Special to RateSpy, By John Bordignon, Capital Markets Consultant

Special to RateSpy, By John Bordignon, Capital Markets Consultant

Earlier this year, while calling for innovation in the mortgage industry, Bank of Canada Governor Stephen Poloz discussed the need for mortgages longer than five years. Longer-term mortgages, he explained, would benefit both consumers and the Canadian financial system.

Based on volumes to date, Poloz’s comments moved the needle only slightly in terms of 10-year fixed popularity.

But let me give you something to think about.

Considering that the majority of Canadians choose 5-year mortgages, roughly 20-25% of all mortgages come up for renewal each year.

In the event Canada experiences a dramatic rise in interest rates (as much as this seems a stretch at the moment), a significant percentage of mortgage renewers would be in for a payment shock.

This increase in payments would cause some borrowers to default, forcing them to sell their homes. An increase in forced sales would, of course, boost the supply of homes for sale.

Couple that spike in interest rates with fewer buyers and the surge in supply would very likely drive down real estate prices, potentially triggering a much larger real estate correction.

But what if…

Now imagine a scenario where a decent percentage of those 5-year fixed consumers were instead locked into 10-year term mortgages. Over time, the number of mortgages coming up for renewal each year would drop to just 10–15% of total mortgages outstanding.

Following a surge in rates, far fewer borrowers might be impacted at renewal. This could foreseeably reduce the number of clients defaulting and undergoing a forced sale. That could potentially cut the number of homes for sale in a crisis by as much as 25–50%, significantly mitigating a home price correction. That’s the theory, anyway.

So, why aren’t more consumers taking 10-year mortgage terms?

Look no further than the difference between 5- and 10-year mortgage pricing.

The Role Bond Yields Play

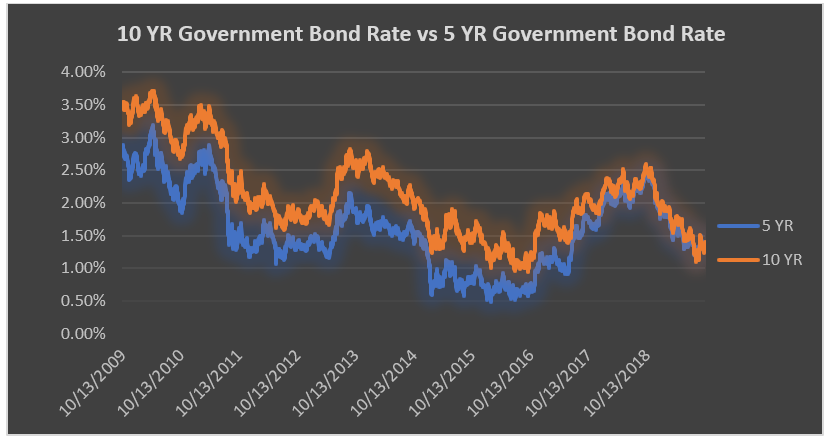

As the following chart illustrates, the 10-year bond yield has been an average of 0.52% higher than the 5-year yield.

This is relevant because mortgage rates closely mirror the direction of bond yields.

Given that 10-year bonds have averaged about half a percentage point higher than 5-year bonds, the logic would dictate 10-year mortgages should also be about 0.50% higher than 5-year terms.

But that hasn’t been the case. Instead, 10-year mortgages have historically sold at ~0.90% higher rates than 5-year money.

The Rate Premium on 10-Year Terms

The 10-year price premium is mainly a function of the maximum penalty a lender can charge the consumer.

The 10-year price premium is mainly a function of the maximum penalty a lender can charge the consumer.

A 5-year fixed mortgage entails a prepayment penalty that is the greater of:

- three months’ interest, or

- the interest rate differential (IRD) between your existing rate and the going rate for the term you have remaining.

On a 10-year term, if you pay out your mortgage before maturity, there are two different penalty calculations:

- If you pay it out in the first five years, the penalty can potentially be the same as if you had taken a 5-year fixed mortgage (as noted above), and often more.

- If you pay it out after the first five years, but prior to the maturity date, the maximum penalty the lender can charge (per the Interest Rate Act) is three months’ interest.

Three-months’ interest is a lot less than an interest rate differential. In most cases, the lender will not recoup their costs if they can only charge three months of interest after the fifth year.

As a result of well-intended legislation, lenders therefore have little choice but to recoup these costs by charging higher 10-year rates to begin with. Most lenders build in about a 0.30% rate premium on 10-year terms for this reason.

Is now a good time to consider a 10-year term?

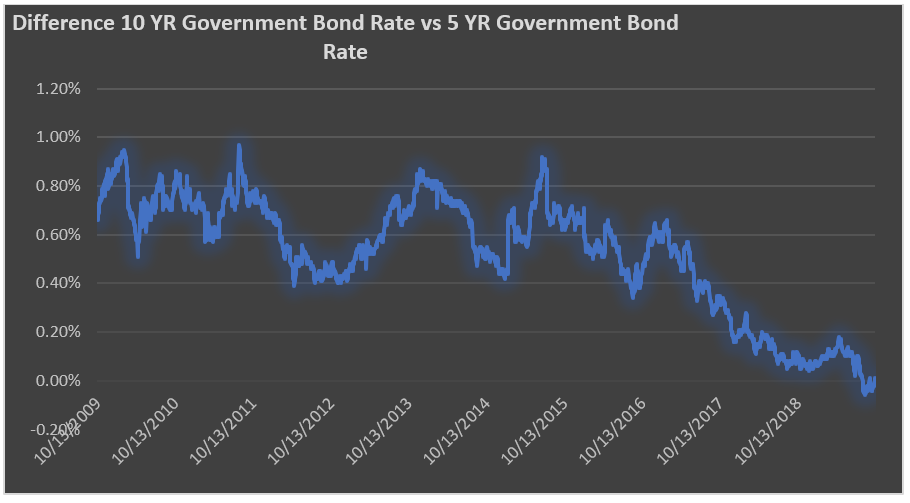

We’re at an unusual point in history. The difference between 5- and 10-year bond yields is almost negligible, as this chart below demonstrates:

In fact, as we speak, the 10-year bond yield is actually less than the 5-year.

