Last meeting, the Bank of Canada finally shifted its rate outlook to neutral. After today’s meeting, the gear shifter is still firmly there.

Last meeting, the Bank of Canada finally shifted its rate outlook to neutral. After today’s meeting, the gear shifter is still firmly there.

Here’s a quick glance at what the BoC did today:

- Rate Decision: No change

- Overnight rate: 1.75%

- Prime Rate: Prime rate remains at 3.95%

- Market Rate Forecast: Likely one rate cut by the end of 2020

- BoC’s Headline Quote: “…the degree of accommodation being provided by the current policy interest rate remains appropriate….Governing Council will remain…especially attentive to developments in household spending, oil markets and the global trade environment.”

- BoC on GDP Growth: The bank expects a “pickup starting in the second quarter”

- BoC’s Full Statement: Click here

- Next Rate Meeting: July 10, 2019

The Spy’s Take

The BoC reminds us of a Toronto Maple Leafs fan. Always optimistic and frequently disappointed.

But the best interpreter of the bank’s comments is the market itself. Today’s statement from the BoC won’t change the market’s unambiguous expectation that there’s a greater risk of rates falling in the next year than rising.

That risk is heightened by the facts that:

- up to 17% of Canada’s economic performance could be hit by a worsening Ameri-China trade war

- oil prices have reversed

- U.S. yields look ominous

But with:

- phenomenal jobs numbers

- inflation on target (average core CPI is 1.97%; the target is 2.00%)

- Governor Poloz suggesting rates will need to rise over time…

…there’s too much upside inflation risk offsetting the downside risks to portend any near-term change in the bank’s policy. CIBC economist Benjamin Tal put it this way on BNN today: “I’m not cutting, read my lips. That’s exactly what [Poloz] is telling you.”

But if you ask that great recession predictor, the yield curve, it’s implying that the opposite will be true, eventually.

That Elusive Neutral Rate

The BoC forecasts a mean neutral rate that’s 100 bps higher than today (its neutral estimate is 2.25% to 3.25%). Nothing in today’s announcement suggests we’ll hit that 2.75% midpoint in this rate cycle.

