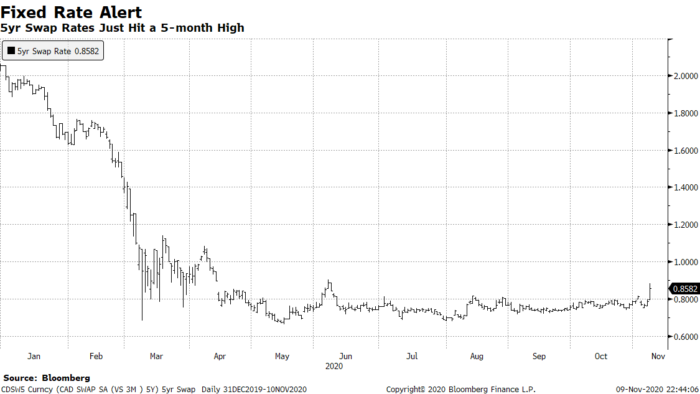

Bond yields shot up like a cannonball after news broke this morning of Pfizer’s positive vaccine trials. Canada’s 5-year swap rate, one of the best leading indicators of fixed mortgage rates, sailed to a 5-month high.

Now, everyone’s trying to figure out how long it’ll take before this translates into above-target inflation, which would be the Bank of Canada’s trigger to start hiking interest rates. (Hint: It’ll take longer than next year, unless the BoC—heck, unless the entire economic establishment—is drastically off base with its forecasts.)

Here’s what we know.

- The BoC’s overnight rate is stuck in a rut — at what the Bank calls its “effective lower bound.” That means prime rate ain’t going anywhere for multiple quarters. Average core inflation would have to shoot meaningfully above 2% to justify a BoC hike, and that “does not happen until into 2023,” the Bank projects.

- Could our central bank have its forecast all wrong? Absolutely. It’s been wrong before. But its credibility depends on following through with its forward guidance. Hence, BoC rates hikes in 2021 are highly unlikely.

- Bond yields, however, are a different animal. They won’t wait for the Bank of Canada. The bond market prices in good news one to two years in advance.

- When bond yields jump, fixed mortgage rates jump. If yields rise materially from here, this time will be no exception.

- Lenders are already advising brokers that fixed mortgage rates are in danger of rising. We got three such emails today. This threat will be magnified if Canada’s 5-year yield breaks above 0.50 to 0.60%. It closed today at 0.48%.

With financial markets getting their first legitimate hope of “normalcy” in nine months, investors are ready to price in higher growth next year. And investors are ready to sell bonds at the first hint of higher future inflation. (That would be bullish for rates since bond prices and interest rates move in opposite directions.)

Regardless of whether this rate spike is for real, lenders know full well that borrowers will rush to lock in if rates break out of their historically tight range. They also know that people who’ve been waiting for lower rates will panic when rates do the unexpected (surge higher), and flood into fixed rates.

Lenders have seen such behaviour time and again, and they price for it. That is, once rates show any kind of follow-through to the upside, they’ll give borrowers scant time to lock in.

Sidebar: The Bank of Canada has pledged to buy government bonds in order to keep yields low and spur more borrowing. Some believe that creates a glass ceiling for rates. In the short term at least, it definitely does not. The bank was buying 5-year bonds today and rates still surged. The bank isn’t scheduled to purchase 5-year bonds next until November 20. A BoC spokesperson confirmed today, “It’s fair to assume that we will be transparent and purchases will follow the schedule.” Hence, any jump in 5-year yields between now and next Friday would presumably be unmitigated by the BoC. And a lot can happen in seven trading days.

log in

log in

14 Comments

The 5-year yields are kept low even before the BoC buys. Simply announcing that they will buy bonds allows the market to price in most of the effect now.

That’s true Ralph. Forward guidance does some of the heavy lifting, but not all of it. Traders know the BoC won’t buy the entire float of 5-year bonds. And there are gaps in the BoC’s buying (e.g., it won’t purchase in the 5yr sector again until Nov. 20). Hence, there is still an opportunity for yields to move somewhat higher, QE or not.

10 companies are in phase III vaccine trials. I think the bottom is finally in.

Here’s to hoping…

Hi, I have P-1.06 from HSBC for a 310K mortgage. I dont have a high job stability. HSBC has 1.84 (5Yr Fixed) right now. Since the five year yield is going up, do you think its a good idea to lock right now. I dont have any plan to move now.

