—The Mortgage Report: Aug. 25—

Yes. The Question is: When?

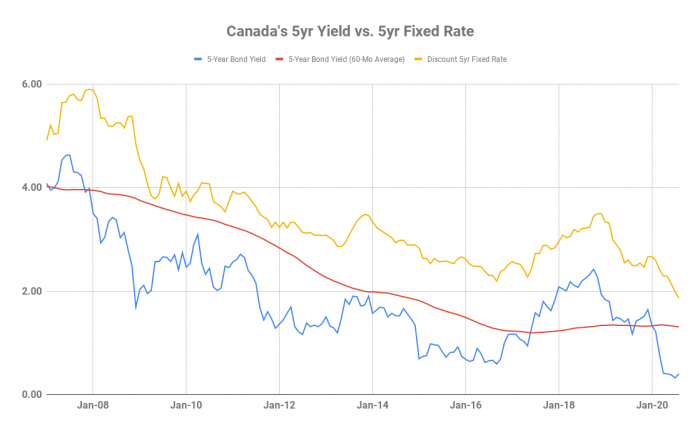

- Most readers know that fixed mortgage rates follow bond yields. But it’s bond yields south of the border that are particularly influential for Canadian mortgage rates — given U.S. influence on our economy.

- To get to 1.49% on discounted 5-year fixed rates, we need a Canadian 5-year bond yield near zero (since 5-year fixed rates tend to be roughly 150 basis points above the 5-year yield).

- To get to 0% on Canada’s 5-year yield, we likely need a U.S. 10-year yield at roughly 0.25% or less (it’s 0.69% now). That’s certainly within reach, with some bond experts projecting it to hit zero or even go negative.

- The real question, though: Is it worth the gamble to wait for record-low 1.49% rates? The prudent answer is usually “no.” It’s too easy to miss the bus when trying to pick a bottom in rates. Yes, yields could approach zero. But it could take months or even years to get there. No one really knows.

- If you’re going to try and hold out anyway, put a tight “stop-loss” on the 5-year yield. In other words, if you see Canada’s 5-year bond yield spurt above 0.55% to 0.60%, lock in a rate hold pronto. You can always keep rate shopping and reset your rate lower after that.

- The takeaway: Canadians already enjoy tremendously low (record low) rates. Insured rates are now just 10 bps away from 1.49%. If your mortgage closes in the next 120 days and you plan to lock in, be careful about pressing your luck too much.

Deferrals Still Running High

- Third-quarter bank earnings reports are starting to come in. Early indications are that mortgage deferrals at major banks haven’t come off their peaks like they have at other lenders. Examples:

- At BMO, 14% of mortgagors were deferring payments in Q3, the same as last quarter

- At Scotiabank, 18% of mortgagors were deferring payments in Q3, up from 17% in Q2/20

- By the end of October, most of these deferrals are expected to wind down.

- One key to remember: Getting a deferral has been far easier at the major banks than at most other lenders. More importantly, big banks have been doling out 6-month deferrals while most smaller lenders were doing 1-3 months tops. That’s contributing to higher and more persistent deferral rates at the banks.

- If you’re worried about the end of deferrals triggering a housing sell-off, note that:

- These are mostly “super-prime” customers with over 40%+ equity on average, says Scotiabank. Very few will be panic-selling houses.

- To date, Scotiabank has seen 99.4% of customers remaining current on their mortgage after coming off deferral. Albeit, there’s just weeks of data here, so we don’t think this is a representative sample of borrowers.

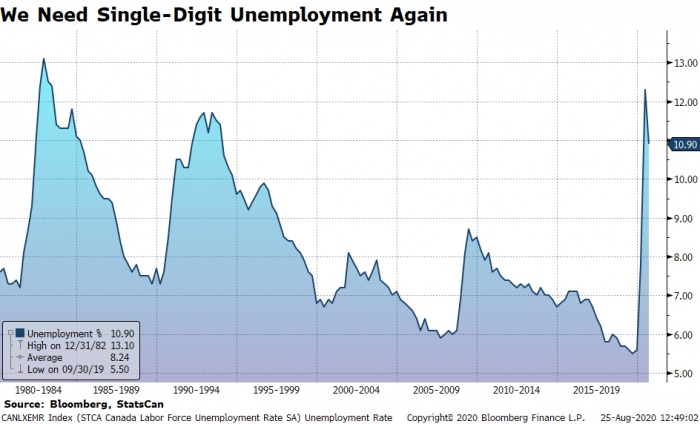

- There’s one thing everyone can agree on. Unemployment needs to drop. That’s the #1 way to minimize the number of people unable to handle their payments when deferrals end.

