RBC released its quarterly housing affordability report last week. Once again, it overstated mortgage un-affordability relative to prior decades (as previously noted).

But it did have some points worth pondering. Among them:

- “Mortgage rates increased for a fifth straight quarter and accounted for the entire” drop in [RBC’s] affordability measure, the bank said.

- With rate-hike expectations dropping like a stone, our sense is that 2019 should be kinder to prospective homebuyers—from a borrowing cost standpoint.

- But RBC sees things differently, writing “We expect that further interest rate hikes will keep upward pressure on ownership costs in 2019.”

- Yet, with bond yields plummeting to near-one-year lows, that’s questionable to say the least. The market now expects only one hike by the Bank of Canada in 2019. Even if it happens, it won’t necessarily affect the mortgage qualifying rate—which is the most important rate determining mortgage accessibility.

- RBC asked, “Are only the rich able to buy a home these days? That certainly looks like it in Canada’s most expensive markets…”

- Of course, it’s not just the rich buying. Existing homeowners who’ve ridden the housing appreciation wave higher for years (or decades) can readily buy using their windfall equity gains. New buyers trying to break into markets like Toronto, Vancouver and Victoria obviously aren’t so fortunate.

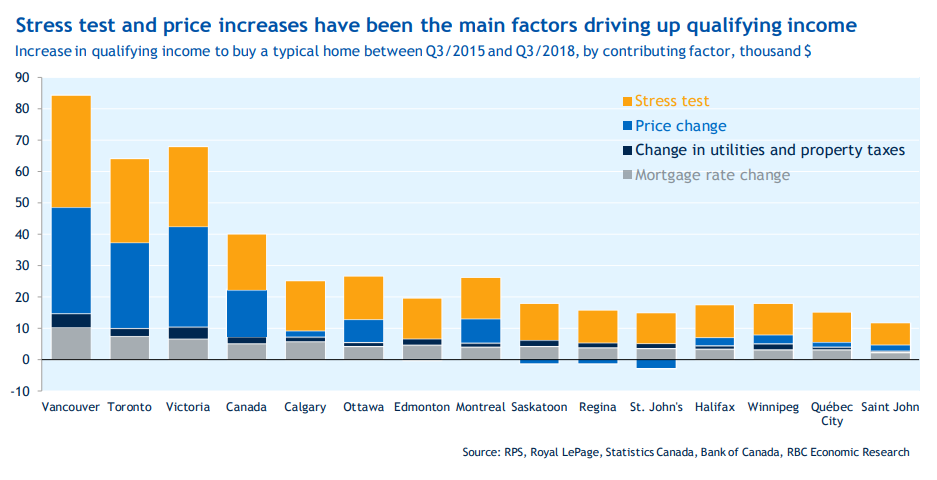

- As you can see from the chart below, over the last three years it’s required considerably more income to qualify for a mortgage in big cities (those with the greatest numbers of net new residents, i.e. highest demand).

- The government’s new stress test was the #1 factor pushing down affordability (access to mortgages) this year, RBC reports.

- One might think—or hope, if you’re a new buyer—that the stress test would knock down prices and make home ownership more accessible. But prices have remained higher in most large markets following the stress test’s January 1, 2018 introduction, according to the Teranet-National Bank house price index.

- The stress test was also directly responsible for driving more people into condos this year, decreasing condo affordability at three times the pace of single-family homes.

- Rental affordability in high-demand cities is also plummeting as credit constricts. Rentals.ca forecasts as much as a 6-11% average rent increase in major Canadian cities in 2019. And fast-rising rents are now being seen in smaller towns as well.

Canada’s population just had the biggest increase in over 60 years. Reducing total purchase and rental demand (via mortgage policies, rental policies, tax policies, rate policies or whatever) is simply not a long-term option. Housing unaffordability is an enduring problem that requires an enduring fix, like building higher-speed transit to get more people to cheaper housing quicker.

In the meantime, millions will wait to see if housing accessibility improves in 2019. Those wanting higher-end single-family homes, geared-to-income housing or homes in economically challenged regions may find that it does. Others needing a big city house/condo (under $1 million) or a rental may be waiting a while.

log in

log in

RBC released its quarterly housing affordability

RBC released its quarterly housing affordability

1 Comment

The government should have stayed out of the housing market. They are making homes unaffordable for most Canadians.

Now many families are paying higher rents and having to rent longer when the real fact is, rents are higher than home mortgage. They are making corporate landlords richer and Canadian families poorer and taking away home ownership dreams. It is simple, you need to pay for lodging and if you don’t, landlords will evict and banks will take back in the end, always.