The Canadian yield curve has officially inverted and that’s bearish for mortgage rates.

An “inverted yield curve” (in this context) means that the interest rate on almost every Canadian government bond is now below the Bank of Canada’s 1.75% overnight rate. That’s pretty rare.

Why it Matters

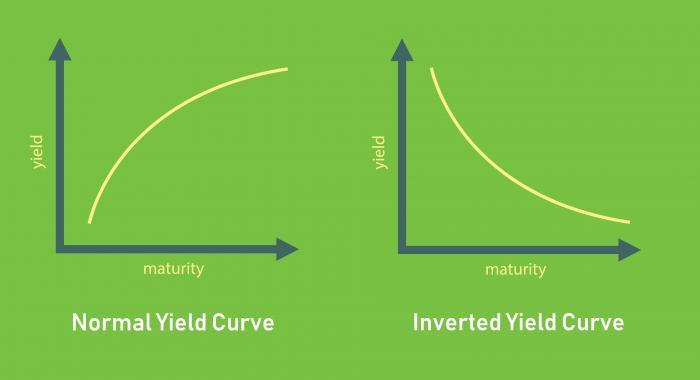

Inverted yield curves are a danger sign. In a normal economy investors like to earn more for holding bonds longer. After all, the longer the investment duration, the more inflation risk, price/volatility risk and credit risk there is.

But that’s all been flipped on its head.

Investors now believe that:

- Risk of an economic slowdown (recession) is mounting

- Inflation could soon start falling, and

- Rates may head lower as a result.

Predicting downturns is what yield curves are good at. Since 1961, 10 of the last 15 Canadian yield curve inversions was followed by 1+ quarters of economic contraction, notes Bloomberg. Moreover, inversion predicted every major recession going back decades.

What the Bank of Canada Might Do Next

Economies around the world are stalling amid record ($240 trillion+) debt levels. There’s now almost $10 trillion in debt out there with interest rates below zero, a freakish reflection of how much global growth has slowed.

Canadian rates may be a ways from zero but our prospects have dimmed by the month. In three of the last four reported months our economy has shrunk in real terms. And if, heaven forbid, we get an unexpected economic shock this year, you can stick a fork in our economy—it’ll be done.

As for our central bank, ignoring recession-talk and yield curve inversion is playing with fire. With short-rates higher and long-rates lower, businesses will invest less, incomes could fall and consumer confidence will deteriorate.

Given the facts that:

- GDP has already been dismal of late

- Inversion precedes recessions by roughly 16 months on average

- The BoC sets rate policy 18-24 months in advance, and

- The BoC usually starts cutting rates ahead of recessions

…then the BoC better get crackin’ on those rate cuts (or at least stop hinting at rate hikes, so it doesn’t lose credibility).

That is, if it plans to minimize potential economic damage.

The BoC knows all of this but maintains that the drag on our economy is “temporary,” citing “strong” job and income gains and inflation that’s near target. If further growth signals don’t materialize before its April 24 meeting, however, the Bank should change to a more dovish tune.

If that happens, the bond market could see it as longer-term-bearish for yields and take rates down even further.

With “the bulk of the curve being below the overnight rate, it really says that the BOC will be reluctantly led to cutting rates,” fixed-income expert Ryan Goulding told Bloomberg this week.

At the very least, Laurentian Bank economist Dominique Lapointe says inversion is a “sign that the BoC is done in its tightening cycle.”

Mortgage Strategy

There’s always the small possibility that this week’s inversion is a fake-out and that rates will reverse higher. But if history is a guide, probability favours rates staying below last year’s high for a few years minimum.

There’s always the small possibility that this week’s inversion is a fake-out and that rates will reverse higher. But if history is a guide, probability favours rates staying below last year’s high for a few years minimum.

Remember, you don’t need a recession for mortgage rates to drift lower. Sluggish (sub-1.50%) growth will also do the trick. In 8 out of Canada’s last 9 inversions, the prime rate was lower or flat-ish one year later.¹ We like those odds.

Knowing that, then:

- If you’re someone who can handle the small risk of meaningfully higher interest costs…

…you can afford to bet on variable or short-term rates, on the assumption that their historical outperformance will persist in a slowing economy. Just be sure to get one near/under 3% or you’re wasting money.

- If you’re someone with less certain employment/income, a high debt load (e.g., a total debt service ratio near or above 42%), borderline credit, less than 20% home equity and/or minimal savings…

…you may be better suited to the lowest 5-year fixed rates. That minimizes your exposure to both higher interest costs and the risk of not qualifying to switch lenders when renewing a shorter term. (Remember, if you want to change lenders to get a better rate on most mortgages, you have to pass a strict stress test.)

But do yourself a favour. If you’re going with a 5-year fixed and there’s any chance of you changing your mortgage before five years, pick a lender with a fair penalty. Breaking up with a big bank early can cost you two to three times as much as a smaller lender. (Don’t dismiss this. As rates drop, big bank interest-rate differential penalties will increase because of how they’re calculated. And they’ll increase by the thousands in some cases!)

The Mortgage Market During Recessions

Mortgage growth is already in the toilet thanks largely to the stress test, a rising qualifying rate (5.34%), record-high debt levels, punitive taxes on foreign buyers/speculators, overvaluation in big cities and, now, falling home prices.

An economic slowdown won’t help. That’s especially true if we go into recession, when credit growth virtually always tumbles.

That said, falling interest cost will help in the interim. Once the mortgage qualifying rate finally drops, more people will buy and refinance. The big banks haven’t changed this critical rate since last May, but they should soon.

That could give the housing market a small shot of adrenaline—at least until we start seeing unemployment spike.

¹ Refers to where Canada’s 10-year government bond yield was below the overnight rate.

log in

log in

5 Comments

Mortgage rates have been suppressed for 10 years by the BOC buying bonds and instruments to artificially juice the economy (socialism for the rich- it ain’t capitalism) which created housing price inflation in spades, corporate welfare, bank bail outs and a devaluation of the national currencies contrary to the Bank of Canada Act.

We need higher interest rates to correct the shenanigans of the central banks.

Ummm…no.

Mortgage rates have been suppressed for 10 years because inflation is below target.

Raise rates and the economy crashes. Simple as that.

So when would you recommend to buy? And for those who have purchased but not closed, what do you recommend?

I would have no issue with purchasing right now. Rates are good. We don’t have a crystal ball, so we can never know for certain what the future holds.

Apart from the population increasing 450,000 people a year, what is to keep Canadian home prices rising? I just don’t see the bullish case for housing here. When has an economic contraction ever being good for housing, let alone a housing market dealing with extreme debt, credit tightening and irrational prices in some places?