—The Mortgage Report: July 9—

- Play Stocks or Play it Safe?: That’s a common question for otherwise debt-free mortgagors with nothing else to do with their money. It’s not a question we can answer for everyone, given all the personal variables to consider. But here’s an interesting look at what might have happened had you got a standard mortgage 10 years ago and overpaid $100 a month, versus investing that $100 in your TFSA in the world’s most popular stock index, the S&P 500.

After 10 years:

What does this prove? Not a heck of a lot.

-

- The past won’t tell us the future

- Stocks entail more risk than mortgage prepayments and aren’t suitable for everyone

- Stock gains of 11.9% annualized — like we’ve seen over the last decade (including dividend reinvestment) — are unsustainable.

If you make more conservative assumptions, like using today’s 2.79% 10-year fixed rate and a 6% stock index return, the hypothetical results look like this after 10 years:

-

- With mortgage prepayments: You’d have a $13,847 smaller mortgage

- With Monthly Stock Investing: You’d have a $16,388 bigger tax-free investment portfolio

So again, in a highly simplified example like this, investing wins. But it only wins if historical long-term returns hold up, if you have the stomach for it and if you won’t touch your investments for a very long time.

- Scotia Cuts: Scotiabank has dropped the following posted fixed rates:

- 1yr: 3.19% to 3.09%

- 2yr: 3.29% to 3.19%

- 3yr: 3.89% to 3.79%

- 4yr: 4.19% to 4.09%

- 5yr: 4.94% to 4.79%

- 7yr: 5.49% to 5.39%

- 10yr: 5.99% to 5.89%

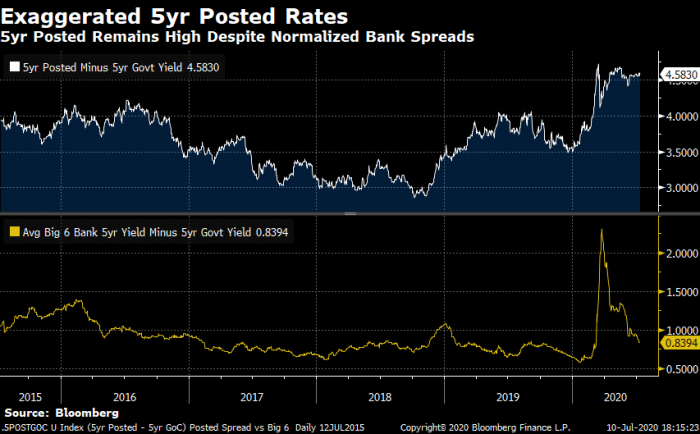

Scotia trimmed its 5-year posted rate to 4.79%, the lowest in years. Meanwhile, the Bank of Canada’s official 5-year posted rate — which dictates the minimum mortgage stress test rate — remains hugely inflated relative to all objective benchmarks. This chart below shows how inflated it is. Despite bank funding spreads coming back to normal (as seen in the bottom pane of the chart), banks are keeping 5-year posted rates drastically propped up (as seen in the top pane of the chart). Scotia’s move today provides some hope that other banks will drop their posted rates too. That would not only make it easier to qualify for a mortgage, but save fixed-rate borrowers on mortgage penalties. As we speak, the gap between typical 5-year posted rates and actual discounted rates is over 250 basis points. We don’t have to tell anyone who knows how to calculate an interest rate differential charge how outrageous early prepayment penalties can be with those sorts of discounts.

- Jobs Return: Canada got an estimated 952,900 jobs back in June, exceeding optimistic forecasts. Capital Economics says, “the majority of the pandemic-related job losses will be regained by the end of the summer.” But it doesn’t expect unemployment to fall back to pre-virus levels for at least 2-3 years. Bond yields, which steer fixed mortgage rates, barely budged and remain in an oddly narrow trading range.