A QE Primer

- “When we buy Government of Canada bonds, this is called quantitative easing, or QE for short,” says the Bank of Canada. “QE can encourage spending and investment by households…For example, if our purchases lowered the yield on five-year government bonds, this would be reflected in lower interest rates on five-year fixed-rate mortgages. And that makes it cheaper to borrow to buy a house.”

The BoC Wants Your Opinion

- You can tell the Bank of Canada exactly how you think it should guide its key interest rate…..by taking this survey.

log in

log in

46 Comments

How are 10 year rates looking? Offered 2.39%

You got 2.39% on a 10 year fixed? With who??

I’m applying with Tangerine on a 10 year fixed at 2.59% as the IntelliMortgage is only for a closing within 30 days at 2.55% and my mortgage is in Nov. So who is offering 2.39% and what are the conditions….

Manulife have offered me a five year fix @ 2.04%. I’m taking that.?

TD offered me a five year at 1.79%

TD is offering 1.89% on a 5 year fix.

Isn’t TD a Collateral charge? Also, do banks cover the legal fees at renewal when you switch lenders and have a collateral charge? Also, Is there no legal fees when switching lenders at renewal when you have a conventional charge?

Planning to get a mortgage and want to make sure I know most of the variables in the equation.

Hi Nitish, Some lenders now cover the collateral charge switch fees and/or offer cash rebates big enough to cover them. You’ll want to compare total borrowing cost, however. Sometimes the lenders that pay more have higher rates.

And no, there are always legal costs when switching lenders. It’s just a matter of who pays them. On conventional charges, almost all competitive lenders pay the legal and appraisal costs for 3- to 10-year year terms. A much smaller number pay them on 1- and 2-year terms.

I have offer from EQ bank for 1.69 5y closed. Or 1.6 variable.

Is 1.79 using high ratio 5 year fixed mortgage or traditional 5 year fixed?

National bank offers 1.70 for 5 year fix, 25 years amortization.

Unless people state their equity (loan to value) and disclose if their mortgage is insured I find these random rate posts pretty useless.

The point of the article was with respect to Bond Yield / Price direction. The assumption is Bond Yields are going to continue to fall (i.e. “higher” bond prices / demand).

The near-term has been much different since early August, as US treasury has been doing a multitude of new issues (mid to longer dated) resulting in lower bond prices (oversupply / “no takers”). The issues are to pay for US stimulus.

Yields have risen considerably in the last 3 weeks and unless the US Fed reverses course and starts buying again, yields are likely to rise further.

Canadian Gov’t bond yields have risen as per US Treasuries.

Hi Bond_Watcher, The main point was that it’s not worth waiting for lower rates — for most people.

And yes, yields have been in a mini-uptrend. Of course, that says nothing about where rates will be next month.

80% equity in home. 10 years left. Plan to early refi with 2.5 years left on previous 5 year term of 3.19%. Have offers of 1.84% and 1.96% from two major banks.

Hey Joe, Just curious. What did your existing lender offer and what is the penalty and mortgage balance?

Joe, which major banks? I’m just about the renew my term and I’m currently with RBC.

I have 1.74% from BMO

Are any posters able to provide input for uninsured mortgages due to mortgage size over $1M? As required, this would involve 20% down.

Via a broker, the best rates I have been advised of thus far are (i) 5 yr fixed with 25 yr amortization at 1.84%, (ii) 5 yr fixed 30 amortization at 1.94%, or 5 yr variable at 1.7% (via a rebate of 0.1% cash).

Hey Car, Those are solid rates. Good job. At $1M+ you might be able to shave another 2-5 bps off if you’re well qualified and talk to a bank or high volume broker.

Looking to break my 4 yr fixed uninsured mortgage with TD Bank which is at 2.79%. I’m only about 14 months into the 4 yr term.

TD offering me 1.89% for 5 years fixed but penalty would be imposed for refinancing early. Blend & extend option is alternative to paying the penalty upfront but would result in a rate higher than 1.89%.

Hey Barry, You might be able to get TD to lower the penalty 15% (the amount of the prepayment privileges).

I’d ask them to do that and then tell you the total borrowing costs — including penalties and fees — of each option:

1. status quo

2. break/refi

3. blend to maturity (i.e., blend with a new term that matches your existing remaining term)

Hey Barry Penner, what about blend to term, what offer do you get?

Hi Arun, did you get the 1.74% 5 yr fixed from BMO recently and is that an employee rate?

Speederpro it is traditional.

My Manulife renewal of 2.04% fixed for 5 years is on a non insured mortgage of $226,000 With 50% equity on a 20 year amortization. I also have a line of credit if needed of $134,000 @ 3.05%.

