Despite higher rates, a healthy slice of our population is staying open minded to variable mortgage rates.

A CIBC poll today finds that:

- 72% of Canadians expect rising interest rates over the next 12 months (26% think they’ll stay the same)

- An overwhelming 83% of Canadians favour “predictability and stability over risk” when it comes to their finances (unsurprisingly)

- 77% of current mortgagors already have a fixed mortgage rate.

Yet, just half (54%) of homeowners or prospective homeowners say they’d take a fixed-rate mortgage if they had to choose today.1

The more rates increase, the more we could see informed borrowers choosing variable rates. Variable-rate advantages only improve the higher rates go.

The fact that variable rates are maintaining consumer mindshare in a rising rate environment is not surprising. Consider that:

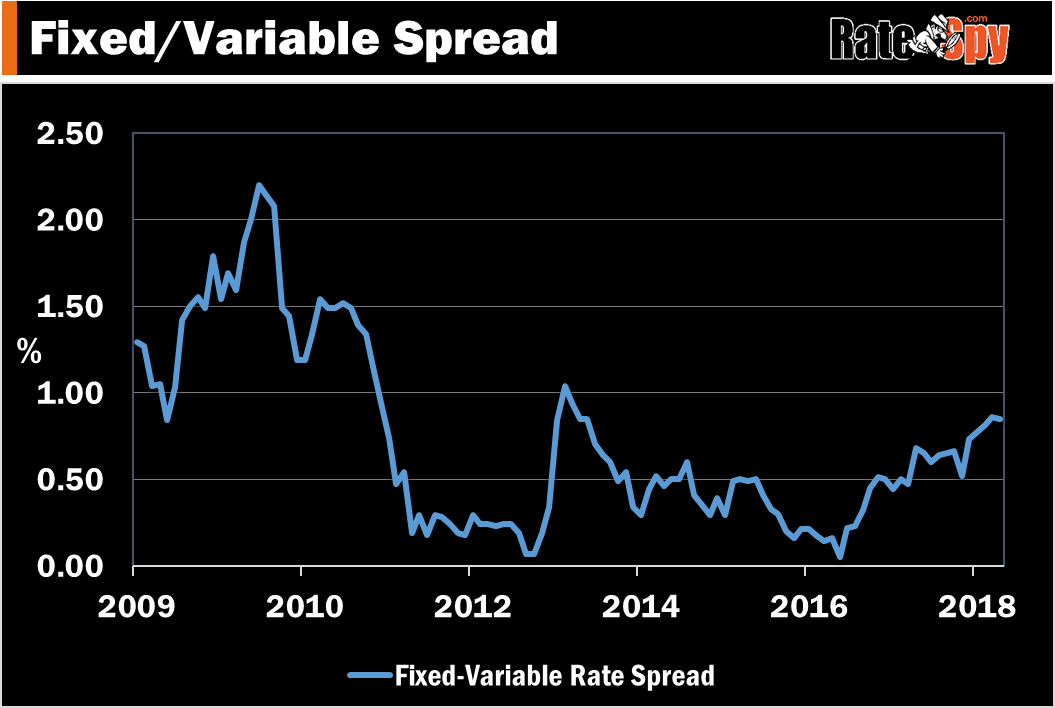

- The wider the gap between fixed and variable, the more costly the “insurance” of a fixed rate, and the lower the demand

- With higher debt loads, some consumers are drawn to the upfront cashflow advantage of a variable rate

- Rising home prices create bigger equity buffers, giving some borrowers the confidence to assume more risk with a variable rate

- Many floating-rate mortgages have fixed payments, reducing their perceived risk

- Some folks are simply more prone to variables, regardless of the rate environment. Past studies have suggested that one-third of variable-rate mortgagors always choose floating rates

- There’s anecdotal evidence that mortgage advisors have increasingly been recommending variable rates given the wide spreads from fixed rates and given their shrinking ability to compete with the lowest uninsured 5-year fixed rates

- Due to the latest government stress test, there is no longer a qualification advantage for choosing a 5-year fixed rate over a variable

- Variables have received an inordinate amount of media attention this year, boosting their demand somewhat.

The takeaway is that variable-rate market share will likely continue holding its own, despite further Bank of Canada rate hikes. And barring a drastic upside inflation surprise (which would not be variable-rate friendly), that’s a good thing.

1 The rest: 19% would choose a variable-rate mortgage and 26% are undecided.

log in

log in

Despite higher rates, a healthy slice of our population is staying open minded to

Despite higher rates, a healthy slice of our population is staying open minded to

14 Comments

Wow #1 a big footnote. It is correct, but misleading

Misleading? How so Tyler?

BMO was totally flooded with applications during its prime – 1% special. I imagine the other banks were too.

When I first read:

“Yet, just half (54%) of homeowners or prospective homeowners say they’d take a fixed-rate mortgage if they had to choose today.”

