Mortgage Report – May 14

- De-Stressing: Call out the marching band, BMO’s posted 5-year rate cut today should ease the government’s mortgage “stress test,” effective next week. As it stands, the minimum stress test rate will likely fall from today’s 5.04% to 4.99%. It’ll mark the first time since January 2018 (when OSFI’s stress test began) that this benchmark rate has been under 5%. And, if one more bank matches BMO’s and RBC’s 4.94%, it could drop another 5 basis points. A 5-bps lower stress-test rate won’t get you that mansion in West Vancouver, but it’s something. If it does go to 4.99%, a household making $100,000 a year with 5% down and no other debt can afford about a $2,000 bigger mortgage, versus today.

- BMO’s Other Rate Drops: Here are all of its posted-rate changes today:

- 1yr: 3.29% to 3.09%

- 2yr: 3.54% to 3.39%

- 3yr: 4.05% to 3.89%

- 4yr: 4.64% to 4.34%

- 5yr: 5.04% to 4.94%

- 5yr variable: 2.95% to 2.45% (Prime)

- TD Cuts: TD did a little rate cutting too, this time to its advertised “Special” fixed rates:

- 3yr: 2.89% to 2.74%

- 5yr: 3.09% to 2.97%

- 5yr (high ratio): 2.79% to 2.69%

- For Those Who Were Wondering: This one sentence from today’s Bank of Canada Financial System Review is the main reason why advertised bank mortgage rates are still inflated: “…Bank funding spreads and mortgage interest rate spreads are higher than they were before COVID‑19.”

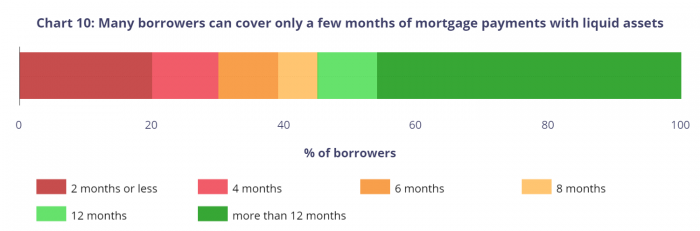

- 1-in-5 Mortgagors Have Little Safety Net: “About 20% of all mortgage borrowers do not have enough liquid assets to cover two months of mortgage payments,” the BoC estimates.

- Debt Ratios to Climb: “The proportion of households with debt-service payments of more than 40% of their income, an indicator of household vulnerability, is likely to rise.”—BoC

- Arrears to Rise: If the Bank of Canada’s “pessimistic” scenario (its words) plays out, the percentage of people 90+ days behind on their mortgage will peak in Q3 2021 at 0.8%, well above most economist forecasts. The highest arrears rate in CBA records back to 1990 has been 0.65%. The Bank estimates it would have shot up to 2.11% had lenders not agreed to payment deferrals.

- Our Banks are Solid, But…: “…The country’s banking system and financial market infrastructures are strong enough to deal with [the pandemic]—and even the more severe economic scenario that we outlined in last month’s MPR,” says BoC Governor Stephen Poloz. But, “…The pandemic remains a massive economic and financial challenge, possibly the largest of our lifetimes, and it will leave higher levels of debt in its wake.”

- Timing the Bounce-Back: The timeframe for a housing rebound is “uncertain” and price expectations have softened “quite a lot,” said Deputy BoC Governor Carolyn Wilkins today, but it will “firm over time.” Clearly. The question is whether to characterize the rebound time in months, quarters, years or a decade+. Likely not the latter, say the trusty econo-scientists in the banking and real estate sectors.

