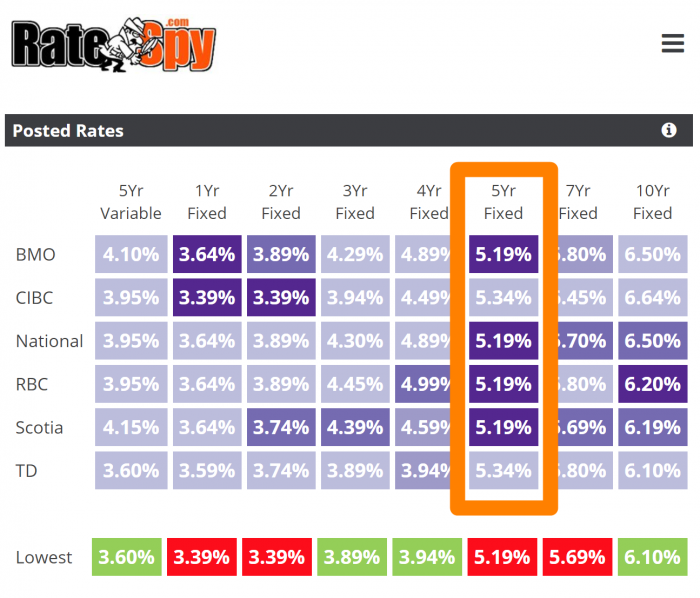

A fourth major bank has cut its posted 5-year fixed rate today. This time it’s BMO.

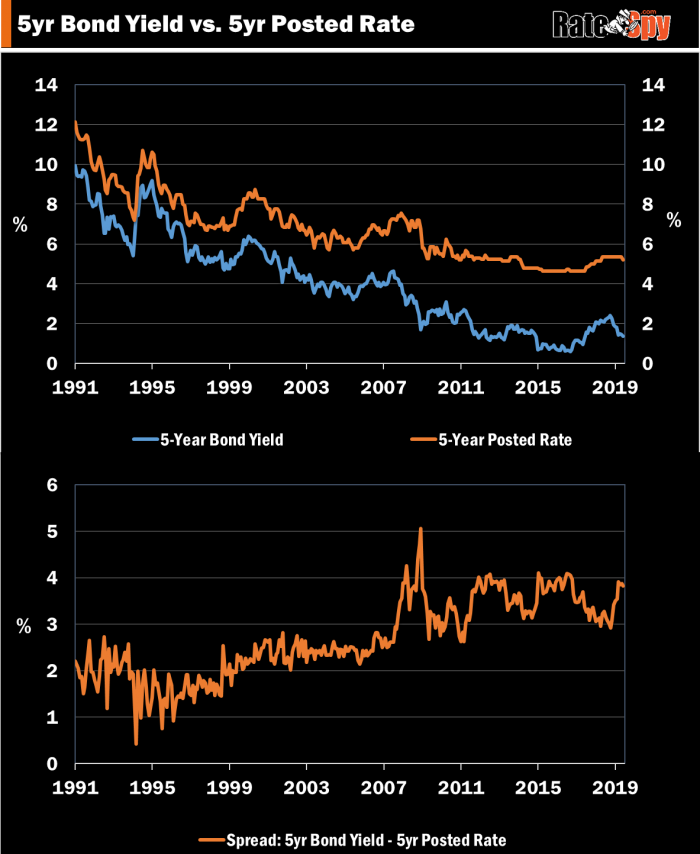

The move comes four long months after the 100+ basis-point collapse in 5-year bond yields. Such a delay in reducing posted rates after large, market-wide rate drops is unusual historically speaking, as we’ve explained previously. See the chart below for more perspective.

BMO’s cut today has implications for the federal government’s mortgage stress test rate. It means that rate will likely stay at 5.19% or lower for quite some time.