It makes me think approximately half of the people will choose a variable rate. But that’s not true, 26% of the people are on the fence.

I appreciate you putting in the footnote, as many other websites would not.

Gotchya. Yeah, the fact that variable-rate share is still near or somewhat above normal is notable given Canada’s well-publicized rate hike cycle.

On a side note: Over the last two weeks at the Spy, 42% of rate searches were for variable rates verses the 35% long-term average. 3 out of 5 of the site’s most popular rates (as measured by clicks) continue to be variable rates.

If this is your primary residence. It makes sense to go with variable.

Using 20 years average for example, variable always win because your rate is a prime minus.

Prime rate goes up and down. If it goes up, you will pay more after 5 years; if it went down, you overpaid in the 5-yr term.

Calculate it for 20 years, not 5.

What’s the consideration when choosing a variable rate from HSBC (prime – 1.06) vs the big banks? Why would people go with big banks when HSBC is offering a better variable rate?

Also, would you predict that there’ll be further discount for variable rate (bigger than prime – 1), given that the spread of variable and fixed are trending upwards?

Hi Clinton,

A few notes about HSBC’s variable:

* It’s the lowest variable in Canada for refinances (the rate savings is a big reason people trade their big bank mortgage for an HSBC mortgage)

* After the third anniversary, the mortgage is fully open (a great feature)

* HSBC limits you to a 25-year amortization at this rate

* This rate is not good on non-owner occupied rental properties

* HSBC does not offer this rate with an automatically re-advanceable credit line (like all the big banks). HSBC’s version is manually readvanceable (inconvenient if you use your HELOC a lot).

Many folks are wed to their banks because they trust the brand, like to consolidate their finances in one place and because that’s where they have their chequing account and “relationship.” Does that relationship outweigh the extra interest they pay? In most cases, not likely.

On your last question, we could see variable-rate discounts increase slightly from here if/as prime rate increases. But it wouldn’t be a dramatic improvement, like 1/4 point or something.

I bought a house last year with a variable rate of 2.10 percent. Now, it stands at 3.10 percent with 4 years remaining. Should I continue the path of variable rate or lock in ? I heard that more rate increases are coming and it makes me nervous ! Any insight appreciated ! Thanks.

Hey John,

So many things go into answering that.

What lender is it?

Is your variable rate fixed?

What is the home and mortgage value?

What is the remaining amortization?

Do you have a lot of non-mortgage debt relative to your income?

Can your family budget withstand a 0.75%-pt higher rate?

Are you well qualified with great credit and stable provable income?

Do you have liquid financial resources to fall back on?

Will you make any changes to the mortgage in the next five years?

John,

Early renew or switch to another bank like HSBC, and you’ll save money. The 5yr variable only has 3 months interest penalty, which would be much less than the interest savings over the next four years. Some banks will even let you add the penalties to the mortgage principal (such as BMO).

John,

Quick math

3.10%-2.64% = 0.46%

$300,000 * 0.46% = $1,380 per year

$1,380 * 4 years = $5,520 over 4 years.

($6,900 over 5 years, but you said you have 4 years left)

The cost to switch usually 3 months of interest with variable

3.10% * $300,000 / 12 month in a year * 3 month = $2,325

You’ll have to pay for your mortgage discharge fee. With HSBC they won’t cover your lawyer fee, however, they’ll give you $1,000 cash back and another $300 for the bank account they’ll request you open (you only have to if you want to make double payments). They will ask to pay a $298 appraisal fee too, but you might be able to talk to them to cover this (I could not as I was switching from a collateral mortgage to a conventional mortgage). So it’s almost a wash.

Ratespy says if you have an insured mortgage, then you can get an even better rate than HSBC 2.64% (Prime – 1.06%).

So bottom line:

$5,520 (interest saved) – $2,325 (penalty) – 400 (discharge) = $2,795 over 4 years.

You’ll be trading your 4 year mortgage for a 5 year.

I am on fence whether to go with Fixed or Variable. I got a fixed 5 year for 3.25 and Prime -1 for 3 year variable. Which one I should go for? Any advise?

Hi Ace, Both those rates are solid. You might be able to save a bit more if your mortgage is “insurable” and you compare more rates, but well done regardless.

The gap between those two offers is just 55 bps. That’s not much historically speaking. In other words, you’re paying relatively little for the certainty of a fixed rate, assuming these are the only two choices you consider.

While there’s not enough info in your post to make a recommendation on fixed or variable, these links might help you decide:

https://www.ratespy.com/fixed-or-variable-rate-the-decision-checklist-02223752

https://www.ratespy.com/canadas-neutral-rate-in-perspective-07176601

https://www.ratespy.com/bank-canada-may-favour-07086461

https://www.ratespy.com/dont-go-variable-rates-overextended-05266065