Many don’t realize that there are two flavours of floating-rate mortgages:

Many don’t realize that there are two flavours of floating-rate mortgages:

- The adjustable-rate mortgage (ARM)

- Its payment rises and falls with prime rate

- The variable-rate mortgage (VRM)

- Its payment doesn’t change when prime rate changes

- The only exception is when rates soar so much that you’re not paying all the interest. Then the payment generally rises to cover the interest due.

The latter was the subject of this cautionary story by the Globe’s Rob Carrick this week.

He wrote:

“What’s worse than a variable-rate mortgage that keeps getting more expensive as interest rates rise?

The answer is a variable-rate mortgage where payments stay the same…”

One of Carrick’s knocks on VRMs is that they subject you to potential payment shock at renewal. And they do. But that needs some perspective.

How Much Shock?

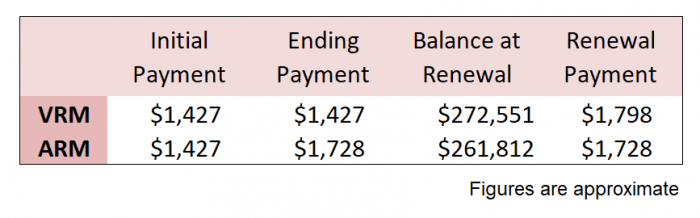

Let’s compare a VRM to an ARM and see how big a concern this really is.

Assume a $300,000 mortgage with a 25-year amortization at a decent rate of prime – 0.90%.

If rates jumped 200 basis points (once every six months), here’s how you’d make out:

As you can see, you’re going to be “payment shocked” either way if rates surge a few hundred basis points.

What Else You Need to Know

Remember this:

- If we may state the obvious, the amortization effect works in reverse when rates drop. In other words, a variable-rate mortgage will pay down your mortgage quicker than an ARM with a floating payment.

- In most cases, and other things equal, your total amortization (how long it takes to pay off the entire mortgage over multiple terms) is the same—regardless of whether you choose a variable or adjustable-rate mortgage.

- By choosing a variable rate with a fixed payment, you can save thousands in payments (over the initial term) if rates jump. And you choose how to spend that extra cash flow. Depending on your circumstances, you may be better off paying down higher interest debt or investing it, rather than paying your mortgage. That can make a variable-rate mortgage the smarter choice economically.

- Historically, floating-rate mortgages have beaten long-term fixed-rate mortgages most of the time. If the fixed payment of a VRM makes you more comfortable with a floating rate, and that leads you to save more overall (relative to a fixed rate), that’s a good thing.

- If rates jump and then fall by maturity (which rates often do as the economy is cyclical), much of this discussion is academic. In other words, your payment difference at renewal may be nominal.

- Making prepayments can offset some or all of the amortization slowdown that occurs in a VRM when rates spike.

In short, neither a VRM or an ARM are “bad” in general. As usual, the right mortgage for you hinges on your goals and financials.

And it also depends on rates at the time. The best rates in Canada are currently on ARMs. Paying a materially higher rate for the fixed payment of a VRM isn’t worth it, unless you really need that payment “insurance.”

log in

log in

4 Comments

Get the lowest rate regardless of the payment type. If you can’t handle increasing payments you should be in a fixed rate.

A 5 year fixed payment is about 8% higher than a variable rate payment. If a variable payment worries you maybe you shouldn’t be in any mortgage, fixed or otherwise.

Dave, I agree.

The analysis above is great. However all this prognostication about the direction of interest rates over the lifetime of a mortgage may be (as stated in the article) academic. The 2 best things a borrower can do are:

1) get the lowest possible rate

2) borrow an amount that doesn’t reach the limits of how much they can handle

The second point is one that is never stressed enough. Not only does it give you flexibility on how much you can prepay your mortgage but it will also boost your savings. Additionally it will allow you to reallocate between the two so you never become the victim of payment shock.

Telling people to just get the lowest rate is like telling everyone to buy stocks instead of bonds. Horrible advice. Have you every heard of the term “suitability “??