That’s because there is now a majority of Big 6 banks at that 5.19% number. This, in turn, lowers the odds that the government’s tie-breaker rules will result in the stress test increasing next month. (The tie-breaker rules are based on Canadian bank assets, which fluctuate month-to-month.)

The Unusual Posted Rate Drop Delay

Here’s a chart of how posted 5-year fixed rates have moved with 5-year bond yields over the years (back to the dawn of inflation targeting in 1991).

The Big 6 banks have intentionally chosen to widen the spread between posted and discounted rates. Conveniently, this lets them charge bigger prepayment penalties on fixed-rate mortgages.

Thus far, banks have refused to lower their 5-year posted rates below 4.64%. That’s despite down-trending bond yields, which, prior to the Great Recession, would have triggered more aggressive posted rate reductions.

It’s notable that this spread-widening occurred well before the government imposed a stress test on all insured mortgages (in 2016) and uninsured mortgages (in 2018). That confirms business interests are the primary driver of this trend.

Going forward, the more rates fall and the more intense online mortgage competition gets, the more bank margins will be pressured and the less inclined banks may be to drop their 5-year posted rates.

Going forward, the more rates fall and the more intense online mortgage competition gets, the more bank margins will be pressured and the less inclined banks may be to drop their 5-year posted rates.

We believe policy-makers knew this when they established the government’s mortgage stress test. Linking the stress test to a non-objective, non-independent rate almost guarantees them a higher minimum qualifying rate. Tricky, tricky.

Whether inflated qualifying rates are in Canadians’ best interest depends on whether you’re someone who is:

- Shut out from qualifying for a deep-discount mortgage because of an artificially high stress-test rate

- Worried that home demand will be artificially suppressed in recessions and slow economic recoveries.

- Rooting for lower home prices (to reduce valuation risk and/or save yourself money on a home purchase)

- Rooting for higher home prices (to protect your existing equity and boost your retirement assets).

Sidebar: Two other BMO mortgage rates also fell today—its posted 1-year fixed (3.79% to 3.64%) and its posted 2-year fixed (3.99% to 3.89%). Naturally, the bank’s actual discounted rates are far lower in both cases.

log in

log in

A fourth major bank has cut its posted 5-year fixed rate today. This time it’s BMO.

A fourth major bank has cut its posted 5-year fixed rate today. This time it’s BMO.

8 Comments

Shower Thought: Since the qualifying rate is artificially held high, the supply side of the mortgage market is artificially held low, which drives up the market-clearing rate. Those who do qualify, get lower rates cause this artificial number is held higher.

The rich homeowner pays less in interest. Rich get richer? Tricky, tricky indeed.

Correction: …which drives down the market-clearing rate…

Thanks for the note, JM. Good to see the shower water is keeping your glass half full. Lower prime mortgage demand (that is, lower than there would have been with a adaptable stress test, not necessarily lower overall) may theoretically fuel incrementally more rate competition. Albeit some lenders would try to maintain margins with wider spreads. That may be a tiny silver lining in theory, however offset it is by the overall economic ramifications of an insufficiently flexible stress test — which Mac.Ro alludes to.

Housing activity is an important shock absorber in times of negative GDP. By not allowing the stress test rate to float with market rates regulators put the economy at risk. It’s short-sighted policy that will only extend the next recession.

I don’t understand how posted rates can be so high. Is it just so the banks can charge larger prepayment penalties? There aren’t actually homebuyers who get a posted rate for their mortgage, are there?

Banks can set posted rates at whatever they want. Depending on things like the term, the customer’s risk profile and whether it’s a renewal or not, there may be a few people out there paying posted rates.

I work in new homes construction and the stress test is really hurting sales to the point of major layoffs in the construction industry. People that put down deposits on their houses cannot get the financing are forced to walk away.

We’ve seen a lot of deals crumble this year because financing fell through during the conditions period. It’s usually because of the stress test. Sometimes it’s because of the appraisal coming in too low. In either case, deals are collapsing way more than usual.