“You better be prepared to deal with rates 5% or higher. It’s a higher probability than most people think”

“You better be prepared to deal with rates 5% or higher. It’s a higher probability than most people think”

—JP Morgan CEO, Jamie Dimon

What if interest rates surged far higher and faster than you now envision?

Picture this scenario for a moment:

- U.S. core price inflation above 3% for the first time since 1995

- U.S. unemployment at 60-year lows

- Record U.S. debt relative to GDP

- $1 trillion annual deficits in America.

None of this is the case today, but all of this is possible in just a few years (not a prediction).

If these things did come to pass, inflation and deficit-averse investors would conceivably dump U.S. Treasuries en masse, particularly foreign investors. With that intensity of selling pressure, North American interest rates (which move inversely to bond prices) could blast off like a SpaceX rocket.

Canadian Rates. The Tail on the Dog

Assuming our economy wasn’t hamstrung by Trump tariffs or plunging oil exports to the U.S. (99% of Canada’s oil exports go to the U.S.), Canadian rates would likely go along for some of the U.S. ride.

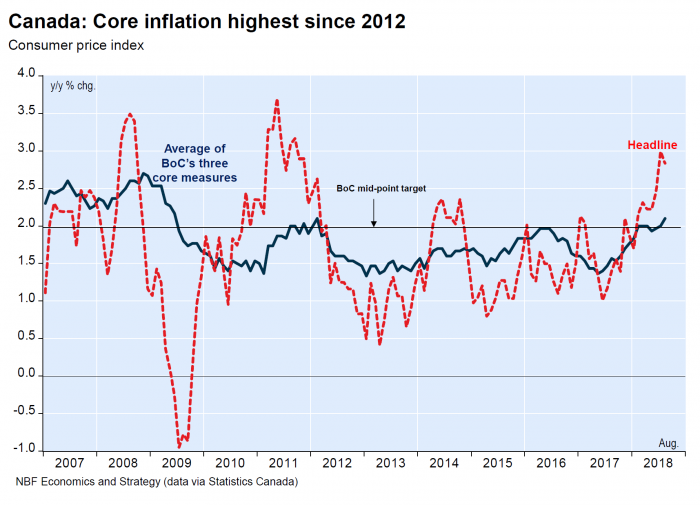

Given that Americans purchase over 70% of our exports, an economic bonanza down south would potentially push Canadian inflation towards or above the Bank of Canada’s 3% tolerance. Just today we saw core inflation climb to a six-year high.

National Bank Economics posed an important question: “Will the central bank keep blaming temporary factors for the upside surprise on inflation?” Assuming rising inflation is temporary can be a deadly sin, one that requires catch-up rate hikes later.

Given that, and the fact that there’s a 95% correlation between U.S. and Canadian 5-year bond yields, there is at least a chance that Canada’s 5-year yield could exceed 4% for the first time in over a decade. That could result in:

- discounted 5-year fixed rates near 5.50%, a whopping two points higher than today

- the stress-test rate near an unthinkable 7.34%.

The more leveraged borrowers among us would be in a real pickle, to put it gently. To put it less gently, upwards of one million Canadian mortgagors could be scrambling for payment relief (a good estimate if you triangulate recent surveys and government debt ratio data).

What it Means to You

No one is predicting all of this to happen. It’s merely a hypothetical that borrowers would be crazy not to ponder given the trajectory of U.S. growth, surging government debt service costs, the impending eruption in bond supply and ballooning deficits.

If you’re not as financially secure as you’d like, it’s this sort of possibility that deserves a place in the back of your mind, in the financial disaster planning section.

The message is this: if a 200-basis-point rate spike would put you at risk of missing a mortgage payment, plan ahead.

If you’re illiquid and need a bigger financial safety net, set up a HELOC. Do it today while it’s still relatively easy to qualify (compared to how hard it would be with a 7.34% stress-test rate, for example).

You can get a new mortgage with a HELOC built in (i.e., a readvanceable mortgage) or you can add a HELOC behind your existing mortgage.

Spy Tips: If you’re considering adding a HELOC behind your existing mortgage:

- Make sure your existing lender allows it

- Look for a HELOC provider who covers the set-up fees and has a competitive rate like prime + 0.50%

- Keep in mind that second-position HELOCs need to be “postponed” behind any new first mortgage if you decide to switch lenders at renewal time. Usually that’s not a big deal. It mainly entails a few hundred bucks in extra legal costs and approval from the new lender

- If your debt ratios are high, some credit unions offer HELOCs in second position without the federal stress test.

The Counter Scenario

Despite the prudence of developing a rate-shock contingency plan, no one can dismiss the possibility of an opposite outcome: rate cuts.

For all anyone knows, Trump-fostered anti-Canadian sentiment could result in further trade barriers that slow our goods and resource exports to the U.S., hog-tying Canada’s economy. Add to that structural disinflationary forces (e.g., automation, the Amazon effect on prices, etc.), which could continue keeping a lid on rates.

These phenomena could suppress Canadian mortgage rates even as U.S. rates climb. In such a case, the U.S-Canadian 5-year bond spread could surge to over 150 bps. (Today we’re at 63 bps and the average going back to 1990 is -34 bps.)

This potential scenario is one reason we love deep discount hybrid mortgages (i.e., half fixed rate and half variable rate). In times of extreme rate uncertainty, no one can be faulted for hedging their rate bet.

But rate cuts are not the scenario you need to worry about, or root for. The primary mission is to protect your cash flow. For if judgment day ever does come to the interest rate market, your mortgage contingency plan has to account for it.

log in

log in

The message is this: if a 200-basis-point rate spike would put you at risk of missing a mortgage payment, plan ahead.

The message is this: if a 200-basis-point rate spike would put you at risk of missing a mortgage payment, plan ahead.

2 Comments

5yr fixed rates at 5.50% sounds pretty dire, I wonder how many of today’s new homeowners could make their budget work with those kinds of rates. Don’t forget, that would imply significantly higher LOC rates as well.

I imagine the market of new homebuyers able to pass a 7.34%+ stress test would be pretty small as well. I would never say never, but I sincerely hope that’s not the scenario that plays out.

Hey Brett, You’re right. Relatively speaking, it is dire — but it is not a high probability. It’s just one possibility.

The majority of borrowers would still be able to qualify at 7.34% (based on government published data on total debt service) but it only takes a minority to precipitate economic destruction.