Thanks for the content and frequent update. Your content is very helpful.

Hi Whitesnow, Great question and thanks for the shoutout. You can confirm this but we understand that HSBC allows variable-rate borrowers to fix their payment. So the payment shouldn’t change, even if there’s an income interruption.

If the goal is peace of mind in terms of interest expense, 1.84% is an excellent 5yr rate. But it’ll nonetheless cost you roughly $1,300 extra interest per year until prime rate changes. That could be one to three-plus years if we’re to believe the BoC and economist forecasts.

You didn’t note your fallback resources, equity, debt ratios and other qualifications so it’s hard to make a recommendation. But knowing that rate predictions are futile, it largely comes down to whether you want to pay ~ $100+ a month indefinitely for interest cost certainty. 1.39% is an outstanding rate. The BoC would have to hike more than three times for you to feel noticeable interest pain. Economists would tell you the odds of that happening in the next three years are modest, FWIW.

Speaking of three years, HSBC also allows early termination with no penalty after three years (a great perk that let’s you escape the mortgage — e.g., switch into a better rate elsewhere — with very little cost, assuming you qualify at the time).

Quick comment on Ralph’s point. I think he means, 5-year yields WERE kept low. We shouldn’t confuse the past and future.

A friend of mine has a mortgage up for renewal in July 2021. Should he break his mortgage now and lock in, or will he be fine to hold off until then?

Hi Matt, Too many missing pieces of the puzzle to make a recommendation but pass this along to your friend: https://www.ratespy.com/fixed-or-variable-rate-the-decision-checklist-02223752

I’m in a similar boat as Matts “friend”

Renewal coming up on August 27,2021

I have a MCAP flex value so i cannot break my mortgage. I have to wait patiently until roughly April 27, 2021 (120 renewal period)

What are the educated presumptions on fixed rates at that time??

Hi Michael, Thanks for the question. We’ll have to write something on this because there are hundreds of thousands of Matt’s friends out there right now.

We’re not tea leaf readers of course but the odds are probably better than 50% that rates will be higher on April 27, 2021 than they are today. (And don’t remind me I said this if I’m wrong!) The likely reasons: more/continued federal stimulus, vaccine developments, re-opened borders (hopefully), increased immigration, higher spending from consumers who’ve hoarded their savings (the savings rate hit an all time high of 28% in Q2), and potentially even inflationary supply disruptions, among other things.

Out of curiosity, did you ask MCAP what they’d quote you to blend your ValueFlex into another five year term?

Hi Spy,

I did not, but your response inspired me to call. After speaking with the representative, apparently I can renew early (my broker told me otherwise) and I can blend and extend as long as I am continuing with MCAP and a Valueflex mortgage.

Current Mortgage:

$249,331.68

2.49%

25 year amortization

5 year term – Maturity August 27, 2021

Offer 1: early renewal

5 year

fixed – 1.99%

variable – 1.90%

penalty – 3 months interest – 1,548.23 reduced by 10% to 1,393.41 for appreciated business paid direct to MCAP

Offer 2: Blend and extend

5 year

fixed – 2.206%

penalty – 1393.41 rolled into mortgage

Offers valid until Nov. 20, 2020

What do you think?

Sub 2% is great, but 1.99% seems a little high….no?

Michael Stewart why not renew with another lender at 1.79-1.89%? depending on the term rates may vary….fixed rates are the lowest theyve been and may be gone soon….What makes you think that rates will be low in 2021? Refinance/Transfer ASAP! Ask your broker as some lenders are giving cashback!

Hi Redo!

Unfortunately, MCAP’s valueflex mortgages basically have a “bona-fide sales” clause (a fancy way of saying that you can’t leave your lender until the term is up, unless you sell the property) or if I re-sign with MCAP in another “valueflex” mortgage product.

This was something I didn’t know at the time of buying/signing (first mortgage and I’m learning).

Didn’t expect a pandemic/rate reduction like this.

I’m not optimistic that rates will remain this low, but I’m also not convinced they will sky rocket by April 27, 2021.

Basically, if i can get 1.99 by April, I feel like that would be a win compared to MCAPS current offer of 1.99 today plus the cancellation fee ($1393.41)

What are the chances we are 2% (even slightly below) come end of April, 2021 :S?