- ICYMI: RBC and TD have extended the deadline to apply for mortgage deferrals until September 30, matching CIBC. RBC is still reportedly getting about 400 deferral requests a week.

log in

log in

13 Comments

Your comparison of stocks vs mortgages is with good intention and is for the average reader. However, any seasoned and savvy stock investor will also use derivatives to enhance returns and mitigate risks to produce a superior equity ROI vis-a-vis a collection of fixed-income product, ie: bonds, mortgages.

For investors with a 10 year time horizon and risk tolerance I would go even further and say buy on margin. Academic research shows that long-term returns are significantly better with margin with acceptable risk over the long term. Sadly investment advisors shy away from margin because they’re scared of liability. With rates so low margin is the answer to insufficient retirement savings for long-run investors.

@Mike S

Are you talking covered calls?

Or selling puts on Tesla? lol

how do I get me some of that incredible 5.89% ten year fixed rate?

ummm ummmm good

that Scotiabank really knows how to get me excited

I’ve always viewed a mortgage as being short on fixed income. What you are essentially doing here is running a horse race between equity and bonds (just with a higher coupon).

Mike

A mortgage prepayment is equivalent to being long fixed income because you’re earning the coupon.

A valid point with respect to the liability fear exposure to IAs (who are simply salespersons whose primary concern is Assets Under Management / Administration) with respect to margin. Margin is a valuable tool that is effective for also enhancing ROI. However, you must know how much and when to use leverage it as many unsophisticated investors find themselves under-margined or in a house call due to the market going against them. Plain vanilla options are often just right to profit from the herd mentality with something like TSLA as more exotic strategies such combinations, straddles, strangles can be difficult to unwind if the market does do what you were forecasting.

Most don’t know how to invest and are better off paying down the mortgage … 6% return less inflation is nothing unless they are doing options and getting 30-70 % return on average. But what do I know?

Most home owners in the top 50 percentile of income are already invested in stocks. It they don’t know how to invest they hire investment advisors. Inexperience is not a reason to avoid investing.

Having said that, average investors should run not walk from options. 90% of retail investors lose money in options.

William’s inflation point seems irrelevant because both a home and investments are subject to inflation. You are actually better offer paying a mortgage in future less valuable dollars.

Lastly, I would remind everyone that houses are not the perfect “investment.” They are rarely liquid especially in down markets, they have high carrying and transaction costs and they usually don’t generate cash flow.

Most homeowners have the bulk of their net worth tied up in home equity. That is dangerous. I would argue that diversification into non-housing assets is essential for those with discretionary money to invest.

Once you hit 30 just pay the damn house instead of playing in the casino. Two separate budget, money in the stockmarket is what you can afford to lose.

Most people look at mortgage interest rate as if it’s the actual rate. In fact, you’re paying all the interest up front. As an example, a 6% interest mortgage over 30 years is actually 118% interest.

Paying off your mortgage with prepayments should be everyone’s number one priority. Full stop.

Patrick: If you think investing in equities is a casino you need to buy an investing 101 book and get some education. People can’t afford not to be in stocks if they hope to retire comfortably. Any financial planner (CFP) in Canada will tell you that.

Adam: What you said makes no sense. Interest is paid with each payment, not upfront. It’s not the year 2000 either. Most people now pay interest in the 2-3% range, not 6%. People with extra money have the choice of earning a 2-3% guaranteed return or a 5-7% return in the stock market over time. Take your pick based on your goals and holding time-frame, but don’t try to tell “everyone” what they should do because you don’t know everyone’s situation.

@Go long

Thanks for your sollicitude, the nature of the internet makes it that I cannot give you a satisfying reply some subjects are better discussed face to face. I understand accounting and I’ve been speculating for 12 years or so. I couls go on a long rant, but let’s just summerize it this way, the times I’ve made the MOST money was out of ignorance and luck example Ivanhoe mines in around…2016 huge pop made a lot of money but damn was I clueless. Same goes for Tesla, an automaker thats worth korw than Toyota? Give me a break! But some speculators made a shit ton of money anyways end of rambling good luck and please dont burn yourself.