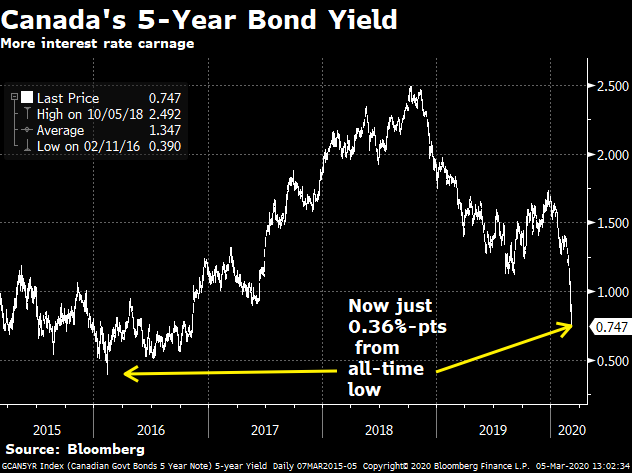

If you want to know what investors think of Canada’s economic prospects, this chart almost says it all:

This sort of meltdown signals raw fear. Such moves are not usually reflective of just a little economic blip ahead, but a king-sized economic crisis. No hyperbole intended.

What does it mean for rates? It means rate expectations are falling by the day.

This will all end at some point and panic will give way to a bottom in rates. In the meantime,  financial markets now project another 75 bps of Bank of Canada rate cuts by October.

financial markets now project another 75 bps of Bank of Canada rate cuts by October.

Fixed rates are (slowly) falling as we speak. Albeit, there’s no indication we’ll see fixed rates drop as much as bond yields. The two usually trend together, but credit spreads are increasing. That suggests banks might end up paying more for their mortgage funding, relative to safe government bonds.

What will that do to housing markets? Bank of Canada boss Stephen Poloz said this today:

“…Risk management demands a prompt and sizable policy response to larger shocks to ensure that the economy remains well anchored. Governing Council agreed that the downside risks to the economy today are more than sufficient to outweigh our continuing concern about financial vulnerabilities.”

In other words, surging home prices (in some markets) and growing consumer debt loads won’t hold him back. Not this time.

But unlike those who think plunging rates could inflate the housing balloon to its bursting point, Poloz says:

“…Lower interest rates will actually help to stabilize the housing market, rather than contribute to froth.”

That’s a somewhat different tune than the Bank has been singing. In January, he warned of increasing risk of housing “froth.”

That’s a somewhat different tune than the Bank has been singing. In January, he warned of increasing risk of housing “froth.”

His apparent logic today is that people’s debt servicing will ease—for example, when they reset their mortgages at lower mortgage rates. He made no mention of how higher home prices, bigger mortgages and invitingly low rates might add to debt levels and offset that benefit.

Critics will say, today’s speech was BoC-speak intended to calm the market.

Poloz continued:

“Further, we expect that the B-20 mortgage lending guidelines will continue to improve the quality of the stock of mortgage debt.”

Oh yes, those B-20 guidelines that OSFI proposes to significantly loosen come April 6, pending public comment and its final determination.

The rates we’re seeing today are amphetamines for housing. (That’s assuming lenders don’t slash discounts.) Plunging prime rates, plummeting fixed rates and diving qualifying rates will give housing a good high for the foreseeable future. Further out, we’re a lot more worried than Poloz seems to be.

log in

log in

3 Comments

Hey guys,

How long would you guess the sugar high of low rates will drive up home prices?

Thanks

As Poloz says, stay calm and carry on spending money! $$$

Hi 52wkHi, Not even the foggiest. Depends how ugly this coronavirus monster gets. Housing inventories are a factor too, among other things.