In Brief

- Today’s Announcement: No change to rates

- Overnight rate: 0.25%

- Prime Rate: 2.45% (also no change; see Prime Rate)

- Market Rate Forecast: No BoC hikes until late 2022

- BoC’s Headline Quote: “The Governing Council will hold the policy interest rate at the effective lower bound until economic slack is absorbed so that the 2% inflation target is sustainably achieved. In our projection, this does not happen until into 2023. “

- BoC on the Economy: “Beyond the near term, the outlook for Canada is now stronger and more secure…The outlook remains highly conditional on the path of the virus and the timeline for the effective rollout of vaccines.”

- BoC’s Full Statement: Click here

- Next Rate Meeting: March 10, 2021

The Spy’s Take

The Bank stated the obvious: “lockdown measures are a serious setback.” But the market is looking through it. Yields and the loonie rose after the BoC lifted its long-term economic outlook. The market, which factors in virtually all knowable information, believes inflation (and rate hikes) will return faster than the BoC’s narrative suggests.

The Bank gave no hints about cutting rates further. Leading up to today, there was ample speculation about a potential “micro-cut” — a 10- or 15-bps rate drop. That now “seems nearly ruled out ahead,” said CIBC economist Avery Shenfeld this morning, as reported by Bloomberg.

How to Play It

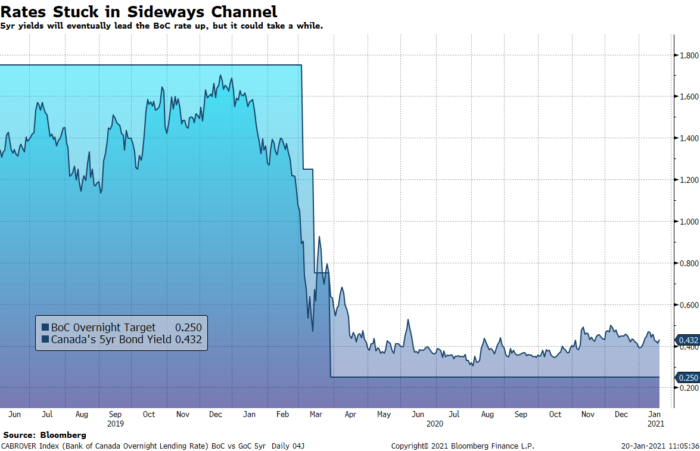

For 2021, analysts see almost no chance of a BoC rate increase. The BoC repeated its projection today that its main interest rate should hold at 0.25% until “2023.”

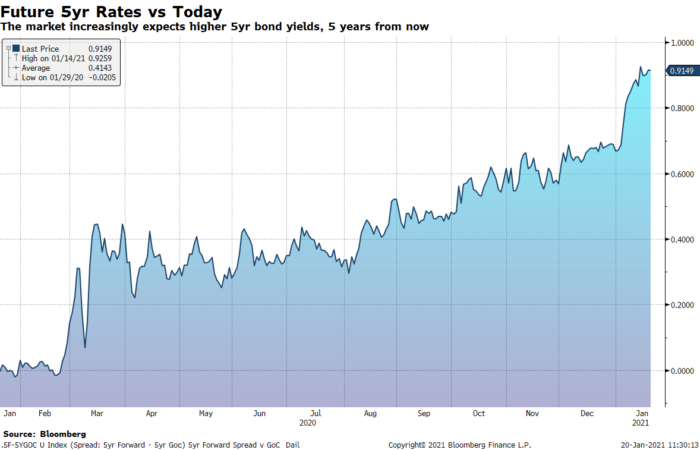

Meanwhile, the market increasingly believes that rates will be higher five years hence, as the following chart shows.

The #1 question on the minds of countless rate borrowers is, when will bond yields finally lift off and signal we’re getting closer to a prime rate hike?

Bay Street analysts and investors think it’ll start happening by the second half of this year. But that’s mostly guesswork. As we’ve repeated since June, until the 5-year bond yield closes above roughly 0.60%, there’s little chance of a meaningful bump higher in mortgage rates.

From the looks of it, new variable-rate borrowers will get a head start on fixed-rate borrowers by at least 12-24 months. But if the BoC begins hiking as planned in 2023, that narrow variable-rate advantage could evaporate in short order. (For more on that, see this analysis [PDF file].)

And it should be noted that market expectations are now for the first hike in mid 2022. The market is usually somewhat more reliable than central banks in predicting rate turns.

Given all this, today’s BoC statement does nothing if it doesn’t reinforce one thing. Variable-rate holders will enjoy many more months in the sun, but the least risky path for average homeowners is a 5-year fixed from a fair-penalty lender…one with flexible refinance options.

log in

log in

13 Comments

Any chance of releasing that spread sheet for the analysis attached to this article? Thanks

Hey Steve, See: https://www.ratespy.com/amortization-schedule

Hello Spy

I was wondering if you could weigh in on how much QE tapering might push up fixed rates this year?

