If you’re carrying floating-rate debt, the rate lords at the Bank of Canada have just added to your interest burden.

If you’re carrying floating-rate debt, the rate lords at the Bank of Canada have just added to your interest burden.

Here’s what the BoC just did and what it means to your wallet:

- Rate Decision: Canada’s key interest rate rose 25 bps today

- Prime Rate: Should climb to 3.95% within the week

- Market Rate Outlook: 3 more hikes by year-end 2019 (as of this writing)

- BoC GDP Outlook: 2.1% in 2018 and 2019, slowing to 1.9% in 2020

- BoC’s Headline Quote: “…Governing Council agrees that the policy interest rate will need to rise to a neutral stance to achieve the inflation target….” (It estimates neutral at 2.5% to 3.5%)

- BoC’s Full Statement: Click here

- Next Rate Meeting: December 5, 2018

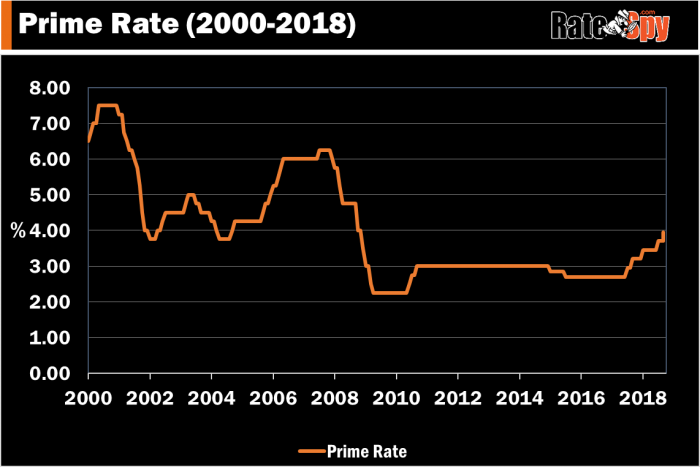

The Spy’s Take: Prime rate should rise to a 10-year high by day’s end, up 125 bps in the last 15 months. If you’re riding out an adjustable-rate mortgage, or getting a new one, your payment will jump about $12-13 a month for each $100,000 of mortgage. As of last night, the market was pricing in the next hike by March, followed by another next summer. We might see the next one even sooner, given the Bank just removed the word “gradual” from its rate hike projections.

*****

The Good News

Bond traders are not betting on rates going stratospheric. If the market’s implied rate forecasts are to be believed, we’re witnessing prime rate climbing a hill, not a mountain.

Market projections currently suggest Canada’s key lending rate is about 75-100 basis points point below:

- the Bank of Canada’s minimum forecasted neutral rate

(the rate at which the Bank doesn’t have to hike anymore to keep inflation on target) - the average total amount that rates have increased during past rate-hike cycles (going back to 1991, when the BoC started inflation targeting)

The Fed Funds target rate, which influences Canadian rate policy, is also 75-100 bps below most neutral rate estimates.

