Not much to see at today’s Bank of Canada meeting. It was another yawner as prime rate held at 3.20%.

Not much to see at today’s Bank of Canada meeting. It was another yawner as prime rate held at 3.20%.

Among the few takeaways:

- The Bank stated: “While higher interest rates will likely be required over time, Governing Council will continue to be cautious…”

- Interpreted this means: Higher rates are on their way, between now and when we die.

- If you prefer more objective indicators, lean on OIS prices. They have a bit more predictive ability than a coin flip and they’re suggesting that the next hike will come post-Easter.

- Advice for floaters: If you’ve got a variable rate mortgage, today’s news was no news. Hold tight.

- “Housing has continued to moderate, as expected,” the BoC added.

- That’s true overall (unless you’re a renter being edged out by people who used to qualify for mortgages).

- Watch those big-city condos, though. They’re still being bid up (+24% y/y in Vancouver; +18% y/y in Toronto) as aspiring homeowners realize they can’t afford houses. Last fall’s new insured mortgage stress test are doing a bang-up job (at making affordable housing less affordable).

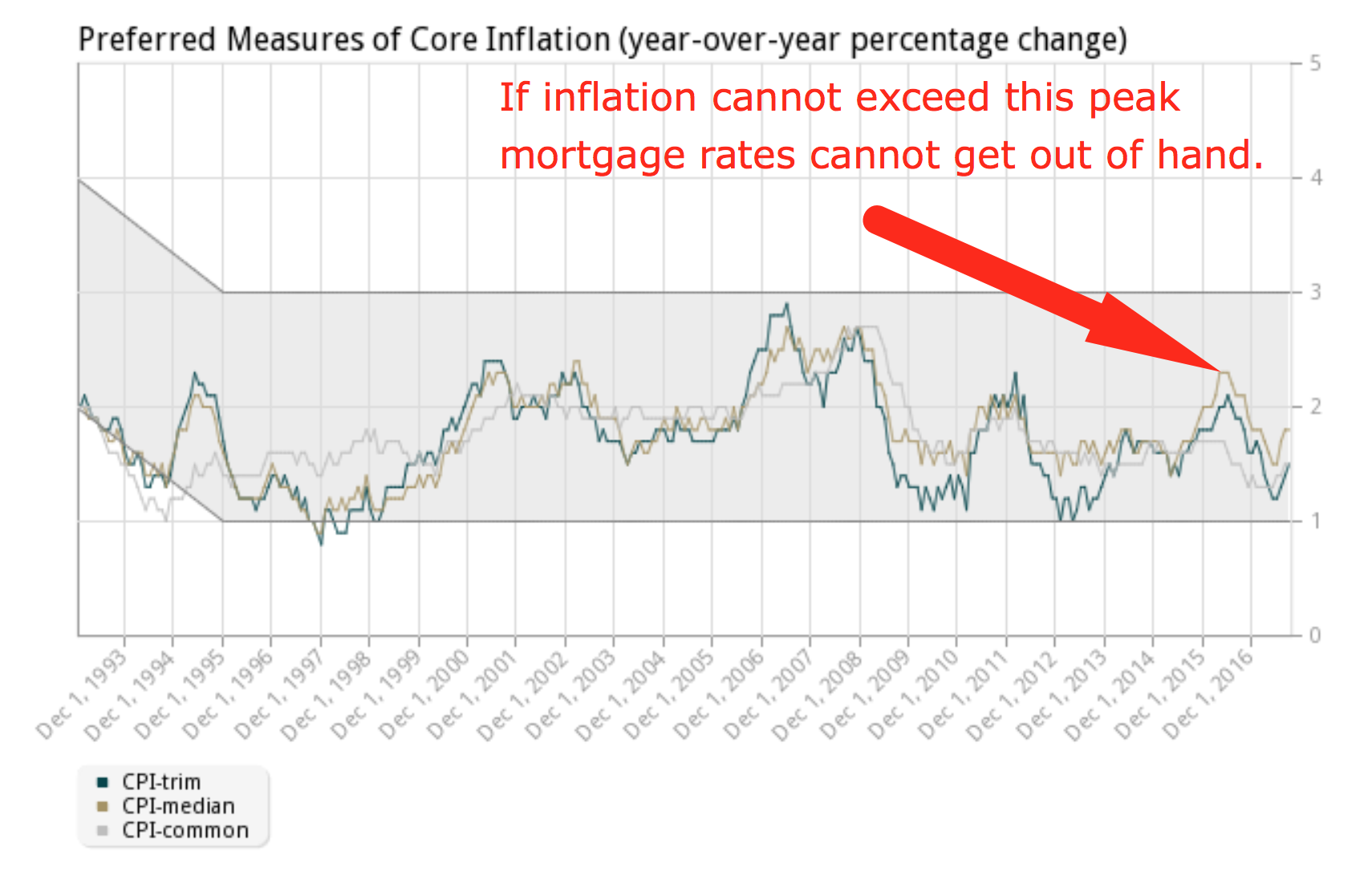

- “Inflation has been slightly higher than anticipated.”