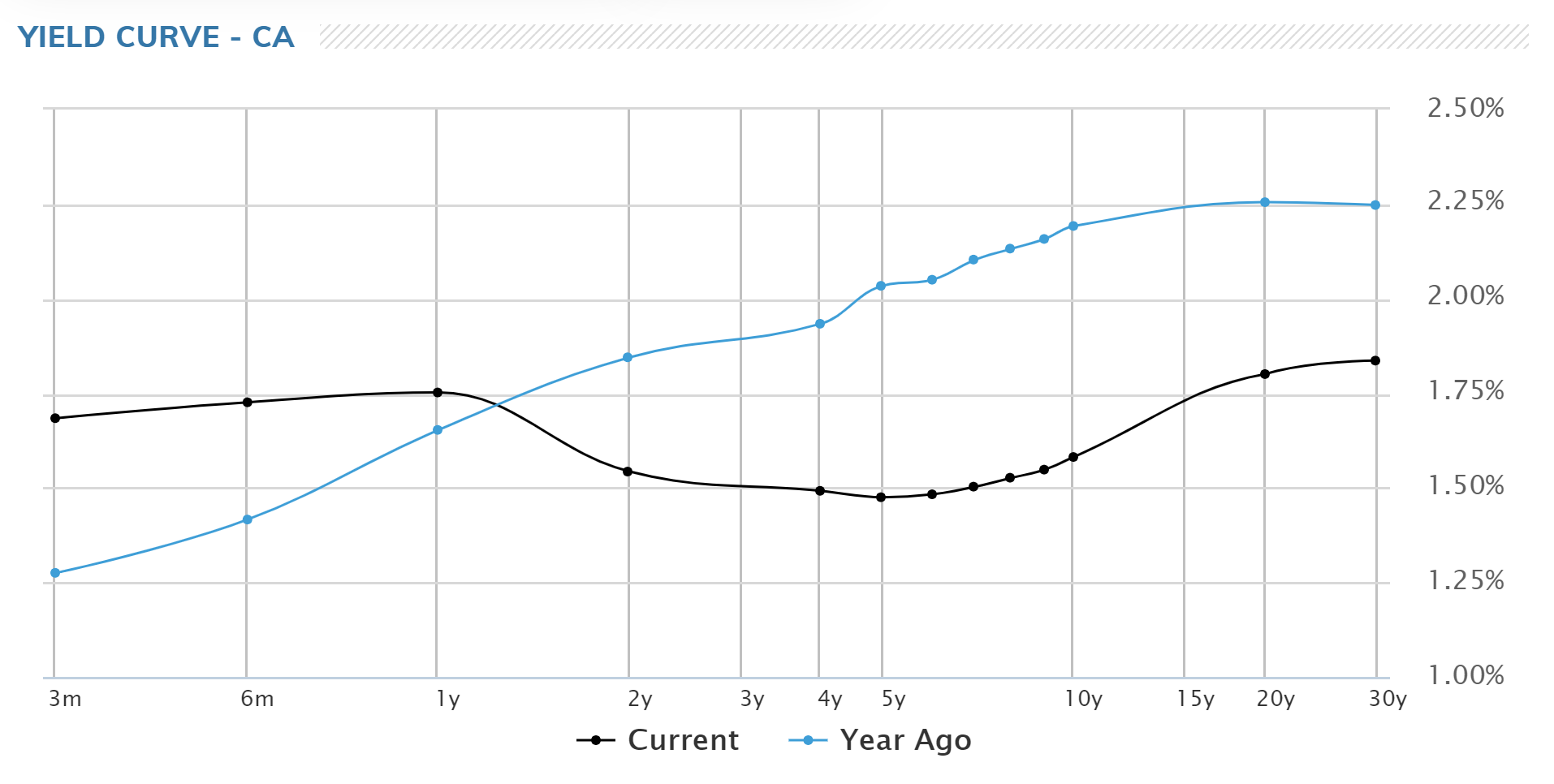

And check out Canada’s yield curve. Here’s a comparison of how it looks today versus last year, from MarketWatch.

Source: MarketWatch

The curve just keeps inverting. If you locked your money into a riskier 10-year government bond today, you’d make 10 basis points less than you would by investing for just three months, in a 3-month bill. That market distortion reflects a stark lack of confidence in the BoC’s ability to hike rates.

It’s also why variable rates, which many consider riskier, are oddly higher than the best 5-year fixed rates.

How to Play It

All signs point to flat rates for as far as the eye can see (which isn’t that far, actually).

And remember, rates can go sideways a long time. Earlier this decade they held at 1.00% for over four years.

In that environment, the play for most well-qualified risk-tolerant borrowers is the same as it was last month. Pick the lowest most flexible mortgage rate that you can find.

For those who can’t afford as much volatility in their expenses, or those with rate-based insomnia, five-year fixed rates under 3% are a sounder bet—especially if you choose a fair penalty lender. Just promise yourself not to have buyer’s remorse if rates keep dropping.

log in

log in

6 Comments

Is it normal for a Bank of Canada governor to have such a strong personal desire to want to hike rates, even in the face of so much risks from a global trade perspective? I feel like he won’t be happy until he gets at least one or two more hikes in.

Hi Nonuk,

At various times throughout history central bankers have resorted to such jawboning — i.e., tried to create the perception that rates are headed higher. It happens if a central bank truly believes it’s got insights the market doesn’t. And sometimes it happens when a central bank is trying to scare people from doing something — e.g., over-accumulating more debt, dumping its currency, etc.

Strongly believe the whole notion of Interest rates need to adjusted for inflation purposes is flawed thesis on a developed market like us in this age. I feel, the way they calculate inflation is skewed and a model inherited 50yrs back.

The CPI index needs to be relooked to make much broader sense. Probably we are looking at the wrong direction.

For eg: Shelter – The property values for most of Canadian market have risen atleast 70 to 100% in the last 10 yrs but inflation hasnt rose above 2%. If shelter is that pricey, then we should have see inflation skyrocketing.

– Transportation is another industry where prices will go cheaper because of Ubers & electric vehicles.

With the advancement of technology and other tools, its only pushing you towards deflation pressure.

Who knows, 2% will be norm for the next 10yrs for overnight rates.

Hi San,

While shelter is the biggest component of CPI (at 26.8%), many agree with you that it’s still under-weighted.

More from StatsCan: https://www150.statcan.gc.ca/n1/pub/62f0014m/62f0014m2017001-eng.htm

Poloz appears to want to raise rates as the U.S. is on the verge of lowering them. It’s like he doesn’t realize that the yanks steer the ship. I think he’s just trying to talk rates higher, but if he keeps it up for too long no one will believe him anymore.

The math does not add up. Thats why I am concerned, they are looking at the wrong direction or the data model they receive is not accurate.

Also, the traditional metrics of inflation may not provide the correct picture. There are inflationary pressure on wage growth but deflationary pressure on consumer consumption behavior..

What model worked during baby boomers may not work during gen Z..