When Scotiabank announced its new “digital mortgage” offering called eHOME, we thought to ourselves, “Oh, how grand, another glorified online application from a big bank.”

When Scotiabank announced its new “digital mortgage” offering called eHOME, we thought to ourselves, “Oh, how grand, another glorified online application from a big bank.”

But after digging into this thing a little, we have come away genuinely impressed.

Scotiabank’s eHOME app is officially the best online mortgage experience we’ve reviewed to date. The bank took some risks with this technology, and they’re ultimately going to pay off.

Here’s some of what’s to like…

Rate Transparency

Finally, a major bank has the guts to show its best rates online. This is a big day, seriously.

The Big 6 have a reputation for rate haggling. A common tactic is to quote you a “discounted rate” and then when you press them, the banker plays the “I need to ask my manager if the pricing department can make a rate exception” card.

It’s a terrible waste of the borrower’s time and disadvantages people who aren’t good at negotiation or rate research (caveat emptor, I know). This sort of rate opacity is a key reason more people are comparing mortgage rates online.

But now, for the first time, we see a bank willing to give everyone a fair shake directly on its website. As Janet Boyle, Scotiabank’s Senior Vice President, Real Estate Secured Lending, explains it, “We are committing to a rate digitally for the customer.”

And by fair shake, we mean “great deal,” at least for some terms.

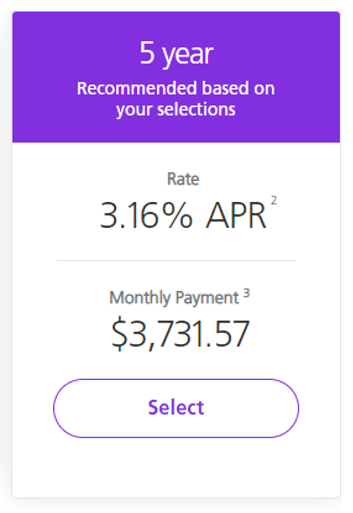

Take Scotia’s eHOME 5-year fixed rate, for example. Based on the sample data we entered, it showed us a 3.16% APR for a conventional 5-year fixed. That is the best uninsured rate from any Canadian lender that we track, and we track all prime lenders. It’s even below the bank’s own standard branch rates and broker-channel rates, and well below advertised scotia mortgage rates.

Take Scotia’s eHOME 5-year fixed rate, for example. Based on the sample data we entered, it showed us a 3.16% APR for a conventional 5-year fixed. That is the best uninsured rate from any Canadian lender that we track, and we track all prime lenders. It’s even below the bank’s own standard branch rates and broker-channel rates, and well below advertised scotia mortgage rates.

That’s what makes it gutsy. The bank knew going into this that some retail Scotia reps and brokers would complain about HQ undercutting them.

Indeed, many Scotia mortgage originators may not get these rates (which sucks for yours truly, by the way, given our sister company/brokerage does millions a year in mortgage business with Scotia).

But we understand why Scotia must do this. What choice do banks have? Smartphone-toting mortgage consumers are flocking online. “Anticipating [consumer] needs…is key to being relevant,” Boyle says. “If you’re going to bring something to the market and be innovative, sometimes you have to take some risks,” Boyle said. And we’re glad for consumers’ sake that Scotia did.

By the way, such concerns are probably one of the reasons why TD didn’t put its best rates on its recent digital mortgage offering. But that’s not sustainable if you’re a lender hoping to compete in the 2020s. Today’s consumers want ease and transparency. Period.

Expect much more of this so-called “channel conflict” to come. The sooner lenders and traditional mortgage advisors come to grips with the ramifications of online mortgage competition, the sooner they can adapt.

The Race for Closing Speed

eHOME can close almost as fast as you can get your documents together, complete an appraisal and arrange your lawyer.

Customers apply online, submit docs and, “if we don’t run into any issue with appraisal” or documents, Boyle says, Scotia can complete the file in “easily less than 24 hours.” It can then send closing instructions to your lawyer by the day after you apply. That is outstanding service.

Often, a physical appraisal isn’t even required, cutting the closing time to as few as 4-5 business days. That is nearly unrivalled in our industry, at least by a Big 6 bank.

