—The Mortgage Report: Oct. 21—

- Canada’s budget deficit will end 2020 “near 20% of GDP,” according to the IMF. “That represents the fourth-highest projected deficit in the world, after Libya, Aruba and the Maldives,” says Bloomberg News. With that degree of fiscal hemorrhaging in Ottawa, bond yields (and hence fixed mortgage rates) would jump sooner were it not for Bank of Canada bond-buying.

- As regular readers know, the 5-year bond generally steers fixed mortgage rates. And while the BoC hasn’t formally adopted a “yield curve control” policy for the 5-year bond, it has been snapping up 5-year government debt week after week since April. That’s helped keep Canada’s 5-year yield below 0.40% for most of the last five months.

Jargon Buster: Yield curve control is when a central bank pledges to buy all the bonds necessary to keep interest rates of a specific duration (like 5-year rates) from rising above a certain number.

- “Our message to Canadians is that our interest rates are very low and they’re going to be there for a very long time,” BoC chief Tiff Macklem said in July. Of course, that was before the latest wave of COVID, which now implies:

(A) further economic destruction—on top of the human toll

(B) a greater likelihood that BoC bond purchases persist further into next year. - That’s important because, as Desjardins Economics writes, “Fears over public finances (see the next section below) and the supply of bonds may persist, but the effects on bond yields should be limited as long as the Fed and the BoC continue their large-scale bond purchases. We’re unlikely to see a halt to these purchases or a true upward trend in bond yields before a few quarters, and then only if pandemic-related risks subside significantly.”

Fiscal Anxiety

- BoC bond-buying is all the more critical with Canada posting historic deficits. All that red ink is keeping investors on edge and keeping bond yields elevated, relatively speaking.

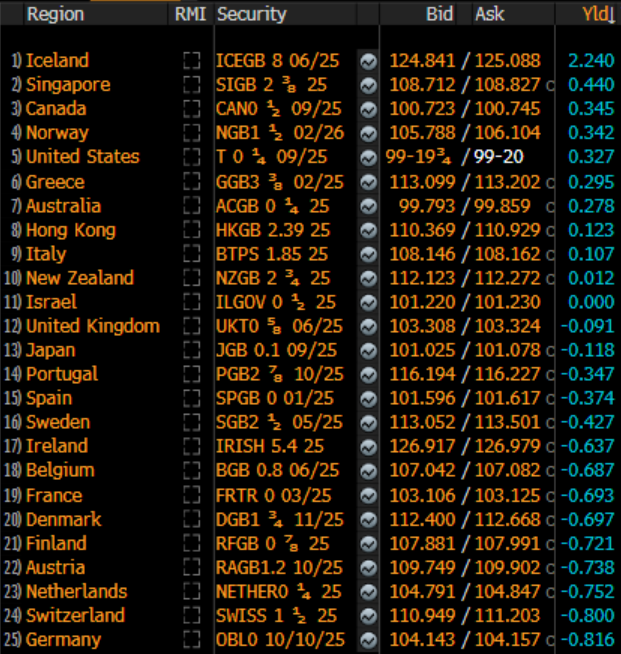

- In fact, at the time this is being written, only 2 of 25 developed nations tracked by Bloomberg had higher 5-year yields than Canada: Iceland and Singapore.

- Investors are even awarding Greece and Italy—two countries on the brink of insolvency not long ago—with higher bond prices and lower bond yields than Canada.

- What’s causing our elevated rates? Well, Canada’s projected GDP growth and inflation in 2021 are only slightly above average (i.e., not enough to justify its #3 five-year yield ranking). That suggests fiscal concerns may be a key factor.

- Another round of epic spending in 2021 would put Canadian rates at even greater risk of increasing (if the BoC doesn’t intervene, per above) and potentially cost our country all of its AAA credit ratings.

Source: Bloomberg

The Gamble

- More people than usual are contemplating 1-year fixed terms. Their logic is that the Bank of Canada has pledged to keep rates low 2-3 years. Therefore, why not save a little on a short term now, and lock into a longer term before rates spring higher?

- To test this theory, we ran some quick back-tests back to 1991.

