Fixed mortgage rates look like a runaway train. Thanks to Friday’s epic jobs report, the 5-year government bond yield, a leading indicator of fixed rates, closed the week above 1.00% for the first time in a year.

That coincided with a barrage of new fixed-rate hikes at the big banks. Most major banks internally elevated their fixed rates this week — by about 10-15 bps.

Publicly, RBC lifted its “special offer” 5-year fixed from 2.24% to 2.39% and 7-year fixed from 3.09% to 3.19%.

BMO boosted its 5-year “Smart fixed” from 2.24% to 2.34% and from 2.09% to 2.19% if the mortgage is default insured.

Variables Will (Eventually) Get More Appealing

The gap between fixed and variable keeps growing. At 69 basis points, the 5-year fixed – variable spread is the widest it’s been since July 2018.

As this trend continues, and it will, we could easily see variables regain a one-point edge over 5-year fixed rates — something that hasn’t happened since 2011 (based on RateSpy’s database of major bank rates). That’s when you’ll see people more seriously consider floating their rate.

As it stands, the market is pricing in 75 bps of BoC rate hikes within two years and almost 150 bps of hikes within three years. Those are not outlandish estimates by any stretch, given the stimulus-fuelled post-vaccine GDP growth ahead.

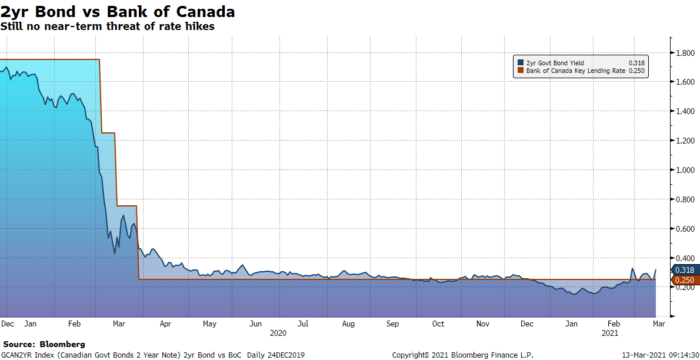

Near-term, there’s no risk of an overnight rate increase, as this chart of the 2-year government yield versus the Bank of Canada’s key lending rate shows. Once the 2-year runs more than a quarter-point (25+ bps) above the overnight rate (it’s 8 bps above now), that’s when you have to start worrying about a prime rate hike within 3-6 months.

Looking further out, the market is still pricing in materially higher 5-year bond yields, five years from now — about 113 bps higher. If market expectations are right, 5-year fixed rates could have a 3-handle within 12-24 months. In other words, they should more than double from this year’s record lows.

Will those kinds of increases be a wet blanket for home price appreciation? It’s possible, if rates climb enough. We’ll delve into that more this week.

One last quick note. Salutations to all you long-term financers who snagged the all-time low 1.98% 10-year fixed rate you saw on the Spy last month. You can pat yourselves on the back—for now at least. The rate premium you paid may soon seem insignificant as 5-year fixed rates surge past the 2% mark.

log in

log in

13 Comments

Does anyone have an informed opinion on how high the 5 year fixed might go?

Jim,

I think you just read one.

Let me rephrase that. Is there a way to know where the next stop is for the 5 year yield?

Hi Jim, We’ll try to touch on this later today/this evening or tomorrow.

What predictive value does the 5yr futures spread have, if any? In early Aug, it was 30-40bps, while the 5yr yield was 30-35bps. Despite the market pricing a future 5yr bond yield of about 70bps, it’s already 30bps higher than that.

Ralph, The forward rate curve changes all the time as the economic outlook changes. It’s usefulness is not predicting specific rates but indicating rate potential. Yield curves are are just about as predictive an interest rate indicator as you can find, albeit far from perfect. They’re certainly more predictive than economist surveys, for example. See this research from the Fed: https://www.federalreserve.gov/econres/feds/files/2018055r1pap.pdf?mod=article_inline

As noted by the Fed: The “forward spread has considerable power for forecasting GDP growth over the subsequent four quarters…”

So, whether rates are 113 bps higher in five years, 13 bps higher or 213 bps higher, the point is, we’re entering an expansion phase and they’re likely going higher between now and 2026.

Thank you for all of the information you provide. It’s a great resource. I know Canadian pension funds are mandated to buy Canadian bonds. Do you know exactly how much of our bond market is owned by our pension funds?

Thanks Nic, Pension funds are the biggest non-governmental holders of Canadian sovereign bonds. The last data I saw pegged their share at about 46% of the domestic private market. Source: https://www.bankofcanada.ca/wp-content/uploads/2018/09/sdp2018-10.pdf

Tangerine just raised their 10y to 3.09%, considering I was able to secure my rate a month ago things are looking better and better by the minute

I also got a rate hold on the 2.14 10 year for tangerine am i correct in thinking that rates would have to be 0.78 higher in 5 years to break even considering 5 years are going for 1.75%

Hey Vince,

The breakeven is a 0.92 percentage point rate increase.

This assumes equal payments (an assumption which eliminates questions about opportunity cost — i.e., what you’re going to do with the payment savings of the cheaper term).

Reading an online article earlier, Financial Post I believe, that talked about mortgage points, prepaying some interest to get a lower rate. Never heard of them before but are they available at most banks and are they beneficial?

Hey Scott, I saw that MoneyWise article (which the Post never should have published without vetting). Its author clearly didn’t know what he was talking about. Canadian prime lenders generally do not use “points” to buy down rates — like they do in the U.S.