For the first time since the stress-test rate last increased (in May 2018), a major bank has cut its 5-year posted rate below 5.34%.

For the first time since the stress-test rate last increased (in May 2018), a major bank has cut its 5-year posted rate below 5.34%.

RBC confirmed the move Saturday morning, lowering its trend-setting posted 5-year fixed by 15 basis points to 5.19%.

Speculation has been running rampant in the industry about the government persuading banks to keep their 5-year posted rates propped up. With housing risk still elevated, people’s theory was that regulators wanted to see the minimum qualifying rate stay at 5.34%. That makes the mortgage stress test harder to pass, thus tempering real estate demand.

OSFI, for its part, suggests it has no such involvement. It told us Saturday that “business decisions including [setting posted rates] are made by the banks.”

We also reached out to the Department of Finance for its take, specifically concerning its history of influencing bank pricing. It responded, ” “The Government of Canada does not interfere in the day-to-day business decisions of financial institutions.” It refused to comment on how that reconciles with prior Finance Minister personnel reportedly calling banks directly on such matters.

Why This Matters

Lenders and consumers have been waiting for banks to drop their 5-year posted rates for months, but banks have held out. In fact, despite 5-year bond yields falling 113 bps since their November high, the benchmark posted rate hasn’t fallen one iota.

Lower posted rates have three benefits in that they:

- Reduce fixed-rate mortgage penalties (other things equal)

- That’s due to how banks calculate interest rate differential charges

- Reduce the stress-test rate

- The mortgage qualifying rate is based on a mode average of the Big 6 banks’ 5-year posted rates

- Allow discounted rates to be reset lower for borrowers who’ve locked in but have not yet closed their mortgage

- This is true for some lenders, not all.

De-Stressing the Stress Test

The government’s stress-test rate hasn’t fallen since September 2016. A decrease this time around would require at least two more banks to follow RBC in cutting their 5-year posted rates.

If that led to the minimum qualifying rate dropping from 5.34% to 5.19%, the median 2+ person family making $92,700 with 20% down could theoretically afford up to 1.4% more house.

That’s not huge, but it is about $7,600 in additional buying power—using the above example.

Of course, a 15-bps cut in the stress test would have little impact on its own. But if it’s the start of multiple posted-rate cuts, it’s significant. A gentler stress test would bolster Canadian real estate psychology at a pivotal moment, with recession risk making headlines and home prices struggling to stabilize. Easier qualification would also slightly boost refinance volumes.

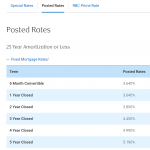

Sidebar: RBC also cut the following advertised fixed-rate “specials”:

4-year: 3.14% to 3.09%

5-year: 3.39% to 3.24%

…as well as the following posted fixed rate:

4-year: 5.04% to 4.99%

log in

log in

11 Comments

So let me get this straight. The bond yield falls 113 bp and all a bank can muster is 15 bp off it’s posted rate?

Banks are the biggest crooks next to the liberals in office

RBC could drop their rate another 5% and still wouldn’t even think of borrowing money from those #&%$@$s! You can guarantee they’ll be squeezing ever cent out of you in fees!

Darryl,

You can’t blame a bank for being a bank. Banks’ first priority is to their shareholders. Don’t forget that. If you ran RBC and had any sense, you’d charge the same fees and have the same posted rates. That is how you maximize profit. Hell even credit unions have to make a profit, despite them calling it something else.

So which Credit unions use lower rates to qualify you for a mortgage?

Would it be unusual if RBC was the only bank to drop its posted 5year? To be honest I’m surprised none of the others have made a move yet given how inflated their posted rates are

Hey Mike, Given the massive slide in bond yields, yes, it would be highly unusual if no other banks dropped their 5-year posted rates.

The posted rate is not the rate you receive… I called today and was offered the following: 4 year at 2.79 and 5 year at 2.89. Maybe you should ask why brokers offer a lower rate to someone with 5% down vs a client with 20% down.

That’s true Jennyfer. RBC’s actual rates for well-qualified new borrowers are much lower than what they advertise, as is the case with all Big 6 banks.

On your last point, may I ask what you are getting at exactly? A lot of lenders, including big 6 banks, offer lower rates on 5% down insured mortgages. Those loans have a zero risk weighting for lenders and are simply cheaper to fund and hold on balance sheet.

As of today I see CIBC has lowered its advertised discount* 5yr to 3.29% and a 7yr at 3.39%. It seems that more and more 7yr options are becoming competitive too.

*the real rate would be 25bps off

Thanks for the post Tbahz. The problem with 7yr terms is that few want them, even at just a 10 bps surcharge.