—The Mortgage Report: Sept. 10—

- CIBC has dropped the following special fixed rates:

- 5yr (high-ratio): 2.07% to 1.97%

- 5yr (uninsured): 2.24% to 2.14%

- 7yr: 2.71% to 2.61%

- It’s the first time ever that a Big 6 Canadian bank has widely and openly advertised a 5-year fixed rate under 2%, albeit it’s only on default-insured mortgages.

- This development is more symbolic than anything else. Reason being, banks have offered unpublished 5-year fixed rates for weeks now. And smaller lenders like HSBC, brokers, etc. have advertised 1.99% or less since June.

- The Big 6 almost always take their time on rate drops, given they:

- Have a never-ending stream of business regardless

- Want to maximize profit margins

- Are hesitant to reset (lower) rates on mortgages in their pipeline — i.e., mortgages that are already approved at higher rates

- In this particular case, the rate-drop delay is also the product of heightened credit risk thanks to a little predicament called Coronavirus.

- For those who have a CIBC bank account, or don’t mind opening one, the bank is still offering $1,000 to $3,000 cash back. The offer applies to purchases and transfers, and can be like getting an extra 8-10 bps off the rate depending on the mortgage amount.

- CIBC also trimmed its special 5-year variable rate from 2.03% to 1.93% (prime – 0.52%).

Don’t Expect Canada’s Rebound to Continue at this Pace: BoC

- Bank of Canada head Tiff Macklem reminded people this week of Canada’s “exceptionally severe” economic downturn, with GDP posting its “sharpest drop on record.”

- The economy has “bounced back…a little more strongly…than we were expecting,” he said. But “We don’t expect the strong rebound we’ve seen to continue at the same pace in the months ahead.”

- We’re facing structural unemployment and the reality that certain business investment (e.g., in the oil patch) may never come back, Macklem added. As a result, “extraordinary monetary policy support”—and a 0.25% overnight rate—will likely be with us for several quarters.

Macklem: No Fan of MMT

- Modern Monetary Theory (the idea that deficits almost don’t matter for governments that can finance themselves by creating more currency) has a “superficial veneer of legitimacy,” says Macklem. “When you look at MMT, there’s really no evidence in history that it’s worked. In fact, when monetary policy has been directed to supporting government deficits and underwriting the government, it’s ended badly. So…I’m not a big fan.”

- That’s probably not enough to stop free-spending politicians from running up government debt, however. Borrowers in variable or short-term rates should keep that in mind given that extreme deficits are usually bullish for rates once a recovery takes hold.

- The more that credible sources like Macklem fight MMT, the better the chance that rates will stay lower for longer.

Safeguarding Your Gift

- RATESDOTCA has a list of ways to keep a rogue son/daughter-in-law from hijacking your down payment assistance. See: “Protecting a Down Payment Gift: Tips for Parents”

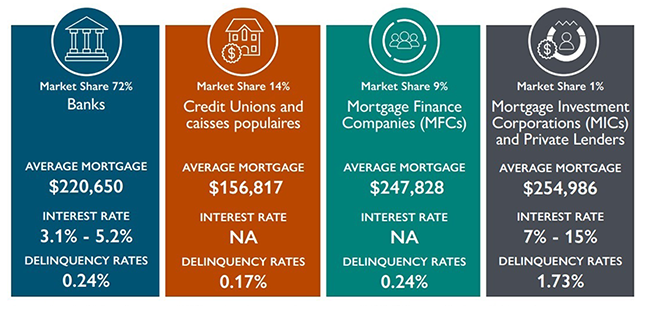

Mega-Banks Still Dominate

- Big 6 Banks originate two out of every three new mortgages, reports CMHC. But subprime lenders (specifically, private and mortgage investment corporation lenders) issue the biggest mortgages on average—and have the highest interest rates and the highest delinquencies.