Where Now

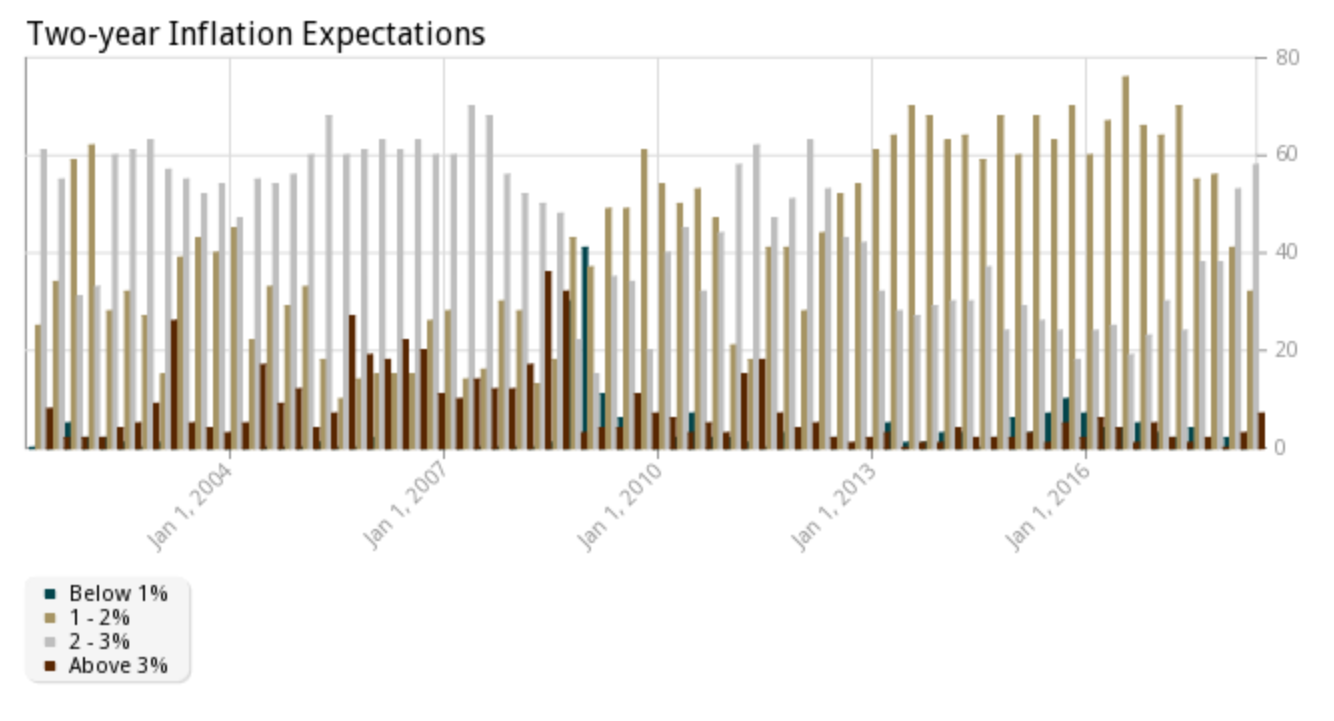

Economic activity is stronger than the BoC envisioned and inflation expectations are rising. That’s largely why traders (and the Bank of Canada) believe rates will keep climbing.

Source: Bank of Canada

As mentioned, mortgage rates by no means appear to be on a runaway path. Many feel we’re late in the economic cycle. The stock market will validate this if it continues weakening further. It’s important to remember that government bond yields have historically fallen as the stock market falls. That’s another reason to think mortgage rates might potentially start levelling off within 18-24 months.

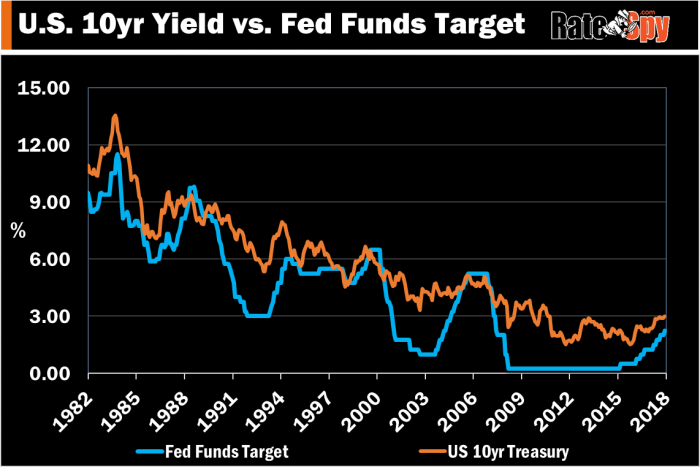

In the meantime, Canadian rates will continue to key off the U.S., the biggest foreign customer for our goods and services. As you can see from this chart, the U.S. policy rate (Fed Funds Target) always catches up to bond yields. And when it does, it rarely goes much above them.

The difference between U.S. bond yields and both the Fed funds rate and the Fed’s estimate of neutral is as little as 100 bps. One percentage point of additional tightening would therefore be a reasonable rough bet for how much higher rates go from here, based on the best available information today.

Of course, rates can and do overshoot such crude estimates. How much more the “robust” (the BoC’s words) U.S. economy grows is a major factor. Trump could stoke it further if he gets another round of tax cuts through Congress, which would clearly be inflationary.

So for now, be safe, not sorry. If you have rate exposure, plan for another 75 to 100 bps of rate tightening in Canada, minimum. If we don’t get it, consider yourself lucky.

Ways to Play a Higher Prime

- Variable rates are still a fair wager if you get one at prime – 1.00% or better. The more rates rise, the better bet they become—given Canadian’s heightened rate sensitivity and given that economies and interest rates are cyclical.

- For many, one-year fixed rates are currently an even better bet. One-year fixed rates are effectively as low as 2.89% (versus 3.15% for the average variable). Plus you get full protection from rate hikes for one year. Just be sure your mortgage is big enough to make a one-year worthwhile given the costs of switching lenders and the effort it takes to renew in 12 months.

- Many 5-year fixed rates are getting a tad rich, but not if you need an insured mortgage. You can still find insured 5-year rates near 3.19% or less. That could prove a bargain if the BoC hikes more than three times in the next 18 months and/or your budget cannot handle rate risk.

- If you’re in a variable already and have a mediocre discount, scan the market and find the best rate you can. Then do some math. If you have a sizeable mortgage, an amortization over 10-15 years and can save over 1/2-point on your rate, consider paying a penalty and switching lenders.

- If you’ve got a variable already and want to lock in, compare your lender’s fixed-rate quote to the rates you see at the Spy. Calculate the cost of switching (including penalties, legal fees if any, appraisal fees and discharge fees). Lenders typically quote subpar rates to people who want to lock in their variable (because they know you have to pay a penalty to leave). You might find that you’ll save more by breaking your mortgage and locking in elsewhere.

Spy Tip: In some cases, your lender might discount your penalty and offer you better rates if you tell them you’re leaving. If you like your lender but don’t like their quote, ask their “retention department” to match the rates you see at the Spy. In some cases they might, saving you the effort of switching.

log in

log in

1 Comment

I just found a statement by Poloz before the House of Commons finance committee that I think shows why he underestimates the impact of rising interest rates. “When I bought my first house and rates were 12 or 13 percent… we want people to understand that 3 percent would be just kind of a normal thing, given the low inflation environment that we have established, and it shouldn’t feel difficult”.

I think he’s way off the mark when he says, “The policy rate will need to rise to neutral to achieve our inflation target.” A 3 percent overnight rate will mean short-term mortgage rates over 4 percent, and a qualifying rate well over 6. If that happens over the next two years, it’ll cause a housing price correction and drive inflation below 1.5%.