Effective January 1, 2017, financial regulators will make default insurers (like CMHC) hold more capital when insuring mortgages in highly valued cities. The purpose is to keep government-backed insurers more solvent if home prices fall off a cliff.

But financial stability has a cost. Capital is not free so both insurers and lenders will look for ways to offset this higher cost.

Potential ramifications for borrowers could include:

- Higher insurance premiums

- expect 10-20% higher, maybe more

- Slightly tougher qualification requirements

- especially if your credit score is below 680 and your down payment is small

- Higher mortgage rates

- Some lenders insure all of their mortgages, even for borrowers with 20% down. Those insurance costs will rise, and lenders could make up for it by reducing rate discounts.

- Additional costs for long amortizations

- Particularly 35-year amortizations

- Potential regional differences in default insurance premiums

- We’re hearing this from sources but aren’t convinced it’ll happen. It would be a technical challenge and varying premiums in neighbouring cities could get confusing.

We’ll have a better grasp of the consumer impact once CMHC announces its premium and policy changes, which could happen as early as December, or first quarter 2017 at the latest.

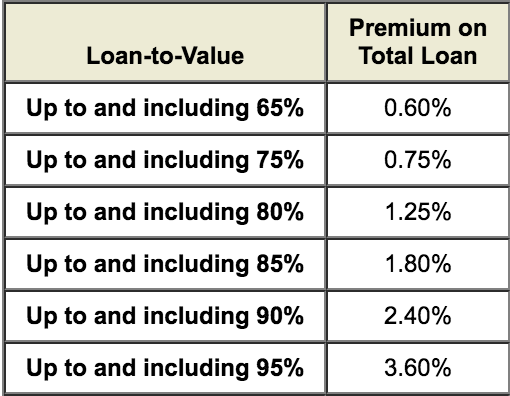

Current CMHC Fees

Inflation Nation We Are Not

Core inflation just dropped to 1.8%. That’s below the Bank of Canada’s 2% target and the lowest in 2 years.

Like clockwork, economists have already begun seesawing on their rate predictions. Whereas just months ago some were calling for no BoC rate changes till 2018, now they’re chattering about rate cuts next year.

Here’s what we know about rate cut triggers. Other things equal:

- If oil dips (now $44) into the low $30’s or below—and stays there—rates are likely coming down

- If unemployment (now 7.0%) breaks above 8.0% to 8.5%—rates are likely coming down

- If core inflation (now 1.80%) falls near 1.50% or below—rates are likely coming down

- If quarterly GDP (now -0.4%) goes negative again—rates are likely coming down

- If a new global economic crisis makes headlines—rates are likely coming down.

Until catalysts like these emerge, or until the BoC itself hints at cuts, plan on prime rate sticking at 2.70%.

In fact, as we’ve written before, there’s a chance that prime rate doesn’t fall at all after the next BoC cut. Banks can’t make the same gobs of cash they did before these crazy low rates. None of them would cut prime further if they felt they could survive the PR firestorm.

Mortgage Rates of Late

Apart from some jockeying of position this week in 5-year terms, the best mortgage rates have gone nowhere.

That said, Sigma Mortgage became the nation’s leader on 5-year fixed pricing at 1.96%. This rate applies to insured mortgages only.

If the benchmark government bond yield breaks down near 0.50% or below, expect five-year rates to dip another few basis points.

log in

log in

Effective January 1, 2017, financial regulators will make default insurers (like CMHC) hold more capital when insuring mortgages in highly valued cities. The purpose is to keep government-backed insurers more solvent if home prices fall off a cliff.

Effective January 1, 2017, financial regulators will make default insurers (like CMHC) hold more capital when insuring mortgages in highly valued cities. The purpose is to keep government-backed insurers more solvent if home prices fall off a cliff.

Core inflation just dropped to

Core inflation just dropped to  Apart from some jockeying of position this week in 5-year terms, the

Apart from some jockeying of position this week in 5-year terms, the

2 Comments

Daughter is buying first home with mortgage from Primeria. Is this company legit? Seriously, I’m worried!

Primeria is not a lender. They would presumably refer the business to a mortgage agent or brokerage.