Bond yields heavily influence what people pay for a mortgage. In general, the more government bond-buying there is, the lower fixed mortgage rates go.

Explainer: Bond prices and bond rates (yields) always move inversely. Fixed mortgage rates are benchmarked against bond yields.

Governments around the world are manipulating mortgage rates by buying their nations’ own debt.

Take the U.S. Federal Reserve, for example. It’s bought up over 16% of America’s massive Treasury market.

But, percentage-wise, that’s conservative compared to our very own central bank. The Bank of Canada owns almost double that percentage. So far, the BoC has snapped up over 30% of Canada’s $1.04 trillion Government of Canada bond and Treasury bills market (as of Sept. 8, according to the Bank of Canada).

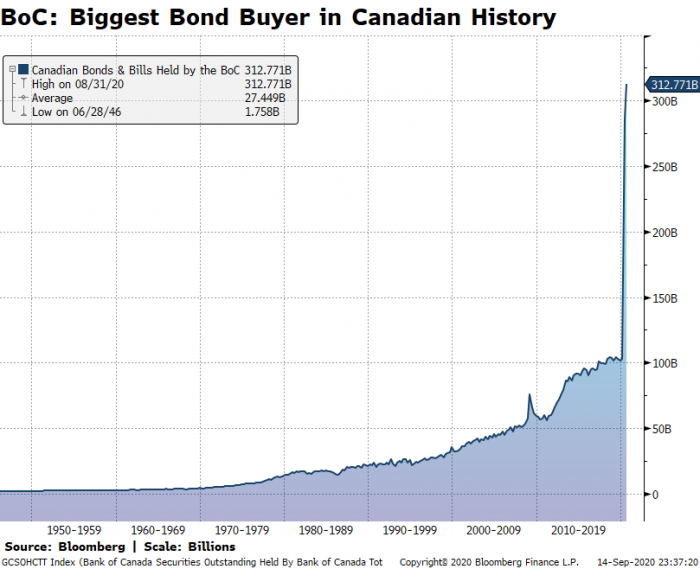

This chart below shows how dramatically the BoC has stepped up its bond-buying.

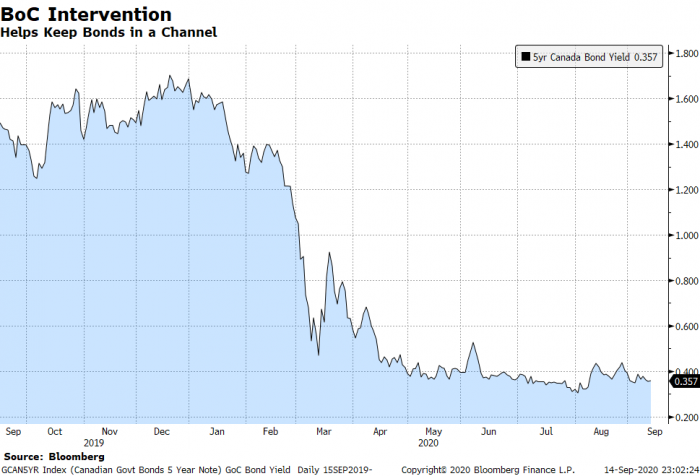

BoC bond purchases are a big reason why this chart of the 5-year yield is going sideways—holding down 5-year fixed mortgage rates in the process.

Investors are less likely to sell government bonds knowing the BoC has a standing buy order. And whenever investors do sell bonds—which would normally drive up rates, other things equal—the BoC is there waiting to scoop them up. If 5-year bond prices won’t go down, yields (and mortgage rates) can’t go up.

As mentioned, all this central bank buying is keeping yields unusually flat. Volatility in Canada’s bond market is now the lowest it’s been this millennium. There’s something somewhat eerie about that, knowing that calm always appears before a bond market storm.

That storm is (hopefully) far off on the horizon, but it’s coming at some point. Borrowers should prepare to batten down the hatches when it does—i.e., when the BoC stops buying bonds or, heaven forbid, starts selling them.

Just last week, the Bank of Canada trimmed its Treasury Bill purchases, showing that its buying is not limitless.

The end of QE (“quantitative easing,” as it’s called) has considerable mortgage rate implications. We’ll explore those risks in a Globe and Mail column this week.

log in

log in

10 Comments

Looking at that chart and reading your commentary makes me think that fixed rates are really near the bottom since the BoC is probably not going to buy even more than 30% of the market.

Is that a reasonable interpretation of the above?

Hey Jack, Fixed rates could drop more but they’re not that far from the bottom.

Unfortunately there’s no way to know when BoC bond buying will end. It may be next year, but it depends how bad Corona II gets.

BOC buying is creating a pressure cooker for interest rates. If you want to see what the end of QE means for rates just Google “Taper Tantrum.” It’s not pretty.

The following article from Reuters provides a play-by-play to the 2013 Taper Tantrum as indicated by reader BaySt:

https://ca.reuters.com/article/idUSKCN1P52A8

Haven’t “experts” been saying pretty much the same thing about the BoJ for the past 20 years? I don’t think their rate has gone over 0.5% in that time.

Negative rates folks….keep your eyes open for the signs. Buffet has exited banks and moved into gold…..oil on the exchange was the first test on the publics’ perception of anything being negative.

Negative bond yields maybe. Negative overnight rate HIGHLY unlikely.

There is something I do not understand… If the BOC decides to stops buying (highly unlikely in my mind…) what will happen with the CAD? The theory says that bond prices will drop, yields will rise, therefore the CAD/USD should rise too? So we will not only have a house crisis but a currency appreciation that will hurt exports even more… What am I missing and if I am right how do you hedge about this scenario? My mind on the other side makes me think the CAD will drop drastically even if yields rise… but I don’t have any theory to support that thinking other than people will think twice to bring money into a market that may be crashing… Again… what am I missing?

Hi Joe, The BoC’s Bond Purchase Program will end at some point; just a question of when. Officially, the BoC says it “will continue until the economic recovery is well underway.”

What happens to CAD is mainly a function of bond yield differentials (primarily with the U.S., as driven by inflation expectations, fiscal policy, etc.), GDP, energy prices, trade developments and “safe haven” flows. So predictions are impossible to pin on one factor. That said, any rising yields that result from a tapering of Canadian bond buying are clearly pro-CAD, “other things equal.”

There’s arguably only a small chance of large appreciation that would significantly slow exports.

Now locking to variable interest rates is about 2.0 % to 2.25% with leading banks and we are in Q4.

Does it means it has a probability of getting down to the level of 1.75 to 1.90% with the latest announcement of BoC for lowering its prime rates though fixed mortgage rates have no connection with it and entirely depends on Bond Yields?

Please elaborate.