Thanks

Hey Dave, Hard to say, especially since any slowdown in BoC bond buying would reflect other signs pointing to >2% inflation. But as a *total* shot in the dark, I’d guesstimate at least 40-60+ bps based on past tapers by other central banks. This assumes the U.S. is tapering, or expected to taper, as well.

Hi folks, we received this question via tweet. It’s a good question, so we’re sharing it here:

QUESTION:

@RateSpy, your analysis (https://ratespy.com/wp-content/uploads/2021/01/RateSpy-rate-scenario-20210120.pdf) ignores penalties and the fact that [HSBC’s] 0.99% insured variable is open after 3-years. Borrowers should run that forecast with probability weighted low/base/high cases to determine IRR. FYI, my guess is variable has a better one 😉

(Tweeted by @ahlaker on 2:44 PM · Jan 20, 2021)

ANSWER:

It’s a useful point of discussion because penalties are indeed a factor for some. But it doesn’t change the conclusion of this particular analysis and here’s why.

First, the recommendation in question speaks to overall “risk” for most borrowers, not the expected total borrowing cost for all borrowers. Consider the rate risk post-QE if inflation blows past forecasts due to unprecedented stimulus, money printing that catches up with central banks, supply constraints, home values that keep surging, a big ramp-up in immigration, a move from offshoring back to “Buy American/Canadian,” a concentrated release of accumulated savings back into the economy, oil prices that remain elevated, etc. etc.

The 75 bps of rate tightening built into our scenario is historically conservative, especially in that context. It’s intended only to show that it doesn’t take big rate hikes to give today’s record-low fixed rates an edge. Rate hike cycles typically exceed 200 bps. This presents unquantified risk, and that is largely why we advocated a “least risky path” for typical borrowers.

Second, the recommendation applies to the “average” borrower, not “all” borrowers. The average borrower doesn’t generally pay penalties. In fact, less than 1 in 10 5-year fixed borrowers paid a penalty over $1,000 according to a 2020 survey from Leger/RATESDOTCA.

Nonetheless, penalties were one reason why this story’s conclusion was not directed at “all” borrowers. And readers will note another very intentional caveat: that borrowers choose a “fair-penalty lender” with “flexible refi options.” With rates at the effective lower bound, big penalties will not be a material concern in that scenario.

Rob, isn’t the “fair-penalty lender” with “flexible refi options” a bit of a unicorn when the big banks control about 70% of the market?

https://www.canadianmortgagetrends.com/2020/09/big-banks-still-dominate-mortgage-market-share-says-cmhc/

For the that significant majority of mortgage clients, I think a 4-year fixed is a much better choice than a 5-year fixed. On top of saving 10-15bps on the contract rate, the big benefit is the 50-75bps lower IRD when the client wants to refi or early renew.

Hey Ralph, No, they are not that elusive. Start here: https://www.ratespy.com/fair-penalty-lenders-which-lenders-have-the-lowest-mortgage-penalties-05109252

Before making a recommendation, we model various scenarios. We do not share your view on the 4-year fixed at today’s rates. As the following table shows, the lowest 4-year rates are not 10-15 bps cheaper than 5-year rates: https://rates.ca/mortgage-report. Quite the opposite. Moreover, the upside rate risk in 2024-2025 is real. A four-year leaves you exposed in year five.

Moreover, choosing a fair penalty lender with flexible refi options largely mitigates prepayment charge concerns for the majority when rates are at the effective lower bound. And I would stress yet again that these conclusions apply to most, not all borrowers. There are always exceptions.

Rob,

Are you actually seeing most 5-year fixed uninsured mortgage deals close at rates 10-15bps lower than 4-year fixed? In the last month I’ve got quotes from BMO, BNS, CIBC, & TD. Every one of them quoted at least 10bps higher for 5-year vs 4-year.

Hey Spy!

I agree with Ralph. My RBC adviser offered me 1.79% for 4years and 2.01 for a 5 year term.

Hi Garry and Ralph,

Unless noted otherwise, any recommendation you see here in print is based on the assumption that the borrower will seek out highly competitive rates, is well qualified and is getting a standard mortgage on an owner-occupied property, among other things. For more, please see: https://www.ratespy.com/standard-assumptions-when-quoting-rates

A rate over 2% is not a highly competitive 5-year fixed rate based on these assumptions. The best full-featured 5-year fixed rates that we track are all lower than the best full-featured 4-year fixed rates. See: https://rates.ca/mortgage-report

That is not to say some folks aren’t seeing exceptions. But we do not assume exceptions are the rule for the masses. If one chooses to deal with lenders such as those you’ve both described, at higher rates, that is certainly your choice. And in that case, the scenario we’ve outlined would not apply. What you’ve described are not the terms we’d recommend for most borrowers, however.

Hope this helps.

Lenders would rather have a 5 year deal than a 4 year deal because the funding costs are better on the 5. They also generate another year of revenue and bigger penalties. It is not surprising that 5 year rates are better.

Anyone got a good system for when to lock in a variable rate?

@ Vic20

Yeah, go to bankofcanada.ca and look at the Total CPI inflation rate. When it has been around 2% for approx 6 months, pull the trigger.