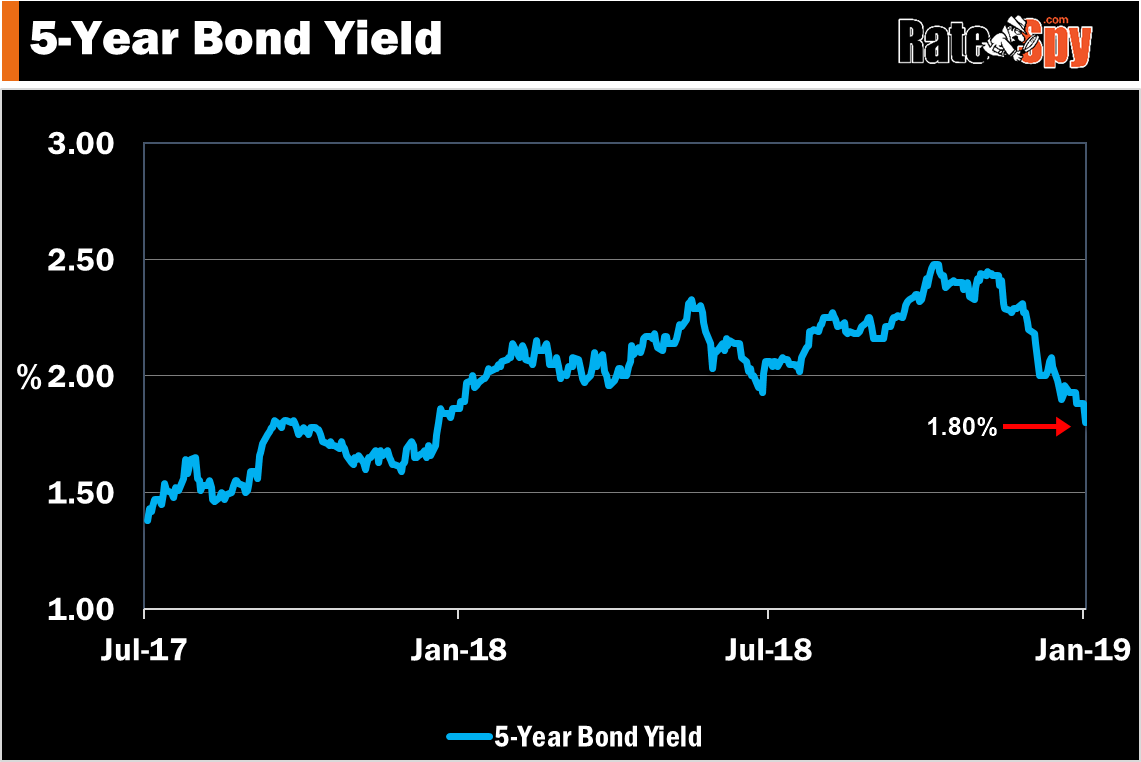

Market rates are diving again. This morning the 5-year bond yield reached its lowest point since 2017.

Investors keep rushing into safe assets (i.e., buying bonds) as the stock and oil markets continue selling off. Oil prices have slid from $75+ in October to under $45 today. That virtually eliminates any chances of a Bank of Canada hike this month. For that matter, rate sentiment is so dovish that the market has almost written off chances for a Bank of Canada rate hike in 2019.

The Fixed Rate Wait

In normal markets, tumbling bond yields would lead to lower fixed mortgage rates. But people have been waiting for lower rates since yields took a downturn in November.

The wait may soon be over, however. At today’s yields, the spread (difference) between the typical bank’s discounted 5-year fixed rate and the 5-year yield is a hefty 193 basis points, the widest since 2016. Long-term normal is closer to 150.

Fat spreads like these are generally not sustainable unless there’s a financial crisis, and that doesn’t appear to be the case today. Now that bankers are back from holidays, lenders we’ve talked with expect them to take fixed rates at least slightly lower. “When” remains the question. With today’s 5-year yield being a brand new relative low, mortgage shoppers may have to wait longer for the volatility to die down. That said, today’s gap down in yields looks like the start of short-term capitulation so perhaps the volatility will subside sooner than later.

log in

log in