—The Mortgage Report: Nov. 17—

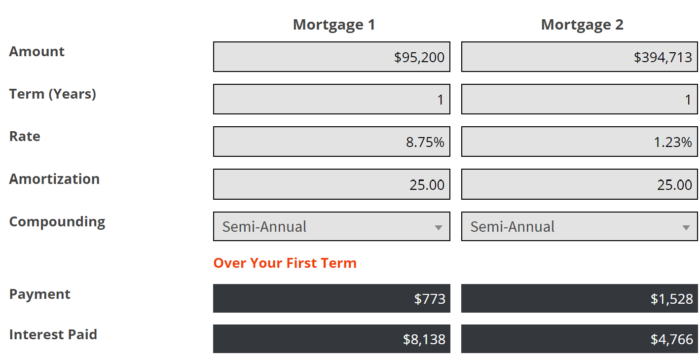

- Remember that rate: 8 3/4%? Your average first-time buyer wouldn’t, as he/she would’ve been just seven years old at the time (1991).

- 8.75% was a tremendous 1-year fixed rate back then. But man, did it take a bite out of people’s budgets.

- Consider that on a standard $100,000 mortgage, you would’ve paid:

- $811 a month, of which:

- Only $95 went to paying down the principal

- A whopping $716 went towards interest

- $811 a month, of which:

- Today, those numbers are radically flipped. On that same mortgage you’ll pay as low as 1.23%, or:

- $387 a month, of which

- The majority ($285) goes to principal reduction

- Just $102 goes towards interest

- $387 a month, of which

- Mind you, home prices are up 315% since 1991, according to CREA. And yet, mortgage payments have risen just 98% in that same timeframe. That’s the magic of plummeting rates.

- The most mind-blowing part: Even though Canada’s average home now costs over four times more in nominal dollars, someone with 35% down would pay roughly $3,300 less interest to mortgage it today. *

This comparison shows sample mortgage payments & interest: 1991 vs. today

* Example is based on a 1-year term and 35% down on the average home. Note: The selected down payment does not change the conclusion.

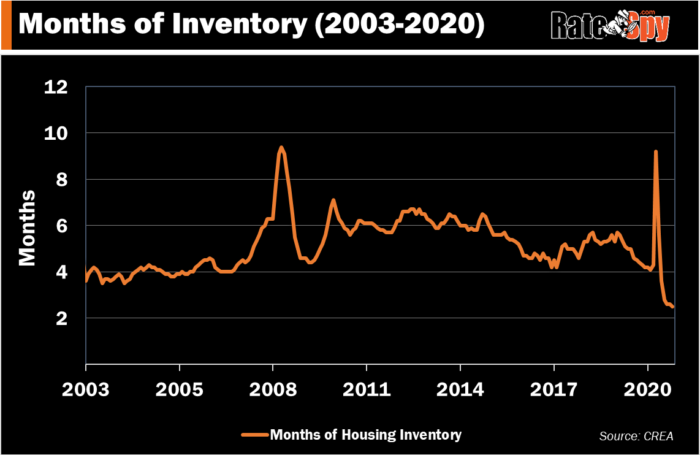

Record Supply Constraints

- Resale housing inventory is one of the best home price indicators. And this indicator portends further price strength.

- At the current pace of home sales, it would take just 2.5 months to deplete Canada’s resale housing inventory. That 2.5 is “the lowest reading on record for this measure,” says CREA.

- “At the local market level, some 18 Ontario markets were under one month of inventory at the end of October.” That’s nearly unheard of.

Equitable Gives Reverse Mortgagors What They Want

- Most people who get reverse mortgages want as much money as they can pull out of their home. The knock on Equitable Bank’s reverse mortgage product has always been that it limits you to extracting just 40% of your home’s value, depending on age, location, etc. That’s compared to a more appealing 55%+ at reverse mortgage pioneer HomeEquity Bank.

- But now, Equitable has finally matched HomeEquity’s standard 55% LTV limit. That’ll likely drive more serious competition in the space. That story…

Fed Speak

- The U.S. Federal Reserve drives Canadian mortgage rates practically as much as the Bank of Canada drives Canadian rates. So, when Fed officials speak, Canadian rate analysts listen. Here are some of the latest clues on future rate direction from Fed officials:

- Fed Vice Chair Richard Clarida suggested Monday that inflation may have to exceed 2% for a whole year before the Fed next hikes rates.

- Last week, NY Fed’s John Williams told the Financial Times that if “we get really good news…that is going to pull forward somewhat the time we could expect to raise interest rates,” and vice versa.

- North America’s economy has bounced back faster than expected, and much faster than the last recession. That’s thanks to “exceptionally effective monetary and fiscal policies,” said the Fed’s James Bullard. The jobs recovery is “48 to 50 months ahead of where it was following the 2007-09 recession.”

- Despite this positivity, the Fed still projects (for now) that it won’t hike rates until the end of 2023.

Quick Hits

- The Bank of Canada forecasts potential GDP will be 3% lower at the end of 2022, compared to pre-COVID.

- In 2016, 67% said they “rarely or never” checked their credit reports. In the last 12 months, 71% have checked their credit.

Quotable

- “Our view is that monetary policy will be kept extremely loose, in part to help manage the increase in public debt that has resulted from the crisis. If we are right, then real interest rates will remain in negative territory…perhaps for the rest of this decade.”—Capital Economics

log in

log in

2 Comments

I wonder how much incomes have risen in that same time. Is it possible mortgage payments on the average property are lower today in real terms?

Hi Phil, Here is the income data: https://www150.statcan.gc.ca/t1/tbl1/en/tv.action?pid=1110023901&pickMembers%5B0%5D=1.1&pickMembers%5B1%5D=2.1&pickMembers%5B2%5D=3.1&pickMembers%5B3%5D=4.2&cubeTimeFrame.startYear=1991&cubeTimeFrame.endYear=2018&referencePeriods=19910101%2C20180101

Mortgage payments have risen roughly 20% faster than inflation since 1991, based on the national average home price.