This phenomenon, which you’ve probably heard talked about in the news this year, is better known as an “inverted yield curve.” It essentially means longer-term rates are lower than short-term rates.

An inverted yield curve often foretells the possibility of an economic slowdown or recession. This is another reason why locking into a historically low 10-year term could be a good idea.

The current difference between most lenders’ 5- and 10-year fixed mortgages is about 0.30%. And if we analyze the main differences of taking a 10-year term versus a 5-year, there are two questions you need to ask:

- Am I comfortable paying a higher rate (0.30%) for the security of knowing that my payments will not change for the next decade?

- What is the true benefit of having the option of only paying three months’ interest to break the mortgage after the fifth year?

Question one is easy enough to quantify. The higher cost of a 10-year fixed rate vs. a 5-year translates to a payment difference of about $46 per month—or about $1.50 a day. As the cliché goes, that’s less than the cost of a cup of coffee. Especially if you like Starbucks. (Assumes an average mortgage of $300,000 and 25-year amortization.)

Question two is more complicated and requires some hypotheticals.

Suppose, for example, you take a 10-year fixed mortgage and want to sell your home to purchase another. Lenders commonly let you take your mortgage with you and not pay a penalty (a.k.a., port). That’s assuming you don’t require any new funds and keep the remaining term and loan amount the same.

If you do require additional funds, lenders will negotiate either a reduced penalty, no penalty or allow you to blend the penalty into your new mortgage. The same is true for most 5-year fixed mortgages.

The one advantage with a 10-year term comes after the fifth year.

Let’s suppose that in the fifth year of your mortgage one of the following happens:

- you decide to move and purchase another home

- you decide to refinance your existing mortgage for home improvements

- rates drop considerably below your existing rate.

In all these scenarios, you will have to pay out your existing mortgage.

In this case, the lender knows you can get out of your existing mortgage simply by paying a three-months’ interest penalty. You’re not trapped like those in more expensive interest-rate differential penalties.

Lenders in such cases are often more motivated to keep the client dropping their rates and/or improving their terms. That’s especially true given they don’t have to pay an originator’s commission to get the mortgage back.

Effectively, you have an embedded option in a 10-year mortgage that provides you with great flexibility after the fifth year.

Based on today’s rates, the extra cost of taking a 10-year fixed mortgage over a 5-year is equivalent to a few cocktails per month. For that investment, you get the certainty of knowing your mortgage payment won’t change for a decade. Not to mention a lower prepayment penalty after the fifth year. (Note: If you do break before year six, the penalty can be higher than a 5-year fixed depending on rates at the time, your lender, etc.)

The 10-year mortgage isn’t for everyone. But if you find one on sale, and plan to stay in your home for 5+ years and crave mortgage payment stability, 10-year mortgages can be a sensible option.

log in

log in

The current difference between most lenders’ 5- and 10-year fixed mortgages is about 0.30%. And if we analyze the main differences of taking a 10-year term versus a 5-year, there are two questions you need to ask:

The current difference between most lenders’ 5- and 10-year fixed mortgages is about 0.30%. And if we analyze the main differences of taking a 10-year term versus a 5-year, there are two questions you need to ask: In all these scenarios, you will have to pay out your existing mortgage.

In all these scenarios, you will have to pay out your existing mortgage.

5 Comments

Lenders should be allowed to charge full IRD after five years. That is the only way they can offer lower rates on 10 Y terms. But, lenders should also be required to protect the borrower by offering fair rates, portability and blends without penalty if the customer moves or refinances before maturity.

You make a good case for 10yrs even with a slight premium in rates. But mr. consumer just isn’t bighting. for me that is the real question. is this lender driven, broker driven, or consumer driven.

If you get a 10 year mortgage NEVER pick a bank that doesn’t advertise its best rates on its website. If you do and you have to refinance mid-term, you’ll be at the lender’s mercy as to what rate you’re quoted.

hey spy, can you summarize how the IRD would differ between a 5 yr and 10yr term loan (assume same contract rate) if the mortgage was broken in year 3. Does the IRD for the 10 go all the way out the additional 7yrs or just to the end of year 5. But do they then add the 3mos of interest on top of the equivalent IRD for a 5yr term. thanks. Curious how punitive the longer term IRD is and whether the interest act provision limits how punitive the IRD is on a 10yr term.

David,

In your 10 year fixed example the term remaining would be 7 years when the mortgage was broken instead of just 2 years were it a 5 year term. The IRD is multiplied by the term remaining. That is why breaking a 10 year mortgage before 60 months is more expensive.

The interest act doesn’t restrict how lenders calculate fixed penalties if less than five years has elapsed

Jim