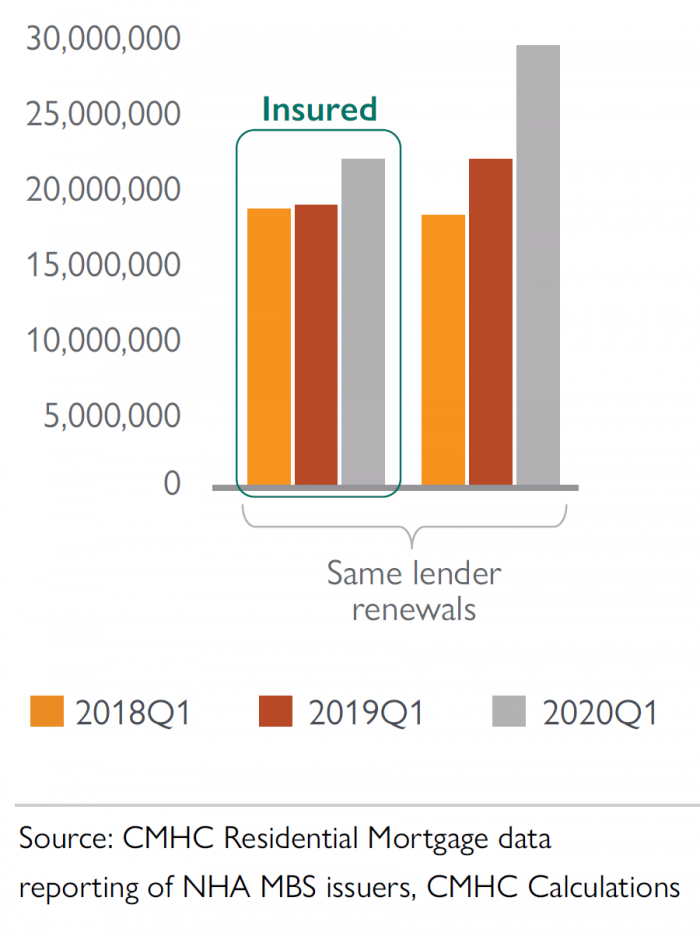

Lender Retention Increases

- As the chart below shows, lenders were holding onto more of their customers at renewal (as of March 31, 2020). “Renewals with the same lender increased by 11% relative to the previous year and accounted for more than half of all extended loans,” writes CMHC.

- Part of the reason has been lenders competing aggressively to retain business amid slower originations. There may have also been a small COVID effect near the end of March, with borrowers less likely to go out to shop for a mortgage, and unemployed borrowers less likely to qualify elsewhere.

log in

log in

38 Comments

Hi RateSpy, working with a mortgage agent. Refinancing second rental property. Fixed 5 year, 25 amortization at 2.44%. Thoughts? I’m trying to understand rate spread between rental and principal rate mortgages.

Hey Joe, If (and that’s a key “IF” as I don’t know your situation) it is a plain vanilla mortgage on a marketable rental property with a well-qualified borrower, 2.44% is unquestionably high and I’d suggest you keep shopping. There are brokers now doing 2.19% and under, and some banks might get you close to 1.99%, maybe less. If it’s a non-prime deal, your debt ratios are high or there’s some other quirk, it’s a whole different conversation.

MMT is a way for joke politicians to get votes, nothing more.

Hi RateSpy, I got 4 year @ 1.92% annual interest rate but annual percentage rate (APR) on agreement is 1.94126%. When people normally talk about or negotiate rate, is it APR? Also on the agreement, there is admin fee (valuation) $300, discharge fee to prepare document $260, and assignment fee $260. I understand banks have valuation fee, is discharge fee & assignment fee negotiable? Thanks a lot!

Hi Tracey, You always want to compare total borrowing costs, to the extent they are known. That includes all expected interest, fees and penalties over the full mortgage term. Annual percentage rate (APR) is an effort to capture known borrowing costs, including things like compound interest, appraisal costs, etc. That can be helpful. But often there are harder to quantify costs such as prepayment charges, reinvestment fees, and extra interest costs as a result of refinance or portability restrictions. Truth be told, very few mortgage originators compare all these costs for consumers. But comparing APRs is technically better than just comparing advertised rates.

Thanks RateSpy, I’m using a mortgage broker so I’m surprised that you say I if the rate is high. Is there any broker or company you recommend to use.

Hi Joe, Yes, different brokers operate at different levels of profit margin and service. Some quote higher rates for their “expertise;” others sell at deep discounts with less hand holding. While we can’t recommend specific brokers in this forum, you’ll find a bunch of brokers and lenders listed in the rate tables. Good luck!

