Canada could see government interest rates below zero for the first time in history.

Canada could see government interest rates below zero for the first time in history.

That’s not a prediction, but it’s a real possibility. The probability of recession has surged from the coronavirus pandemic and oil market collapse. The Bank of Canada has just 125 basis points of rate-cutting left before it hits zero. That is insufficient ammunition to fight the potential deflation this crisis could cause.

In a 2015 speech, BoC Governor Stephen Poloz stated:

“…We have seen the experience of several central banks, such as the ECB and Swiss National Bank, which have adopted negative policy interest rates. There, we’ve seen that financial markets have been able to adapt and continue to function. Given these and other developments, the Bank is now confident that Canadian financial markets could also function in a negative interest rate environment.

We now believe that the effective lower bound for Canada’s policy rate is around minus 0.5 per cent.”

Somewhere in that – 0.50% neighbourhood could be the ultimate target for Canada’s overnight rate if a recession is serious enough. That would be 175 basis points below where we now stand. Albeit, the BoC will likely try a 0% or 0.25%-point overnight rate and other measures first, before experimenting with negative rates.

And if we do go sub-zero, there isn’t a snowball’s chance in Honolulu that banks will drop Canada’s prime rate by a similar amount. The economics for banks simply wouldn’t make sense.

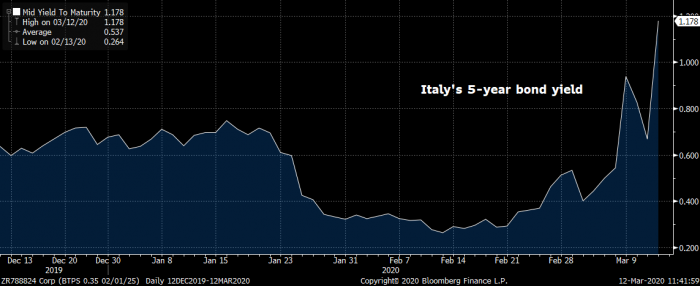

And then there’s bond yields, a key driver of fixed-mortgage pricing. If you think Canadian bond yields will go sub-zero as well, you could be right. But we can’t assume anything during a black swan event. Witness what just occurred with Italian 5-year yields.

That’s what happens when investors expect a country’s balance sheet to deteriorate, fear of sovereign credit risk grows and not enough is done by the government to stem it. (By the way, Italy is suspending mortgage payments nationwide.)

The situation is growing increasingly grave with the TSX Composite stock index, now down 30% from its high last month—an almost unprecedented collapse. And it’s not because COVID-19 is going to knock out 10% of the population by next year. Top epidemiologists say the fatality rate is far less. The economic risk that’s hammering markets is that isolation of our citizenry will decimate spending and production.

Almost half of Canadians are $200 away from not paying their monthly obligations, Ipsos recently found. Defaults could soar if people who can’t work remotely cannot service their debts.

Thankfully, that prospect hasn’t dried up liquidity in Canada’s mortgage market…yet. But we fully expect credit tightening (making it harder for fringe borrowers to get approved) and mortgage liquidity challenges (not positive for rate discounts). The government will address the latter if things get too bad, as it did in 2008.

Apart from cutting rates, the BoC has said in the past that it could:

- make “large-scale asset purchases” (e.g., buy mortgage-backed securities)

- “provide collateralized funding at a subsidized rate as long as banks met specified lending objectives”

- provide forward guidance (e.g., pledge to keep rates low to boost demand)

All of these measures would have a more limited effect if people can’t go to work in factories, distribution, retail, etc., and consumers can’t freely shop, go out to eat, travel and so on.

One last note on home values

If you’re thinking about getting into the housing market, think long and hard about how a recession weighs on home prices.

If you’re thinking about getting into the housing market, think long and hard about how a recession weighs on home prices.

Yes, as we’ve noted before, plunging mortgage rates and an easier stress test are normally a boon for real estate. But these are no longer normal times.

In the same BoC speech referenced above, Poloz said, “…consumers and businesses respond less to interest rate declines when interest rates are already very low. And there is evidence that their responsiveness is also lower when confidence is low…” Homebuyers shouldn’t forget that.

And for that matter, home sellers shouldn’t either. Watch the number of new listings carefully. If surging unemployment becomes a reality, housing supply could rebound strongly. Prices could drop 10%-plus within six months of an adverse employment effect. For most people, there should be no urgency to buy a home today.

All this said, we have no uncanny ability to time the real estate market. We’re simply noting the negative impact on real estate from past recessions. So, do what’s right for your family, knowing that this crisis will get worse, but eventually blow over.

log in

log in

6 Comments

Hi Spy

What is your best guess on how low prime rate could fall if rates are at zero?

Thanks

1.5%

2.2%

2.70%

BOC just dropped the overnight rate another 0.5%.

10% to 15%