By The Spy on

February 23, 2021

If you have faith in Canada’s top banker, Bank of Canada chief Tiff Macklem, you needn’t worry about prime rate rising in 2021. Here’s what he said in a speech on Tuesday:With a complete recovery still a long way off, monetary policy will need to provide stimulus for a considerable period. We have committed to keeping our policy interest rate...

read more

By The Spy on

February 22, 2021

People hear the Bank of Canada predicting no rate increases until 2023 and take that as gospel. Maybe they shouldn’t. The Bank of Canada’s key overnight rate—which more directly impacts floating-rate mortgages—doesn’t constrain fixed mortgage rates in the same way. The latter are driven more by what the bond market thinks the Bank of Canada (and the economy) will do...

read more

By The Spy on

February 16, 2021

The entire mortgage market was waiting, and now, after 10 months, it finally happened. Canada’s 5-year bond yield (which influences fixed mortgage rates) broke through major resistance, resistance that goes all the way back to April of last year. It’s a signal that better economic times lie ahead. A sign that inflation should no longer be just an afterthought. A...

read more

By The Spy on

February 10, 2021

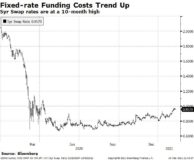

It’s not getting any cheaper for banks to fund a fixed-rate mortgage. In fact, Canada’s 5-year swap rate, a common measure of 5-year funding costs at the big banks, is running at a 10-month high. Yet, still we’re seeing lenders trim 5-year fixed rates as the cut-throat spring market approaches. RBC chopped its 5-year fixed by 18 bps last week....

read more

By The Spy on

February 6, 2021

5-year fixed mortgage rates tend to shadow 5-year government yields. And for most of nine months, the 5-year yield has been locked in a 21-basis-point range, a range so tight it was practically inconceivable prior to COVID. And, while no one has ever seen a range like this in our lifetimes, ultimately the 5-year yield will break out. When that...

read more

By The Spy on

February 4, 2021

Lenders are not done sacrificing profit for market share. On Thursday, we hit yet another all-time low for 5-year fixed mortgage rates: 1.25%. That’s for default-insured mortgages only (like virtually all the lowest 5-year fixed rates). Insured or not, it’s a staggeringly low price for 5-year money. At 1.25%, this offer is just 31 basis points above the 5-year swap...

read more

By The Spy on

January 29, 2021

Tangerine has ratcheted up its competitiveness. For non-default insured mortgages, it is suddenly the national leader on four fixed terms: 2-year fixed at 1.64% 3-year fixed at 1.59% (lowest refi rate in the country) 4-year fixed at 1.69%, and 10-year fixed at 2.14%. These are exceptional rates for uninsured mortgages (which include refinances and purchases over $1 million), particularly if...

read more

By The Spy on

January 24, 2021

The government’s “B20” stress test has blocked countless people from buying rental properties as investments. The current 4.79% minimum qualifying rate means would-be buyers have to prove they can afford mortgage payments far above what they’d really pay. Fortunately for some borrowers, there are alternative lenders (e.g., credit unions) that don’t impose the federal stress test. They qualify borrowers on...

read more

By The Spy on

January 19, 2021

If you’ve got a hankering for a mortgage with maximum rate assurance, none beats the 10-year fixed. But once Canada rounds the corner on its economic recovery, 10-year rates could climb faster than other mortgage rates. The reason: 10-year terms reflect longer-term economic expectations than 5-year terms, for example. As a result, they often react more to changes in the...

read more

By The Spy on

January 14, 2021

Variable rates on new mortgages could get a little cheaper this quarter, for one of four reasons, or maybe all four: Bankers’ acceptance (BA) rates — a general proxy for variable-rate funding costs — are at an all-time low. That’s boosted the spread between prime rate and BAs to almost a 12-year high. Think of that spread as a rough...

read more

log in

log in