I can invest any other extra cash In a TFSA, RESP, or other investment platform, which should make more than if I were to pay down the mortgage…..even if I have to pay CGT.

We have no car payments or other debts.

Using Manulife, I don’t need to go to any other lender, ever and have lots of room for a rainy day or more.

Hey Spy, In answer to above. Existing lender offered 1.96 initially with 20% reduction on prepayment charge of about 23K with $670K remaining on mortgage. Since other major lender drop offer to 1.79% on 5 fixed the existing lender is sharpening pencil. These are non insured.

Hey Joe, If you haven’t seen it already here’s a quick calculator to estimate rate differences: https://www.ratespy.com/mortgage-rate-comparison-calculator

You can compare the savings of leaving to the penalty and make the right call. Be sure to factor in all fees.

hi I have private loan of 290000 left and looking to refinance. I like to pay off my mortgage asap. looking for 5 year fix. the best rate I can get

thanks

Hi James,

Have a look here: https://www.ratespy.com/best-mortgage-rates/5-year/fixed

But keep in mind, these rates apply to well qualified borrowers with an owner-occupied property.

So they may or may not apply to you, depending on your situation.

Hi Spy team,

I just bought a house with closing around Oct and am looking for various mortgage options. Is it better to go for fixed or variable? I am guessing with the pandemic the interest rates may still go down? Should I take a chance and go with Variable option

Hi Sneha, See: https://www.ratespy.com/canadas-newest-fixed-rate-record-1-39-082715542#comment-126816

I know no one has a crystal ball. My question: Is it worth breaking 3.19% contract in mid term of 5 years (30 months) and pay penalty to get new mortgage.

Half term of the new mortgage (first 30 months) is more of paying the penalty if I keep the same payment and remaining half will be more of benefit on low rate of 1.90%

Hi Saad, Depends largely on your mortgage amount, penalty amount, objective. See: https://rates.ca/mortgage-calculators/mortgage-refinance

Butler is offering us a 5 year fixed at 1.74%. We were planning on variable (current offer is 1.69%.

Butler did our last mortgage contract and we were pleased.

Matt says: August 25, 2020 at 02:41 PM

How are 10 year rates looking? Offered 2.39%

I was just on Tangerine and the 10 year rate is showing 2.59%. Did you get a direct offer for 2.39%

True North posted their best 5-year fixed rate as 1.79%, but for Maritimes, it’s 1.94%, has anyone got 1.79% in Maritimes?

Hi Jaya, Assuming you’re well qualified, the answer depends largely on what your home value and mortgage balance is?

Hi, Spy, my home value is about 300K, and mortgage balance is 120K. The posted rate for Maritimes went down again to 1.89% now.

Hi Jaya, Is it a basic renewal with no new money being borrowed? Which province?

Hi, Spy, I am in NS. It’s a basic renewal, no new money involved.

Hi, Spy, I am in NS. It’s a basic renewal, no new money involved.

By the way, the message I posted this afternoon somehow disappeared, here I post it again.

Hi Spy/ Experts

I have an option of going from current 2.49% fixed to 1.78% fixed (5 year uninsured ) with CIBC but with 12K penalty for early renewal .

Any tips on how to negotiate for a lower penalty?. I have tried but failed . They gave me an option of adjusting the penalty in the mortgage but with blended rate 2.1% which does not make sense

Hi AA, Did you ask CIBC if it would apply your unused prepayment privilege to lower the balance on which the penalty is calculated? That’s a very reasonable request and the least they could do to keep your business.

I am looking at a new mortgage for 480, 5% down. I am thinking I should try to get a short term low interest, and switch to a 10 year in 2 to 5 years. But the 10 year rate I was quoted was pretty low! What do you guys think?

5-year variable which is 1.55% (Prime – 0.90)

2-year fixed = 1.99% with THINK financial

3-year fixed = 2.09% with TD Bank

5-year fixed = 1.69% with THINK financial

10-year fixed = 2.89% with Scotiabank

Hey Kzin,

Tough to recommend a term without background info on you, but here’s what we can say.

1) That variable rate is solid from a discount standpoint, but it’s hard to comment on its desirability because we don’t know the lender/features, your 5-year plan, risk tolerance, etc.

2) Those 2-, 3- and 10-year rates are weak for an insured mortgage.

3) Depending on what province you’re in, that 5-year fixed rate is average.

4) We would almost never recommend a 2.89% 10yr over a 1.69% 5yr. The upfront rate premium and penalty risk (in months 1-60) is too great.

Hope this helps…