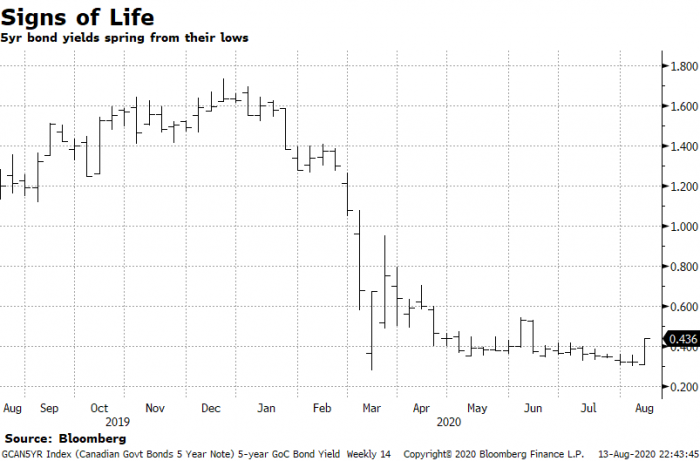

A Two-Month High for the 5-year Yield

- Canada’s #1 fixed mortgage rate indicator, the 5-year bond yield, has stubbornly refused to challenge its March record low. And now it has turned upwards, closing Thursday at the highest level in two months: 0.44%. Concerns over inflation and massive government debt issuance are two key reasons.

- A close above 0.55% could indicate at least a short-term trend change. Alternatively, it could be merely another head-fake given the recovery has temporarily stalled out. There’s no way to know yet.

- At 0.55%, banks would still be selling discounted 5-year fixed rates at a 150-bps+ spread. That’s decent enough margin, so they potentially wouldn’t have to raise fixed rates until we started getting well into the 0.60s.

- Either way, mortgage shoppers looking to nail down a record-low 5-year fixed should do so and protect themselves—if the 5-year yield does hit that 0.55% to 0.60%+ range.

Lower Benchmark Aids Borrowers on the Bubble

- With higher-debt-ratio borrowers no longer able to get CMHC insurance, Genworth and Canada Guaranty are reportedly being pickier with the non-CMHC compliant applications they’re receiving. They’re not stretching on guidelines one bit, according to executives at each company.

- Most borrowers far out on the fringe of qualifying (e.g., someone with a 43.9% total debt service (TDS) ratio and only a 680 credit score—both near the limits) should therefore expect somewhat more trouble qualifying. That makes this week’s stress test rate reduction all the more important for such borrowers—to the extent it lowers their debt ratios. That means they’re more likely to qualify for an insured/insurable rate, which are usually the lowest rates. Of course, they can always qualify for higher uninsured rates, assuming they have 20%+ equity.

- High-debt-ratio applicants with the best chance of approval include those meeting the basic criteria and having income that’s likely to rise materially over the course of their mortgage term.

- A little good news for non-CMHC compliant borrowers: we hear private insurers likely won’t raise premiums on these mortgages—for at least the foreseeable future.

TD Cuts

- TD Canada lowered the following special fixed rates this week:

- 3yr: 2.34% to 2.19%

- 5yr: 2.39% to 2.24%

- 5yr (high ratio): 2.29% to 2.07%

- As usual, expect a minimum 10-15 bps off these rates if you negotiate or use a broker. Sometimes “negotiating” is as simple as asking the bank rep for a “discretionary discount” or the broker for a “buy-down.”

log in

log in

9 Comments

There is another solution available for the tds constrained borrower: the poor old first time home buyer incentive. Yup. If their gds is well below 39 but they have gobs of non housing debt, the fthb incentive will reduce their tds by a couple of points. I know many folks have been very critical, but your example is ironically the exact scenario where the incentive actually helps a borrower on the tds bubble.

Hi David, Thanks for posting this tip. In practice, what we’ve seen is that people with a high TDS usually have a high GDS, and the FTHBI is therefore inconsequential. In a small percentage of cases, however, you are absolutely right.

Does this mean right now banks will have the lowest rates?

Hi nbf2008, The answer to that depends on the mortgage type, term and loan-to-value, among other things. As just one example, most banks can’t compete on default insured purchases but are very competitive on many uninsured refinances.

Fingers crossed that RBC follows suit!

My term ends in January. This looks like I will miss the deals. Should I break it now?

Hey Piper, It’s always possible you might get lucky (from a rate standpoint). In other words, bond yields may not rise much by the time you go to lock in a new rate. You just have to make it about a month and a half — to October 1st-ish or so — unless your existing lender offers competitive early renewals.

How long does CIBC to follow BoC’s posted rate? I’m looking for renewing and wanted to take advantage of the 4.79 posted rate. CIBC on their webpage still advertises 4.94 posted rate

Hi Jaxon, CIBC uses the official benchmark rate (currently 4.79%) to qualify borrowers, regardless of its own 5yr posted rate.