Below from BMO prepayment calculator, and I think just wait till August 2022 to renew my existing 2.59% 5yr mortgage? Had no fees at time of renewal in July 2017 because the junior BMO Mortgage Rep quoted 2.59% then did bait and switch to charge higher rate. I wrote the VP of BMO Customer relations. Next thing we know we get a call from branch manager with 2.59% and no appraisal fee, no legal fees, and no other fees.

Date of calculation: September 12, 2020

Estimated prepayment charge: $9,505.72

Mortgage type: Fixed

Outstanding mortgage balance: $306,636.00

Remaining Term: 2 year(s) – 0 month(s)

Your Current Interest Rate: 2.59%

Discount Received: 2.25%

Today’s posted rate: (used to calculate your prepayment charge) 3.29%

Hey ratespy, renewed traditional mortgage in April and want to refinance in few weeks for a closing in May 2021. Any advise on how many days before applying the new mortgage, should the refinance be done on current mortgage? Can I do both together?

Hi Susan, A lot of people use the equity in one property to buy another. Assuming they’re keeping both properties, they usually do the refi and purchase financing at the same time. It’s usually advisable to start the process as least three months before the purchase closing, or sooner if the funds are required sooner.

Hi everyone. I have 1 more year for my renewal @2.39. since the rate is low now, is it a good idea to break the morgage and get a new 5 years fix?

thanks in advance

Hi Mengistu, Among other things, it depends on the penalty and the financial/personal need to lock in longer-term. If a 5yr fixed is appropriate, it can sometimes make sense to lock in early when bond yields start uptrending again. Did you check if your existing lender offers early renewals with no penalty?

@joe

Sub 2.09 on 25 year AM for sure.

@mengistu it really depends on what your penalty which is dependent on your current lender. But with only 12 months remaining penalty shouldn’t be too substantial especially if you work in some cash back from your new lender. Happy to help secure a great option for you

Jeevan

Unfortunately this article is not entirely true. I wish I can contact RateSpy. Banks have been undercutting the mortgage brokerage channel by offering high-ratio promo rates to conventional mortgages as well. The big 6 banks will do what they want when they want and no governmental body can do anything about it.

George, Specifically which part is inaccurate? What you said does not contradict any part of the article. The main statement of fact is that Big 6 banks haven’t widely advertised 5yr fixed rates (i.e., openly published them on their public rate pages) until this week. What they do on a discretionary basis is another matter.

I’m currently on variable at prime -1%. I’m very much enjoying this low rate as I was at fixed at 2.69 just before the pandemic. I know things can change but pretty much everyone is saying over night rate is not changing for quarters but I’m just wondering if given the absolute uncertainty in the economy and jobs should I consider switching to a fixed at 1.9X% or ride this 1.45% out a bit longer?

Hi Graham, Timing rates is extremely difficult so it’s usually ill-advised, as is relying on other peoples’ predictions. A lot of decision making goes into locking in (see: https://www.ratespy.com/fixed-or-variable-rate-the-decision-checklist-02223752 ) but 1.45% is a spectacular rate. Unless the borrower had some kind of risk they needed to mitigate, locking that in now might be premature. Fixed rates have been stuck in a channel for months, with no material increases expected until the 5-year yield pops above 0.60%: https://www.ratespy.com/5-year-canada-bond-yield#:~:text=5%20Year%20Canadian%20Bond%20Yield,bond%20market%20and%20fluctuates%20daily.

And even that could be a headfake. It’s impossible to say at the moment.

hi ratespy,

I’m looking to refinance for 300,000 mortgage. I have a private loan from family so there is no penalty. my house is valued at 550,000. RBC is offering 1.99 for standard or homeline plan. I can’t seem to find anything else so far can you help please

James

Hi James, Here are sample refi rates: https://www.ratespy.com/best-mortgage-rates/550000/300000/25/any/+29/yes/5-year/fixed

They assume a well-qualified borrower getting a standard mortgage on a marketable property. Hence, they may not apply to your situation. It’s best to contact the provider you’re interested in directly for qualifying details. Some of these rates are also province dependent, among other things.

Thanks Ratespy, still wondering, although rate is negotiable with bank, is it other fees (assignment fee, discharge fee, etc) also removable at the time of signing or contracts are fixed by bank & not changable?

Thanks a lot!

