—The Mortgage Report: Sept. 8—

- One of the most important factors determining your success with a mortgage is the rate, relative to other rates you could have chosen.

- Over the long run and other things equal:

- The higher your rate relative to other rate options, the worse your odds of success.

- The lower your rate relative to other rate options, the better your chances.

- And, yes, we just told you what you already know.

What’s not so obvious, however, is when to make the tradeoff between upfront rate savings and minimizing risk. If we rely on history for the answer, its message is clear: The closer we get to a sustainable economic recovery, the more you should make that tradeoff. - And that tradeoff is now being made every day. There are reasons why people with 20% down aren’t flocking to today’s best conventional fixed rate: a 1.75% 3-year fixed. Far more are willing to pay up 6 basis points for the perceived security of a 1.81% 5-year fixed. Is that the right move? It depends partly on how much you value knowing your rate four and five years from now.

- For most, six basis points is too trivial a rate savings to justify the interest risk of a three-year term. After all, if you had to renew in three years at even an 11-bps higher rate, you’d likely lose money in a three-year term—after considering the potential costs to switch to another lender for the best rate.

- Depending on the borrower, six basis points is also insufficient savings to justify the small risk that they won’t qualify in 2023 (when their three-year term matures). Borrowers who can’t get approved at another prime lender are unlikely to get the best deal at renewal.

- We’re in an oddball time historically — a time when the rate differentials between the shortest and longest terms seems strangely narrow. That makes the relative cost of longer-term fixed rates appear cheap.

- This fixed-rate “insurance” is cheap for a reason: the market expects rates to stay low for a long time. But as every bond market pro will attest, the market can’t discount what it doesn’t know about the future.

- In other words, most borrowers must plan for surprises. One way to do that is by paying 5-10 bps more for an extra few years of rate security—as in the example above. That makes ample sense for most people, particularly those who also pick a fair-penalty lender to reduce potential prepayment charges.

Fiscal Angst

- There’s a vocal contingent who’s not fond of bottomless government spending, pandemic or not. “I happen to believe it’s the biggest financial bubble in the history of monetary policy for the whole world,” outspoken former congressman Ron Paul told Kitco News. “The correction is going to be pretty violent, and it’s going to be pretty bad.” By correction, he presumably means interest-rate spike. Former Fed governor Randall S. Kroszner agrees, in a sense, telling Bloomberg that if runaway federal spending continues, “We’re not going to be borrowing at zero [per cent interest] very long.”

Vaccine Progress

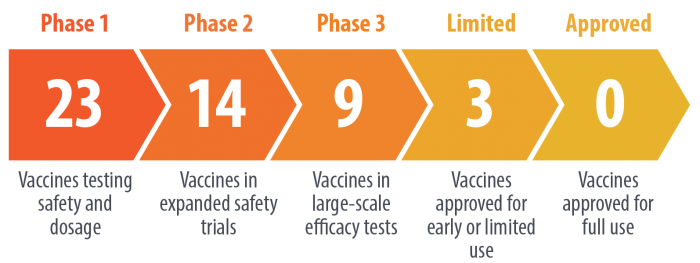

- Many believe that interest rates cannot climb materially until North America gets a fully approved vaccine. If that’s true, we’re slowly getting closer to that day. Here’s the latest vaccine tracker from First Trust.

log in

log in

14 Comments

This is what TD just offered for renewal.

1 Y Fixed 2.53%

2 Y Fixed 1.91%

3 Y Fixed 1.91%

4 Y Fixed 1.96%

5 Y Fixed 2.01%

7 Y Fixed 2.77%

10 Y Fixed 2.97%

5 Y Variable 1.82%

5 Y Variable 3.60%

Do you guys see any good deals in here?

We have been offered 1.99% 5 years fix for refinance from TD

Offered 1.78% on Scotia STEP and TD Flexline 5 yr fixed uninsured mortgage (not refi)

A word of caution to all readers, there has never been a successful vaccine for any Corona virus and to suggest there will be one for C-19 is a false statement. Big Pharma is fast-tracking their work (ie: skipping many required steps needed to produce a remotely valid vax) and what ever they come to produce will be very high-risk with many undesirable negative side effects. The number of new infection cases is immaterial … what matters is the number of people being admitted into ERs and ICUs which has continuously dropped.

To Mike: Why do you think all these drug companies are spending hundreds of millions in a race to create a vaccine? Do you think they believe that no successful vaccine is possible? Do you think they all plan to fail?? The assertion you are making is pretty ridiculous.

Obviously you have no idea what their clinical trials are producing and have no concept of the unprecedented funding going into this research. Yet you try to sound like an insider (“vax”) while concluding that all vaccines will be “high risk” and all will have “many side effects.” There is absolutely no evidence to support that.

What is your idea of a successful” vaccine Mike? One that is 100% effective? No vaccine is 100% effective. That won’t stop people from getting it and starting to live their normal lives again. That is the only thing that matters from a rate perspective.

I for one have faith in medical technology and the profit motive of drug companies. That is enough to make it likely a good safe vaccine will arrive in mass distribution by next year.

It may not matter, however. There is no cure or effective vaccine for SARS in humans and yet the SARS outbreak ended in 2003. COVID-19 spreads easier than SARS and is harder to detect, but it’s also much milder in most cases. As better therapeutics come along people will accept the risk and continue on with their lives, with or without a vaccine.

CIBC just offered us 1.82 refinance for 5yr fixed.

Solid

I signed a refinance through TD five year fixed at 1.79% and felt like I left money on the table.

Hey Shamj, You did well. There are no 5yr fixed refi rates advertised that low anywhere.

Jeona Morh how did you get your TD rate, was it online or through the branch or a broker?

Thanks.

Danh, it was thorough a TD Mortgage Specialist.

Jeona Morh, what is the valuation fee & fee to switch borrower?

Thanks,

Shamj , Is that for 30 year amortization ? Its the lowest I must say

To L-Homes … you’ve just acknowledged my point by stating “No vaccine is 100% effective. That won’t stop people from getting it and starting to live their normal lives again. “.

It’s been 40 years and there’s no vax for AIDS for example. Those with poor health will follow what you suggest … however they’ll be incurring the risks to an inferior laboratory remedy. Is that your standard for “starting to live their normal lives again”?