- Prolonged Pain: Hundreds of thousands of North American businesses will never again re-open post-COVID. That’s partly why Fed Chair Jerome Powell warned yesterday of the “significant downside risks” of a sustained recession following the pandemic. There are reasons why bond yields haven’t been zooming like stock prices, and this is one of them. Rate impact: Bearish

- Powell: Spend More: The Fed chief urged Congress to take even more extraordinary measures to prop up the economy (i.e., deficit spend). That sent shivers up the spines of deficit hawks who fear that gobs of money creation will stoke inflation and perma-deficits will boost the credit risk premium built into so-called “risk-free” government bonds. Rate impact: Potentially bullish…someday

- The Don Wants – 0.25%: Yesterday, Trump once again goaded the Fed on Twitter to go sub-zero with its policy rate. The Fed’s Powell politely declined, saying, “This is not something that we’re looking at.” Rate Impact: Slightly bearish (the Donald usually gets his way)

As long as other countries are receiving the benefits of Negative Rates, the USA should also accept the “GIFT”. Big numbers!

— Donald J. Trump (@realDonaldTrump) May 12, 2020

log in

log in

16 Comments

Hi Spy, My mortgage comes to renewal in August. I am sitting out for fixed rates to drop, but wondering if I should get a rate hold for a variable in case the discount on variable drops if BoC drops rates again. Any thoughts if we would lose variable discounts if there is a BoC rate drop?

Hi Rob, There are no indications of variable rate discounts decreasing near-term. As we speak, banks are increasing them.

That’s not to say they can’t go the wrong way once again, but things would have to get much worse in the funding markets for that to happen. Credit spreads (risk premiums) would probably have to blow up again. If we see that happening, we’ll report it.

Hurray. Why stop at $2000. Do I hear $4000 more mortgage debt. That’s $4000 more you will owe your lender or mortgage insurer when you lose your job and house prices have fallen. And yes, they will and do sue you for their losses, and in Ontario there is no limitation on how long they can wait in the wings to get their money, including any co signer (as long as they start the process within 2years).

David thanks for the fear mongering.

Here’s a better idea. If you can’t comfortably afford a home don’t buy one.

If you can afford the payments, the return on investment of that extra $2000 will probably be 100% within 10 to 15 years.

Don’t be short sighted. Think long term.

It is funny you call that a drop, Spy 🙂 It will allow people borrow how much more on an average mortgage? 4k maybe? That is so insignificant it won’t change a thing. Just a gesture from biggest banks to allow government not to step in. We remember times when a 5 year fixed let us avoid the test (that even then was at much lower rate).

Me,

Well, it’s lower than the previous value so yep, pretty sure it’s a drop. Didn’t say it was a big drop.

Regulators plan to de-link posted rates from the stress test, whether the banks like it or not. The benchmark rate change has merely been shelved temporarily, say the feds.

I mean I think it is not really worth all the marketing …

Me, What marketing?

My house is closing in September with 20% down payment. What rate should I expect for 5 year fixed.

AZ, Is this a trick question?

Hello! Thanks for the write up. I have a mortgage renewal coming up in September. TD is offering me 2.64% for 5 years fixed. I wanted to lock in but last Friday they offered 2.54%. That is gone. Can I expect that the 5 year fixed rate will drop any lower than today at 2.64% that TD is offering me?

Hi Kim, TD’s rates did not go up, according to our sources. If someone there is playing games with you, there are many other lenders in the sea. Use our search tool to find them. You’ll likely save 20+ basis points if you’re a qualified borrower. As for rates between now and September, they may well drop, but you cannot “expect” it.

Kim, try a broker. Canwise, TrueNorth, IntelliMortgage, Butler…

I was offered 2.29% for a 5 year fixed from Canwise Financial on Wednesday May 13th. They are willing to hold that until September and if rates fall before then, then I could take advantage of the lower rate

The title, Spy, is kind of an advertisement. Don’t underestimate the coverage / audience you have 🙂

Me, Not sure if it’s clear what we do here (report on mortgage rates). If the stress test rate dropped 1 basis point it would be news and it would be reported. More than 4 out of 5 mortgagors are measured against the stress test, hence why people care. To refer to said reporting as advertising is just silly my friend.