representative can offer without management approval) to make this deal.”

- “Please take my application to your pricing department to get a rate exception.”

- “I can wait until the end of day tomorrow for an answer.”

(Note: Your lender may charge an additional 10 bps on the rate for amortizations over 25 years and/or non-owner-occupied properties, so add that to the rates on RateSpy—if applicable to your mortgage.)

To improve your odds, show your bank how non-competitive they are by printing out RateSpy’s lowest rates for the exact same term and features.

Or, you can take an easier path to saving. Choose the most competitive mortgage provider on the Spy that matches your circumstances and apply with them online. To the extent their offerings match your needs, the most transparent lenders deserve the business. Such a mindset encourages other lenders to put all their cards on the table as well, which will eventually make comparing mortgages easier for everyone.

log in

log in

6 Comments

I find that some bank mortgage specialists are like car salesmen with the whole “I need to speak to my manager” spiel. Others drop their pants on the rate from the outset. If someone overquotes you just move on to the next specialist. There are plenty of hungry banksters out there.

Hi – Just wondering what the 50% line is on the chart above? Thanks

It is half way between highest and lowest points of funding rates for the given period.

step one : (2.8390 – 1.4489) / 2 = 0.6951

step two : 0.6951 + 1.4489 = 2.144

Hey Mike, Davor is correct indeed. It’s a 50% retracement line. Technical analysts sometimes use it to guesstimate how far prices (rates) could rebound. Such rebounds are often due to short-to-medium-term changes in sentiment and/or market fundamentals.

For us less learned would you mind defining “well qualified”? perhaps some examples?

Hi William,

Absolutely. Well qualified in this context means you can get approved for a standard mortgage with any major bank.

For example, you have:

* A solid credit history (minimum 2-3 year track record of good repayment, multiple credit accounts, 700+ credit score, etc.)

* Stable employment with provable income

* Reasonable debt ratios (monthly obligations less than 42-44% of gross monthly income; housing costs less than 39% of gross monthly income)

* No bankruptcies or consumer proposals