All it takes to derail an uptrend in mortgage rates is one little global crisis. And that’s potentially what we’ve got.

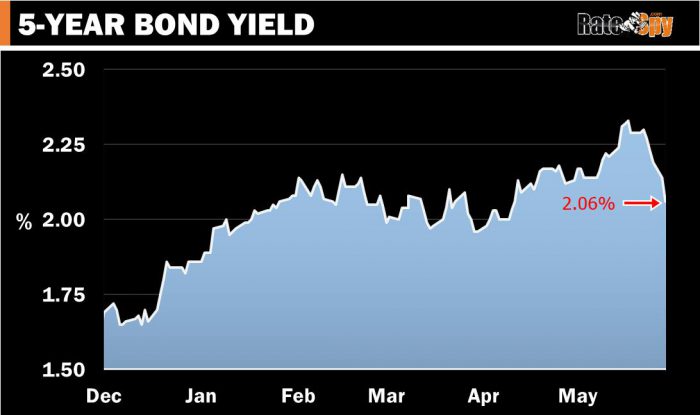

Canada’s 5-year bond yield—which drives fixed mortgage rates—has plunged. As of this writing, it’s down almost 30 basis points from its high two Fridays ago.

This latest nosedive is courtesy of shoot-first-ask-questions-later AAA bond-buying. (Rates move inversely to bond prices.) It’s coming from investors running for shelter in risk-free assets following political/economic turmoil in Italy, Spain and Turkey.

Who Cares What’s Happening in Europe?

Investors do.

A crisis in one country can quickly dim investor sentiment around the world. The Greek debt crisis showed that investors fearing contagion can drive down Canada’s 5-year bond yield by 1/4 point practically overnight, and half a point in not much longer.

That’s enough to derail a rate hike uptrend for months, if not longer. In fact, back at its height, Greece’s woes helped send Canadian yields to record lows. (That won’t happen this time.)

Fixed Rates Should Ease

There’s no telling how long these countries’ distress will last. But we do know it’s going to deflate fixed mortgage rates in the interim. We could see the best 5-year fixed rates drop 5-15 basis points industry-wide in the next week or so.

Compared to a few weeks ago, we’ll see fewer mortgage shoppers rushing to lock-in pre-approvals or convert their variable rates. (Speaking of variable rates, remember that most big banks are ending their prime – 1.00% specials in a few days.)

We’ll have to see how this plays out in coming weeks. It’ll be telling if the Bank of Canada mentions this new Euro-fiasco in its statement tomorrow. While it doesn’t yet smell like a significant global crisis, it doesn’t take much to knock down rates amid a tentative economic recovery.

log in

log in

2 Comments

When you say most banks are ending their variable rate specials in a few days, do you have inside information that they won’t be extended, or is it your best guess?

It’s what they told us a few weeks back. Whether they extend the deadline or not is unknown.