Hey Tracy, I’ve never seen a borrower able to get a lender to remove its standard discharge/assignment fees from the mortgage contract. You’re better off trying to get the bank to pay for closing costs or reduce its rate.

Hi

My company just qualifies for 10 condo prerented units at 2.90% five year fixed 25% down DSR if 1.50 and credit scores for both directors is 800+.

Would you think we should be rate hunting more or are these rates considered ok ?

Kindly let me know

Thx

Looking to do an early renewal. Penalty is about 3400

Current rate is 2.64

Proposed new rate in 5 year is 1.89

Not too happy with the renewal fee as it is with the same lender I have had for 10 plus years… And I just resigned in April from my previous 3.39 rate and paid ,2200 then for early renewal.

Looking forward to determine if I should be shopping around to companies that offer a cashback option to try and reduce the impact I am getting on the penalty.

Hey Crystal,

Best bet is to get advice from a mortgage advisor who can evaluate your entire situation.

In the meantime, you can shop rates here: https://www.ratespy.com/best-mortgage-rates

Then check the estimated interest savings here (use your current remaining term of 4.5 years for “Term”): https://www.ratespy.com/mortgage-rate-comparison-calculator

Compare that and your closing costs to the penalty. You might be able to make a prepayment to get the penalty down a bit, depending on your circumstances.

@Jeevan, will banks extend their new mortgage cash back offers to those renewing with them?

Hi Piper, Usually not but check with the bank directly to confirm.

Hi Menjistu

5 yrs 2.39 1 yr left..the penalty is based on interest rate differential..talk to ur bank and find the penalty first..

The cibc bank is at 1.87% 5 yrs fixed for primary property…all depends on how much mtg balance

1.87 then upto 3000 cash back…

Moni

Note to Tiff Maclem: MMT has been with us since the Great Financial Crisis over a decade ago. Oh, and it works. Where does everyone think the money came from to bail out the economy back then?

Let’s not forget about the farcical “debt ceiling” crisis that occurs every few months in the U.S.A.

Money magically appears from nowhere and the economy doesn’t grind to a halt. That’s MMT!

Methinks Tiff Macklem needs to do a little more reading.

Hey Appraiser, LOL. The magical money tree (MMT) definitely works in the short and medium terms. It’s the long-term that critics are worried about — the tipping point where extraordinary government debt financed by ever spiraling deficits meets faith-loss in the system and, God forbid, surging interest rates.

Here’s a primer from Morgan Stanley: https://www.morganstanley.com/im/publication/insights/investment-insights/ii_bewaremodernmonetarytheory_en.pdf. The gist of it in two lines: “In practice…politicians tend to become drunk with the power of the (money) printing press….MMT is very likely to create inflation and erode asset prices in the long term.”

@ Jeevan

Does refinancing on my rental change the rate significantly?

I’m using a couple of brokers and they still quote me around 2.40% for 5 year fixed, re-financing, 2nd rental, 30 year amortization. Excellent credit score, minimal prepayment options

Hello

we renewed our mortgage in March for 4 years at 2.24%.

I was thinking to refinance now with 5-year term and buy some investments with accessible equity.

Any suggestion on if this is good idea in terms of penalty vs I will be saving with lesser interest rates?

My bank is CIBC and have mortgage or 560K.

Hi Sri, Depends on the penalty among other things. Have you evaluated getting a HELOC behind your first mortgage at CIBC?

Manish Joshi. You said “ My company just qualifies for 10 condo prerented units at 2.90% five year fixed 25% down DSR if 1.50 and credit scores for both directors is 800+.” With which company is this arranged? Thxs.

Hi RateSpy, I’m up for renewal on a rental property. I’m getting fixed 5 year at 1.89% and variable 5 year at 1.80%. This is from a bank as brokers were telling me that they could not beat this rate on a rental property. Do rentals generally not receive good offers? Is the bank rate good for a rental?

Hi Priya, 1.89% is excellent for a rental property 5-year fixed, assuming that’s the term and lender most suited to you.

Banks dominate rental property financing because they’re the source for almost all the funding. Most of the time they keep the best rental rates for themselves and don’t offer the same pricing through brokers.

Hi Priya,

which lender is that? which province? that rate is really amazing for a rental

RBC, CIBC in ON