The mortgage market is a bit like Baskin Robbins. The flavour of the month can change.

The mortgage market is a bit like Baskin Robbins. The flavour of the month can change.

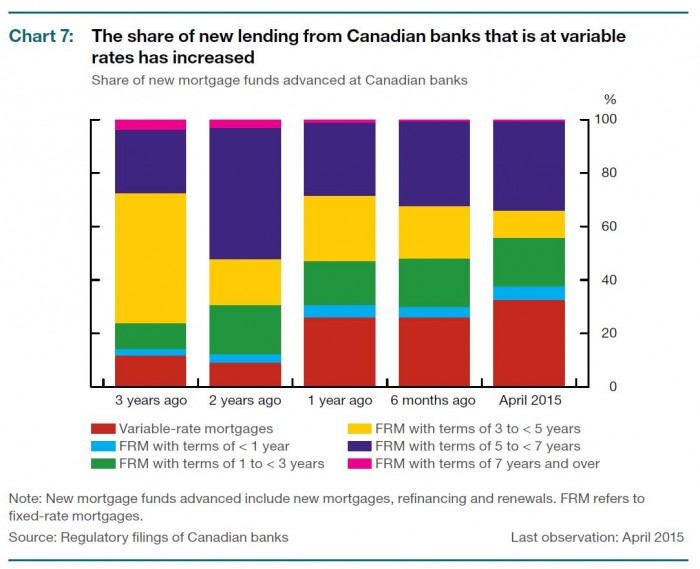

Take the popularity of variable rates, for example. “The proportion of new mortgages being advanced at variable rates has increased over the past several years and has reached about 32% (in April 2015),” says the Bank of Canada (BoC). Compare that to all outstanding mortgages, in which only one in four are variable.

If the BoC cuts its overnight target rate again, even more borrowers may jump on the variable-rate bandwagon—especially if lenders pass through the full rate cut (i.e., reduce prime rate by the same amount). Our beloved banks failed to do that last time.

The popularity of a given term depends on how homeowners perceive its value. That hinges, in part, on the expected savings of that term, relative to some benchmark (typically the 5-year fixed rate).

To illustrate, imagine two hypothetical scenarios:

a) Variable rates are 1.99% and 5-year fixed rates are 2.39% (Spread: 0.40 percentage points)

b) Variable rates are 1.99% and 5-year fixed rates are 3.50% (Spread: 1.51 percentage points)

A floating rate would generally be more popular in scenario ‘B,’ since prime rate must rise further before you lose money on the variable mortgage (relative to the fixed rate). But interestingly, scenario ‘A’ is where we’re at today, and variables are still gaining share.

That’s because we’re seeing multiple factors boost the popularity of variable rates at the moment:

- The lowest such rates are near 1.99%, a number that’s highly appealing psychologically.

- Economists and government officials, who have been wrong about rising rates for years, have lost some credibility.

- People are increasingly believing that rates will stay low for the long term, given Canada’s low growth and inflation.

- Variable mortgages with “fixed” payments are helping alleviate concerns about higher rates.

- People are becoming wise to lenders who impose steep interest rate differential penalties on fixed-rate mortgages.

Once people believe the U.S. Federal Reserve and/or Bank of Canada are about to hike rates, however, we’ll likely see a rush to lock in. Until then, variables may remain the flavour of the moment.

The Spy

log in

log in