By The Spy on

March 13, 2021

Fixed mortgage rates look like a runaway train. Thanks to Friday’s epic jobs report, the 5-year government bond yield, a leading indicator of fixed rates, closed the week above 1.00% for the first time in a year. That coincided with a barrage of new fixed-rate hikes at the big banks. Most major banks internally elevated their fixed rates this week...

read more

By The Spy on

February 10, 2021

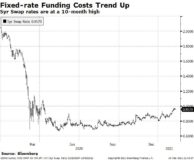

It’s not getting any cheaper for banks to fund a fixed-rate mortgage. In fact, Canada’s 5-year swap rate, a common measure of 5-year funding costs at the big banks, is running at a 10-month high. Yet, still we’re seeing lenders trim 5-year fixed rates as the cut-throat spring market approaches. RBC chopped its 5-year fixed by 18 bps last week....

read more

By The Spy on

February 6, 2021

5-year fixed mortgage rates tend to shadow 5-year government yields. And for most of nine months, the 5-year yield has been locked in a 21-basis-point range, a range so tight it was practically inconceivable prior to COVID. And, while no one has ever seen a range like this in our lifetimes, ultimately the 5-year yield will break out. When that...

read more

By The Spy on

January 20, 2021

In Brief Today’s Announcement:No change to rates Overnight rate:0.25% Prime Rate:2.45% (also no change; seePrime Rate) Market Rate Forecast:No BoC hikes until late 2022 BoC’s Headline Quote: “The Governing Council will hold the policy interest rate at the effective lower bound until economic slack is absorbed so that the 2% inflation target is sustainably achieved. In our projection, this does...

read more

By The Spy on

December 24, 2020

“Vaccines have come too late to avoid a bleak winter,” said Capital Economics in a report last week. The market agrees. Canada’s two-year bond yield, often used to forecast Bank of Canada rate policy, hit a record low on Thursday. That coincides with recent BoC comments that it could cut the overnight rate by less than the standard 25 basis...

read more

By The Spy on

December 9, 2020

Quick Rundown Today’s Announcement:No change to rates Overnight rate:0.25% Prime Rate:2.45% (also no change; seePrime Rate) Market Rate Forecast:No BoC hikes until at least 2023 BoC’s Headline Quote: “The Governing Council will hold the policy interest rate at the effective lower bound until economic slack is absorbed so that the 2% inflation target is sustainably achieved.” BoC on the Economy:...

read more

By The Spy on

November 30, 2020

—The Mortgage Report: Nov. 30— Trudeau’s government said Monday that it plans to lift Canada’s debt ceiling by up to 57% as it embarks on record spending and deficits in the name of pandemic relief. Canada’s historic deficit just keeps on climbing. It’s now estimated at $381.6 billion for the current fiscal year, up from $343.2 billion this summer and...

read more

By The Spy on

November 27, 2020

—The Mortgage Report: Nov. 27— If you’re out there mortgage shopping, BoC chief Tiff Macklem had a message for you Thursday: “We want to be very clear, Canadians can be confident that borrowing costs are going to remain very low for a long time.” It’s a mantra he’s repeated for months. Among the reasons: “…The economy still has more than...

read more

By The Spy on

November 17, 2020

—The Mortgage Report: Nov. 17— Remember that rate: 8 3/4%? Your average first-time buyer wouldn’t, as he/she would’ve been just seven years old at the time (1991). 8.75% was a tremendous 1-year fixed rate back then. But man, did it take a bite out of people’s budgets. Consider that on a standard $100,000 mortgage, you would’ve paid: $811 a month,...

read more

By The Spy on

November 9, 2020

Bond yields shot up like a cannonball after news broke this morning of Pfizer’s positive vaccine trials. Canada’s 5-year swap rate, one of the best leading indicators of fixed mortgage rates, sailed to a 5-month high. Now, everyone’s trying to figure out how long it’ll take before this translates into above-target inflation, which would be the Bank of Canada’s trigger...

read more

log in

log in