The variable-rate market just got a shade more interesting.

The variable-rate market just got a shade more interesting.

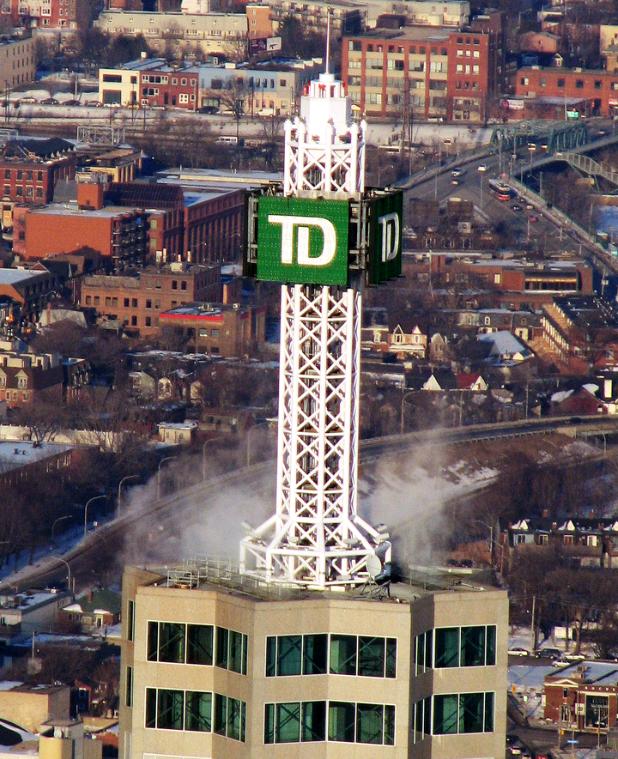

TD has announced that, effective tomorrow, its 5-year variable rate drops from 2.90% to 2.75%.

That’s equivalent to TD mortgage prime minus 1.10%. (In case anyone forgot, TD’s mortgage prime is 15 basis points higher than other banks’ prime rates.)

“Canada’s housing market continues to fluctuate, and rates continue to rise,” a TD spokesperson told us today. “This special rate – on for a limited time – is a strong offer for our customers, while ensuring TD remains competitive.”

Of course, this new rate may not be the hot prime – 1.00% we saw during the banks’ spring rate skirmish, but it’s close. It’s also the best Big 6 bank variable rate currently advertised and much better than most discretionary big bank mortgage rates.

Other points of note:

- This special rate lasts until July 29.

- Unlike some banks’ past variable-rate promotions, TD is making this special available to renewing borrowers as well, not just new customers. Good on TD for rewarding loyalty.

- The offer is available through TD Mortgage Specialists, branches and TD-approved mortgage brokers.

- Thankfully, it also applies to refinances, which means more competition for HSBC’s refi-market-leading prime – 1.06% rate. (Expect deep discount brokers to offer cash rebates on TD’s deal, reducing its “effective rate” to undercut HSBC’s current 2.64% offer.)

More TD Mortgage Rates

log in

log in

7 Comments

What’s up with Scotia lately? For about the past 9 months their rates have sucked. They didn’t match BMO’s prime -1% back in May, and I doubt they’ll match TD now at 2.75%.

I was talking to one of Scotia’s branch managers early this week, and their discretionary rate for a 5yr variable was 2.99%, or 34bp higher than the posted rate at RBC and TD.

This was using their internal “solution builder” tool.

Hey Ralph, One of the issues is that Scotia’s mortgage business has grown faster than its peers. That’s a “problem” for two reasons. One: the market doesn’t necessarily reward outsized mortgage growth in a country with heighten real estate and debt risk. Two: there’s only a limited amount of ultra-low-cost funds available for lending. Scotia could own 1/3 of the bank mortgage market if it wanted to, but banks need to maintain margins. That’s partly why Scotia has throttled back mortgage growth — which it does by modulating mortgage rates.

Strange. CIBC’s Q1 mortgage book is up 9%, and the market seems to love them. Scotia’s book was up 6%, as was RBC.

Maybe Scotia’s problem is too much business going through the broker channel, which I expect would be more costly and therefore less profitable than in-house.

If Scotia is unlikely to be competitive going forward, I guess that’s a good reason to cultivate relationships with other banks…

CIBC has underperformed its peers year-to-date, partly due to its “outlier” mortgage exposure. There’s a reason (apart from OSFI scrutiny) that it cut back its mortgage programs so much this year.

From Barclays Plc analyst John Aiken in May:

“Aside from a strong beat and an announced share repurchase, CIBC’s domestic residential mortgage growth was essentially flat, potentially relieving a relative overhang on the stock as investors have become increasingly concerned with the bank’s relative exposure.”

I talked to a BMO financial services manager today, and their discretionary rate is 2.75, matching TD.

Hey rate spy! What determines the variable discount? Do you think the current discounts off prime will be around a year from now? I’m considering a variable rate @2.46% versus a 1 year fixed @2.42%. My thought is that there may be several increases this year so the short term fixed is better, but that is if similar discounts off prime are still available at renewal……

Hey there David, It’s a great question and one we’ve answered with today’s story: https://www.ratespy.com/what-determines-the-variable-rate-mortgage-discount-08206782