Here’s some good news for people who’ve been blocked from qualifying for a mortgage due to the government’s “stress test.”

Canada’s banking regulator (OSFI) is taking a second look at the mortgage stress test calculation, which requires borrowers who are not default insured to prove they can afford a monthly payment at the greater of:

(A) Their actual mortgage rate plus two percentage points, or

(B) The typical Big Bank posted 5-year fixed rate (a.k.a., the “benchmark rate”).

It’s this second rule (B) that’s the biggest problem.

“We are reviewing this aspect of our qualifying rate, as the posted rate is not playing the role that we intended,” said Assistant OSFI Superintendent, Ben Gully in a speech last week.

The issue—as you’ve heard the Spy report for a year—is that the benchmark rate (5.19% today) is too high relative to actual mortgage rates. That makes it unnecessarily difficult to qualify for a mortgage. And it’s been that way since the first half of 2019, despite diving market interest rates.

All kinds of people have called OSFI out on this, including top economists, banks and housing industry executives. And now, thankfully, OSFI seems to be acting.

“For many years, our data showed the difference between the benchmark rate and the average contract rate was about 2%,” Gully said. “This provided a healthy buffer. However, the difference between the average contract rate and the benchmark has been widening more recently, suggesting that the benchmark is less responsive to market changes than when it was first proposed.”

That creates economic risk because when market rates drop significantly, it implies greater chance of an economic slowdown. Given how vital real estate is to the economy, it’s counterproductive to artificially block people from entering the housing market and creating jobs while Canada’s outlook is dimming. A falling qualifying rate acts as a “shock absorber,” so it helps to be responsive to changes in Canada’s outlook.

It’s also vital that the stress test not be so onerous as to drive borrowers to less regulated, higher-cost lenders. And that’s exactly what’s been happening, in record numbers.

Contract + 200 Bps Seems Here to Stay

As mentioned above, for uninsured mortgages, the stress test rate equals the greater of the borrower’s actual mortgage rate plus 200 bps, or the Bank of Canada’s benchmark rate. The latter is published by the Bank of Canada and equals the mode average of the Big 6 banks’ posted 5-year fixed rates.

OSFI says it “is confident that the contract rate plus 200 basis points is a reasonable measure to qualify a borrower.”

OSFI says it “is confident that the contract rate plus 200 basis points is a reasonable measure to qualify a borrower.”

It “helps borrowers and lenders manage a sudden change in circumstances such as an income loss, increased interest rates, and/or additional expenses,” said Gully. “This will therefore remain a key part of OSFI’s guideline B-20.”

What OSFI is not so confident about (for good reason) is how to calculate the stress test’s floor rate, also known as the minimum qualifying rate.

“We…believe that without a floor on the qualifying rate, some borrowers could select variable or shorter-term loans that may not be appropriate for their risks.” Fair point.

The problem is, those crafty banks are keeping their posted rates inflated, which keeps the minimum qualifying rate inflated.

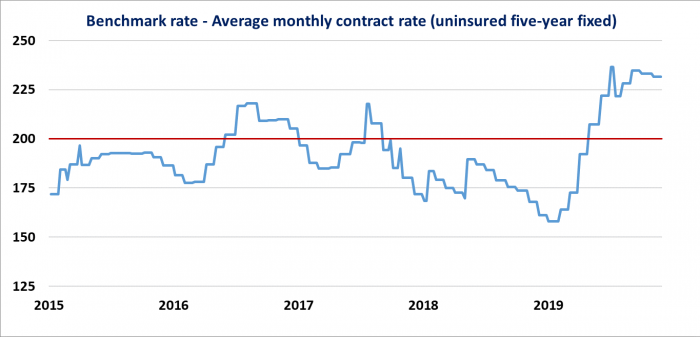

This chart from OSFI illustrates what’s happened since the beginning of last year. It shows the difference between the banks’ benchmark posted 5-year fixed rate and regular 5-year fixed rates.

The spread is increasing because mortgage rates are falling while the benchmark rate stays fixed.

One of the reasons banks are keeping their posted rates high is to earn more penalty revenue from borrowers who break their mortgages early. Other (less sinister) reasons are to increase prudence given heightened housing risk and boost earnings buffers given higher regulatory costs.

Here’s a longer-term look at the stress test versus Canada’s 5-year bond yield.

You can see that the spread has been getting bigger over time, including over the last year.

Based on the level of yields, the floor for the stress test should be no more than 4.84%, give or take.

In other words, the current stress test is at least 35 bps too tight, going by history.

This means a theoretical borrower has to earn at least $2,500 more per year to afford a mortgage on the average $517,124 home. Put another way, it cuts the typical buyer’s maximum purchase price by over 3%.

The effect of a 3% drop in affordability may not sound like much, but view that in the context of a million+ borrowers a year and Canada’s $5+ trillion residential real estate market. Then the numbers start adding up. In aggregate, an overly strict qualifying rate has a meaningful effect on marginal housing demand and the ability to refinance cost effectively.

As for the contract rate + 200 bps part of the stress test calculation, that’s likely not changing—despite industry criticism. “OSFI remains confident that the contract rate plus 200 basis points is a reasonable measure to qualify a borrower for an uninsured mortgage,” the regulator said.

What Happens Next?

The probability of stress test relief has increased thanks to Gully’s speech. That’s especially true given his speech comes after Prime Minister Justin Trudeau’s Dec. 13th request to have the Finance Minister review the stress test.

The probability of stress test relief has increased thanks to Gully’s speech. That’s especially true given his speech comes after Prime Minister Justin Trudeau’s Dec. 13th request to have the Finance Minister review the stress test.

What rate they ultimately choose for the stress test floor is anyone’s guess. But for the first time, there’s a good chance we could see stress test improvements (potentially easing of it) within 6 to 18 months.

We could also see banks being proactive and cutting their posted rates, in order to take the heat off. If so, that could add more fuel to the spring market.

As for the current stress test, “We chose the best available rate at the time…” said Gully. That’s debatable, however, as industry veterans might have suggested a more objective benchmark, had there been more industry consultation. But at least the regulator is cognizant of the problem and seems potentially willing to correct it. If it does, consumers and the economy will both benefit.

log in

log in

8 Comments

So any news on the insured mortgage stress test being looked at?

Hey Vincent, Our understanding is that Finance Department policymakers will be reviewing the insured stress test as well, as part of Trudeau’s mandate to the Minister of Finance.

Admitting there’s a problem is the first step. But I’ll be more impressed when they unveil their solution. Considering it took this long to acknowledge the diminishing relevance of the benchmark rate, I’m not holding my breath.

I think banks will drop their posted rates first!

The banks should be ashamed to be advertising posted rates north of 5%! As per usual, it all comes down to greed. How many poor suckers have actually been roped into a mortgage at those rates do you think?

I feel ya Gary. Thanks to the wonderful world wide web and stiffer competition, there aren’t as many suckers paying Big Bank posted rates. The most insidious effect of these artificially inflated relics (posted rates) is the massive prepayment charges banks can extract from people who don’t understand the penalty risk.

No reason whatsoever that existing homeowners should face the stress test if switching lenders. As long as their payment history is clean, where is the risk? If anything the stress test has created more risk by pushing borrowers who can’t pass the test to unregulated/private lenders. Can someone pls explain how this improves the stability of our financial system?

OSFI favours big banks all day every day. Boosting customer retention is just one more way OSFI helps banks make money. The more profitable banks are, the more stable they are, or so regulators think.