Simplicity

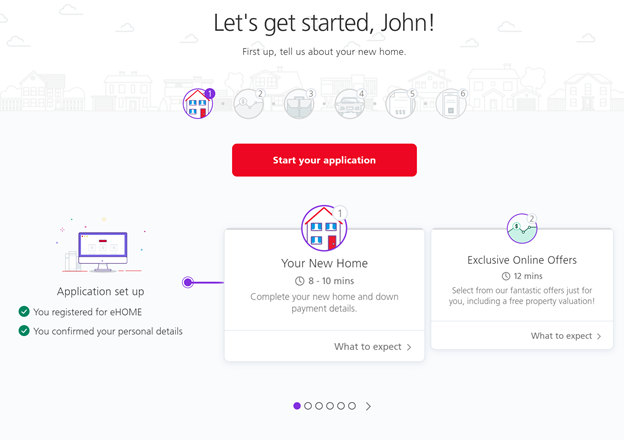

Here’s a look at Scotia’s interface:

The good news:

- It’s super clean and simple

- The bank tells you how long each step will take (it’s about 28-30 minutes total)

- You can choose and lock a rate online in less than 20 minutes (based on our test)

- There’s a clear progress meter and electronic updates of your status

- Live help is a call away

- Once you submit your application, you get a dedicated mortgage specialist to talk to.

- These mortgage reps are all salaried, which: (A) keeps costs [and rates] down, and (B) maximizes advice objectivity. “There are no variable incentives to steer customers to one specific solution,” Boyle says.

What some won’t like:

- It’s only for purchases (the bank is adding support for refinances and switches “soon”)

- Borrowers must get a collateral charge

- Some borrowers don’t want or need collateral charges. Scotia says it did considerable user testing on this and “well over 90% like the…opportunity for additional borrowing right off the gate if additional credit is warranted.”

- “Well over” half of Scotia clients get collateral charges today, says Boyle, who calls them “an anchor product.”

- It’s not yet available in Quebec

Our wish list (from the consumer’s perspective):

- Live chat support (you have to call, which is annoying for some)

- A fair comparison of competitors’ discounted rates to put Scotia’s rates into context (yes, we know banks don’t like to quote their competitors)

- A quick auto-valuation of the home you’re purchasing (RBC has this. It’s useful if you want a second opinion on how much equity you might have)

- More help in choosing the right term (the online advice was seriously lacking, but that’s understandable given they had to get version 1.0 to market. Scotia will improve it)

- Pre-approvals would be nice (Scotia requires a firm purchase agreement to use the system)

Other observations:

- Everything is done online. “We haven’t found another major lender that doesn’t require an in-person visit with a branch advisor or mobile mortgage specialist,” Scotia says. (We couldn’t reach out to all banks by press time to confirm this)

- The bank pays the appraisal cost for online applicants, up to $300. That’s something it doesn’t do for all of its branch customers

In Sum

On its website Scotia proclaims, “No branch visits required!” That’s something you don’t see promoted every day from a company that’s invested hundreds of millions in 963 branches. But you’ll hear this more and more from banks in the next few years. By funnelling borrowers online, banks lower their costs. And that’s crucial to survival in a highly commoditized digital market.

On its website Scotia proclaims, “No branch visits required!” That’s something you don’t see promoted every day from a company that’s invested hundreds of millions in 963 branches. But you’ll hear this more and more from banks in the next few years. By funnelling borrowers online, banks lower their costs. And that’s crucial to survival in a highly commoditized digital market.

When asked what ratio of Scotia’s business will be done through the online channel, Boyle would only say, “It will be a pretty material part of our business in 10 years.”

We’d bet the ranch it will be well over half of Scotia’s business in that timeframe.

“The business makeup will change in 5-10 years…This [online] channel will continue to grow in importance,” she said. “We consider this as a fourth [mortgage origination] channel.”

According to Retail Banker International, “Scotia’s digital banking retail sales are up to 25% in Q1 2019 from 15% in fiscal 2017. The bank has set a target rate of over 50%.”

For more info see eHOME.

log in

log in

12 Comments

Adapt or die!

Not for rental properties either.

When I tried it the rate was 0.13% below what RBC quoted me with 20% down payment. Pretty good.

This is really impressive . Super simple and a great rate. No need for appointments with the bank either. Sign me up!!

Td 5yr fixed is 3.10% as of today

Sounds good for a first try. Not good for realtors in a hurry. They like people that are pre-approved. Not many clients are perfect. Remember garbage in, is garbage out. Hope it works though & gets better with age.

Simhouse:

It’s great for Realtors in a hurry because the approvals next day and the bank can close in a week.

Pre-approvals are coming.

Scotia Ehome Application is great. It is the best end to end application for Canadian Mortgages I have ever seen.

I’m not so impressed. I’ve tried yesterday and today, and keep getting, “Oops! An error occurred processing your request.” after logging in to my profile.

I didn’t notice any technical problems but I did notice that their rates are higher than what I see here on Ratespy.

Scotia’s eHome rates are awesome. They just quoted me 2.84% on a 3 year mortgage and you don’t even have to talk to anyone to get this rate.

This whole article is about how to not be a fish to bad rates and you say 2.84% is a good rate???

Crazy how people shop mortgage rates.