- But is by no means worrisome, with all four inflation measures comfortably under the BoC’s 2% target.

Here’s the Bank’s full statement. Its next rate meeting is January 17.

The Effected

Genworth, the nation’s second-biggest default insurer, did a little test recently. It reportedly looked back at all of its low-ratio mortgage applications from 2016 and 2017. It then stress tested them using OSFI’s new B-20 guidelines.

It found that more than 1 in 4 (27%) of applicants approved back then would not have qualified for a mortgage under the rules coming January 1.

That’s a lot of people. Low-ratio borrowers make up more no less than 4 out of 5 mortgagors (overall) and at least 7 out of 10 purchase mortgages.

After adjusting for the fact that borrowers will adapt (e.g., take longer amortizations, get more down payment money from parents, etc.) Genworth concluded that B-20 could reduce housing demand by up to 10% in 2018.

Stress Test Yourself

If you want to figure out whether you can beat OSFI’s new stress test, give this calculator a spin. –> Link.

If you want to figure out whether you can beat OSFI’s new stress test, give this calculator a spin. –> Link.

Use 4.99% for the “Annual interest rate” or 5.29% if you want to be conservative. This is the “qualifying rate” — subject to change if rates rise.

Once you plug in your numbers, make sure:

- your gross debt service (GDS) ratio is below 39%

- your total debt service (TDS) ratio is below 44%

- your credit score is above 680 (preferably 720+)

- you can prove all your income.

If all that is in order, you should be stress-test ready.

If you don’t pass but you still want a mortgage, talk to a mortgage advisor by next week. Many federally-regulated lenders will stop accepting applications under the old rules before Christmas, even though B-20 3.0’s official implementation date is January 1, 2018.

Refis & B-20

If you need to refinance, particularly if you want to consolidate a lot of debt at the lowest rates, you have 25 days to qualify under today’s looser rules.

In the new year, it’ll get considerably harder to refinance at best rates, especially if home values fall.

In fact, the refinance market could be jolted even more than the purchase market. And if people can’t consolidate debt, you know what that means. More Canadians will be riding the high-interest debt bus for years longer.

Renewals & B-20

We got this question yesterday: “How will the mortgage rule changes affect mortgage renewers if they wait until January to renew?”

The answer is…If you have:

- good credit and provable income

- less than 20% equity or your total debt service ratio is below 33%

…then you likely won’t be impacted.

If you are affected and you can’t pass the stress test, you can always stay with your existing lender. But as we’ve written before, don’t expect an overly charitable interest rate from that lender if it knows you can’t go elsewhere.

Pre-Approvals & B-20

Your lender has lots of discretion on how it handles pre-approvals before January 1.

The banking regulator tells us:

“OSFI recognizes that some borrowers may have received mortgage eligibility commitments or ‘pre-approvals’ from their financial institution prior to the revised Guideline B-20 effective date. In these cases, financial institutions have the discretion to underwrite the loans based on the pre-existing guideline (including the prior qualification rate), or apply the new rules.”

We’ve already seen various lenders announce they:

(A) are cancelling pre-approvals that don’t go “live” (i.e., where you don’t have a property address and closing date) by December 31

or

(B) will honour pre-approvals received by December 31 for 90-120 days

If you got a recent pre-approval and want to maximize your buying power in the new year, then:

- make sure your lender subscribes to policy (B) above, and

- reset your pre-approval by the last week of December if you want to extend your rate hold.

Then again, with 2018 looking potentially ominous on the housing front, we wouldn’t be rushing out to “maximize” our buying power.

log in

log in

Genworth, the nation’s second-biggest default insurer, did a little test recently. It reportedly looked back at all of its

Genworth, the nation’s second-biggest default insurer, did a little test recently. It reportedly looked back at all of its

Your lender has lots of discretion on how it handles pre-approvals before January 1.

Your lender has lots of discretion on how it handles pre-approvals before January 1.

4 Comments

Any idea what the qualifying rules are on assuming a mortgage? People selling that have a 5yr fixed mortgage and can’t port could avoid a lot of penalties if the buyer assumes their mortgage.

My guess would be the purchaser would still have to use the BoC qualifying rate instead of the contract rate on the mortgage they are assuming.

Hey Ralph, Anyone who assumes a mortgage would need to be requalified under federal guidelines, assuming it’s a mortgage funded by a federally-regulated lender.

How long do you think before we start seeing the impact of B-20 on home sales and prices? Will it start showing through in the January data right away?

@Tara, It’ll weigh on prices immediately. How much and how long, are anyone’s guess.