Markets predicted the Bank of Canada would do nothing to rates for the 11th straight month…and they were right.

Markets predicted the Bank of Canada would do nothing to rates for the 11th straight month…and they were right.

Here’s a quick look at the BoC’s rate statement:

- Rate Decision: No change

- Overnight rate: Remains at 1.75%

- Prime Rate: Remains at 3.95%

- Market Rate Forecast: No change to prime through 2020

- BoC’s Headline Quote: “…Canada’s economy is operating close to potential and inflation is on target…In this context, the current degree of monetary policy stimulus remains appropriate…Governing Council will pay particular attention to global developments” (such as “trade conflicts and related uncertainty”)

- BoC on GDP Growth: “…the bank expects economic activity to slow in the second half of the year.”

- BoC on Inflation: “…inflation is on target.”

- BoC’s Full Statement: Click here

- Next Rate Meeting: October 30, 2019

The Spy’s Take

With so many nations easing rates, with $17 trillion of negative rates, the market thinks Canadian rates are virtually destined to drop. But Governor Stephen Poloz is clearly in no rush to meet that expectation.

And there’s no reason to…yet.

Consider that:

- Our economy is holding up, wages are accelerating and rates are already low and stimulative.

- Debt keeps growing faster than GDP and inflation, especially among young adults

- Housing “has regained strength more quickly than expected…supported by lower mortgage rates,” says the bank. “This could add to already-high household debt levels…”

- A Trump-China trade deal is a probability leading up to the election, and it could boost rates roughly 50 bps, estimates one analyst.

Against this backdrop, the Bank risks more with an insurance rate cut (it thinks) than without one. Unless GDP and employment unexpectedly fall off a cliff, there’s a decent chance rates (at least variable rates) could stay flat for months on end. The biggest wildcard for the remainder of the year—besides trade—may be oil. A break below $50 will hurt business investment and itch the BoC’s rate-cut trigger finger.

Where From Here?

The bond market interpreted today’s announcement as inconsequential for borrowing costs near-term. Canada’s rate weather continues to be dictated by economic storms abroad. In fact, some 65% of Canada’s bond yield moves (yields influence mortgage rates) are “imported” from foreign markets, estimates CIBC’s Ian Pollick.

The best that mortgagors can do is to not pay much thought to today’s BoC chatter. If the Bank of Canada ultimately starts a rate-cut cycle by next year, then there’ll be more to talk about. Only then will we have confirmation that the ceiling for rates has fallen further (and will likely stay low for the medium term).

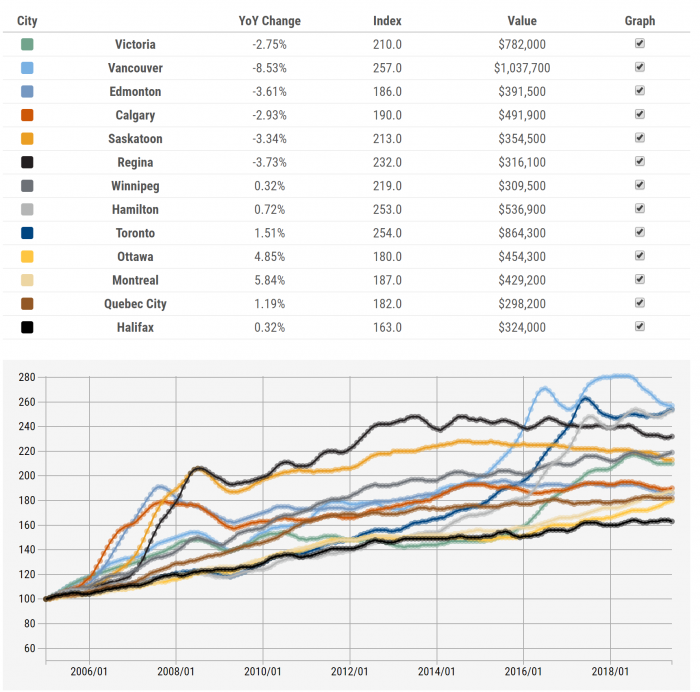

One side note: The BoC argued today that “mortgage underwriting rules should help to contain the buildup of vulnerabilities,” but until housing supply catches up with demand, that’s uncertain. Could we face more mortgage rule tightening in 2020 or 2021? If you see the lines on this home price chart pointing strongly upwards once again, we could.

Source: Brookfield RPS – House Price Index

log in

log in

5 Comments

Negative rates in 2023.

Poloz worked so hard to get rates to where they are now I think he’ll fight tooth and nail to keep them there as long as possible. I read a quote from an economist recently who hit the nail on the head, saying the rearview mirror may be showing strong growth, but the road ahead is crumbling.

Unemployment has bottomed and is now starting to climb. That has been a great recession predictor historically. Once unemployment surpasses 6% it is lights out for rates. 1.50% five year fixed mortgages here we come.

I’m about to apply for a mortgage, what are your suggestions regarding fixed or variable and terms. I was thinking about a 5 year fixed but now after reading your comments perhaps I should get a six months to a year. Any and all thoughts welcome.

Personally if I can get a 5 year mortgage for the same price as a 1 year mortgage I’ll take 5 years all day. Sure, rates might go down but who cares? Rates might go up too. You are getting free rate insurance on a 5 year. Then you don’t have to think about your mortgage for half a decade.