- Note: That year (1991) was chosen because it was the dawn of modern monetary policy—a.k.a., inflation targeting. This changed the rate landscape in Canada forevermore.

- In this timeframe, during which rates trended down most of the time, mortgagors faced a 1 in 3 chance of rates being higher one year out.

- In 2020, however, you have to keep a few more things in mind:

- Periods of low volatility, as we find ourselves in today, often lead to rate spikes in the next year or two, as was the case in 1998, 2012 and 2016.

- When in the trough of an economic cycle, as we find ourselves in today, there are also greater chances of higher rates one year out.

- The point being, even the most die-hard 1-year fixed fans must assume a double-digit probability that rates will rise before they can renew into their next term.

CIBC Cuts

- CIBC has lowered the following rate “specials:”

- 5yr fixed: 2.14% to 2.10%

- 5yr fixed (high ratio): 1.97% to 1.93%

- By comparison, the lowest online broker rates are 1.40% and up on default-insured mortgages (see: 5-year fixed rates)

- 5yr variable: 1.93% to 1.88% (prime – 0.57%)

- 7yr fixed: 2.61% to 2.53%

- There’s nothing to write home about with CIBC’s rate changes, but its discretionary rates are better than what it’s advertising. And it’s good to see variable discounts improving in any case. More big bank rates…

Another Private Open

- Further to Friday’s RATESDOTCA story about Fisgard’s new 7.49% no-fee interest-only open mortgage with no proof of income required, Neighbourhood Lending recently released its own interest-only stated income mortgage. Seems like a trend.

- Here are the specs.

- Some highlights:

- Its one-year open mortgage rates start at 5.95%, with a 1% lender fee for people with a 680+ credit score.

- Maximum LTV is 65% in most places (70% on exception).

- No income documents are required, but borrowers do have to sign a statutory declaration stating their income.

log in

log in

8 Comments

Hi Spy,

Apology for not understanding all technical things here. I have 1.15% (Prime – 1.3%) as 5 yr. variable rate since May 2020. should I continue as it is or think about getting 5 yr. fixed if anyone offers <1.5% ?

FYI. I am not selling home for next 5 years so not worried about penalty for fixed rate. Any suggestion would be helpful.

Thank you.

I would go to my lender and ask someone to work on terming it out to a 5 year MTG term.

Most places will lock in the lowest rate up to 90 days back. You can sit on it and get qualified and all of the paper work ready to go.

Then you can just watch the rates and make the move to lock it in when you see them start to trend up. That’s because of the 90 day hold say for 60 days you see rates going up go sign the paper work and lock in that old rate.

The bond market is like any other market. Supply and demand rule the day. The Liberals cannot run $100 to $400 billion deficits without flooding the bond market with supply. Unless the BOC buys every issue or the economy goes into a total tailspin in 2021 – and I don’t foresee either – bond prices are headed southbound and rates are headed northbound.

@Mediumbad- Thanks for your time replying. Eventhough Prime wouldn’t change for next 1 year but your suggestion is still helpful. I will think about it.

Hi Tejas,

Assuming:

* A well-qualified borrower

* No need to break the mortgage early

* No meaningful deterioration in the borrower’s financial situation

* That a variable was the right term for them in the first place…

…then I would hold on to prime – 1.15% as long as possible. They don’t make these discounts anymore. At the very least, there is little reason to lock in if 5-year yields stay below 0.50% to 0.60%:

https://bigcharts.marketwatch.com/quickchart/quickchart.asp?symb=TMBMKCA-05Y&insttype=&freq=&show=

Hi Spy,

Great to see your reply. Thank you.

Your all 4 assumptions are correct with me getting variable rates. It is actually Prime -1.3% = 1.15% (+ $3000 cashback to be very precise). I got lucky when Prime dropped 150 BPS in less than a month but my worry is what if it go up in similar fashion in 2 years from now. Locking 5 yr fixed at 1.3% or 1.4% may be peace of mind.

I take your word and stay as it is at this time.

Again, Thank you.

@Texas, where did you get this low variable rate 1.15%?

Hey Dani, Not sure but he’s likely had that rate for many months. Discounts have shot up industry-wide since that rate was available.