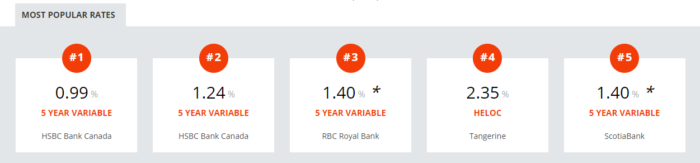

At the time this is being written (10:45 p.m. ET March 29), the top five most popular rates on our site are floating rates. It’s the first time we’ve seen this in weeks. And those numbers are based on tens of thousands of visitor clicks.

Given that fixed rates usually dominate, what does this suggest? Well, among other things, it tells us that:

(A) people aren’t overly worried about higher rates, despite rising inflation risk and market projections of up to 200 bps of rate tightening over the next five years,

and/or

(B) many variable fan’s cannot readily do the math to know what 100+ bps of rate hikes would cost them, relative to a 5-year fixed

and/or

(C) people really like rates in the low 1s and are willing to gamble, or feel they have to gamble because of financial pressure.

“Prediction is very difficult. Especially about the future.”

All we need to know is what rates will average over the next five years. Then the term decision is easy.

Knowing that variable rates would average more than a 5-year fixed through 2026, for example, would make a fair-penalty 5-year fixed quite appealing.

Too bad that few on earth can even credibly guess the path of rates five years into the future—at least with any consistent accuracy.

That unfortunate fact means borrowers have to rely on other things to choose a mortgage term, like:

- their financial comfort level

- their 5-year plan

- the probability that the next Bank of Canada rate change is likely an increase

- the fact that the market itself, which is practically the best rate predictor (albeit fallible), is pricing in more than five rate hikes by 2023.

Karl Schroeder has an insight way back that’s even more applicable than Niels Bohr’s quote, above. He said, “Foresight is not about predicting the future, it’s about minimizing surprise.” In this context that means: don’t guess on rates, manage risk.

If you’re a student of historical rate trends, you’ll likely agree that the risk-reward of floating-rate mortgages is currently unfavourable. But many folks out there remain pro-variable, even with the Bank of Canada assuring us that rates are at the “effective lower bound” and with GDP estimates surging. We’d be the last to say those folks are wrong, assuming they can easily bear the risk of being wrong.

Fortunately, financially secure borrowers are stress tested by lenders at much higher rates. If you’re one of those borrowers and you want to take a leap on a floating rate in the low 1s, then our data confirms one thing: you’ll have lots of company.

This & That

- Among homebuyers, 77% took mortgages with fixed rates last year

- Lenders across the market are reporting record mortgage volumes. Those lenders with the lowest rates are (not surprisingly) even busier. Approval times are longer than normal as a result, so if you have a financing condition/deadline, be sure to ask your mortgage advisor if they’re confident they can get your approval back in time.

- Big-Bank 5-year fixed rates are back above the psychological 2% threshold.

- “The near-term outlook is grim for homebuyers,” says RBC.

- Fitch estimates that “Vancouver and Toronto are currently overvalued by 23% and 32%, respectively,” for what that’s worth.

log in

log in

11 Comments

Rob,

You’ve previously written how there’s only been a couple short windows over the past 20 years when a 5yr fixed has outperformed a 5yr variable. While rightly pointing out how difficult it is to predict rates, you seem to be predicting that this is one of those rare exceptions.

I agree that market signals are as good a guide as any when trying to make predictions. I look at the GoC bond yields and see the market telling me that inflation will average well under 2% for the next 10 years.

https://www.bankofcanada.ca/rates/interest-rates/canadian-bonds/

@Ralph

Actually, there have been many more than a “couple” windows of opportunity for 5yr fixed terms. We’ve written about it a lot over the years. Example: https://www.ratespy.com/fixed-wins-enough-of-the-time-081415269

Those “exceptions” occur at least 25% of the time historically depending on what discount assumptions are used. I wouldn’t characterize 1 in 4 as “rare.”

Such instances tend to be clustered around business cycle points like we find ourselves today, economic recoveries where fixed-variable spreads are tight. That is not a prediction, it is reality. One can ignore that reality and ignore forward pricing in the bond market — which implies materially higher rates 24-30 months out — or not.

History doesn’t always repeat but that doesn’t make it worthless. Insurance companies don’t blindly predict anything. They lean on history and make decisions using probabilities. That’s what most mortgage shoppers should be doing as well.

On your last point, the next 10 years is not pivotal to the conversation. The next five years are. Every inflation indicator we see implies greater than 2% inflation before five years, enough so to lift rates as noted in the article.

Rob,

The 5yr yield is below 1%. Based on your 2% inflation prediction, are you asserting QE has depressed yields by more than 1%?

In fact, subtracting the real return bond yield from the 5yr leaves 131bps to get to 2%.

While I completely agree we are in a rising rate environment, I don’t understand why government bond yields are a bad market indicator for for future inflation.

@Ralph, Not sure which 2% inflation prediction that refers to. It’s worth repeating that no prior expansion was ever led by such massive global stimulus, high savings rates, pent-up demand and supply constraints. Don’t get hung up on detailed inflation projections. Yields are rising mainly because investors expect policy rates to normalize.

assuming it’s a 50/50 proposition between fixed and variable, the majority will always choose fixed

pain is more powerful than pleasure so loss, stemming from rising rates, steers decisions more than gain

I have my own way of looking at what to choose – I review each option, and imagine if I got each one wrong (within likely scenarios).

I note how unhappy each would make me, either because of financial stress, or just overpaying.

I then pick the least bad option.

In other words what will on balance make me happiest?

@Peter Thornton: The least bad approach. Like it!

It seems to me what all comments seem to miss is with variable there are options to mitigate rising rates and real savings at the outset.

1. If you get 1-2 years on a 5 year variable before rates increase what is the savings up until the variable rate = what the fixed rate would be at the outset. Assuming variable is 1% < fixed today you wold need variable rates to move more than 1% even before you go forward cost was higher. So 18 months saving 1% may get you through 3 1/2 years higher rates and still break even.

2. Variable rates can easily be converted to fixed to lock in with NO PENALTY and avoid creeping rate increases. So variable today and save 1% + and lock in 1 – 2 years from now.

3. Variable rates typically have no penalty for early payout and/or better terms for lump sum principal payments.

I’d like to add a #4 to Mr. Calyniuk’s list in helping to mitigate rising rates:

4. Many mortgage lenders allow accelerated mortgage payments in the form of the borrower setting their regular mortgage payment at a higher amount than the calculated payment required. This allows for fluctuation in the rates within the payment while having a steady drip payment to the principle. This has been the strategy that has allowed me to sleep at night through 20 years of variable rates.

Hi Michael,

A few thoughts:

1. A 1%-point increase is easily exceeded in a typical rate hike cycle. The market is currently pricing about 1.25%-points of hikes over the next 30 months. You can use this calculator to plot out that and other fixed and variable scenarios before drawing any conclusions: https://www.ratespy.com/amortization-schedule

2. The fixed rates you get when you convert from variable to fixed are rarely the best rates, and borrowers are usually late to lock in. Those who feel they can lock in “at the right time” should be trading bonds for a living.

3. Most “fair penalty lenders” in a rising rate environment will give you the same 3-month interest penalty. If you choose the right lender, penalties are not a key reason to avoid locking in.

Hi LuluG,

Fixed-payment variables are a great solution for budgetary certainty, so long as rates don’t rise so much that you’re not covering the interest cost. In that case most lenders will hike the payment.

In the meantime, higher rates mean you’ll pay more interest and less principal, but at least the payments are stable.