At long last a Big 6 bank has cut its advertised 5-year fixed rate.

RBC set the trend today in lowering its “special offer” 5-year fixed rate by 15 basis points, from 3.89% to 3.74%. (See: RBC mortgage rates)

It only took a month and a half after five-year bond yields fell enough to warrant a rate cut. (Bond yields typically guide fixed-rate pricing.)

Expect other big banks to follow suit soon and shave some of their advertised fixed rates. In fact, some of them already have but only internally (i.e., by slightly lowering the non-public minimum “floor rates” that their mortgage reps can sell at).

The bank herd should now settle somewhere around 3.64% in coming days on 5-year fixed discretionary rates.

Borrowers have been cursing the banks for weeks, waiting for one of them to pass through their lower funding costs to consumers. But bank competitors, like MCAP/RMG, XMC Mortgage, First National, Vancity and other credit unions, haven’t made borrowers wait. They cut rates weeks ago in some cases.

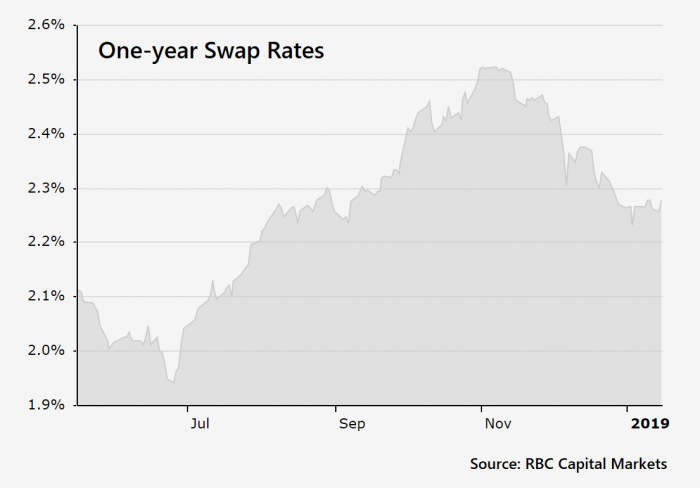

So far, it’s been mostly 5-year fixed rates that have dropped. Short-term fixed rates have remained stubbornly high, despite falling 1- and 2-year money market rates (as shown in this chart). That’s left 5-year terms, and perhaps the 3-year as well, as the only reasonably priced mortgage terms in Canada.

That’s Not All

RBC’s 5-fixed rate drop wasn’t the only big move Canada’s #1 lender made today. It also jacked up its variable rates a hefty 25 bps.

The bank’s 5-year variable leapt from 3.30% to 3.55% this morning, which will come as a surprise to most people. People expect variable rates to rise only when the Bank of Canada hikes rates. But that’s not always the way it works.

The bank’s 5-year variable leapt from 3.30% to 3.55% this morning, which will come as a surprise to most people. People expect variable rates to rise only when the Bank of Canada hikes rates. But that’s not always the way it works.

In this case, the bank cut its discount to prime rate, as opposed to raising its prime rate. So this only affects new variable-rate borrowers, not RBC’s existing customers.

This size of move, in one single shot, is somewhat rare. The bank is clearly making a statement about where it sees the trend in variable pricing.

We won’t reiterate for the umpteenth time why variable-rate discounts are dwindling, but click that link if you’re interested in the backstory. It’s also worth noting that RBC’s move comes after its CEO recently pledged to “do better” on its domestic mortgage margins.

Spread Implications

Based on typical big bank 5-year rates, the fixed-variable spread has now plunged from 104 bps in November to just 35 bps today. That’s going to make a whole lot more people question the attractiveness of variables. And that plays right into lenders’ hands as 5-year fixed rates are now materially more profitable for big banks given current funding costs and projected forward rates.

log in

log in

12 Comments

did RBC raise their prime rate or just reduce the discount on their VRMs?

Hey Tim, RBC cut its discount to prime rate.

basically aren’t they all cutting their discounts on variables so people lock into fixed rate mortgages which are more profitable for the big 6. not very consumer friendly are they?

Marie: Now do you really think banks would stoop to steering customers to a more profitable product?

You mean to tell us the big banks would willingly hold off on passing rate savings along to the consumer, so they could pad their own multi-billion dollar incomes? Surely you jest! 🙂

Why the bank bashing (other than it’s a broker crowd). The article speaks about bank competitors having already lowered. If consumers on new loans are choosing higher bank rates over lower rates from other lenders that use brokers, that’s just the market and consumer choice. Why would brokers complain when banks that don’t use brokers charge higher rates than nonbank lenders that rely on brokers? Not very intuitive. Doesn’t that practice help drive more business to brokers??

I couldn’t care less about brokers or banks but would like to know why anyone would pay more for a bank mortgage. What is the point?

HSBC is now offering 5, 7, 10 years fixed rate closed at 3.54%. Why would they have the same fixed rate at these 3 duration?

Hi Clinton, Where do you see HSBC’s 10yr fixed at 3.54%?

I’m trying to get pre-approved with them and they emailed me the rate.

1 Year Fixed Closed: 3.29%

2 Year Fixed Closed: 3.34%

3 Year Fixed Closed: 3.44%

4 Year Fixed Closed: 3.39%

5 Year Fixed Closed: 3.54%

7 Year Fixed Closed: 3.54%

10 Year Fixed Closed: 3.54%

Any insights on it?

It is currently Canada’s lowest 10yr rate and it’s a limited unpublished offer. A ten year term at that rate is suitable for some risk averse borrowers who don’t plan any mortgage changes before five years, but not for most borrowers.

I have to renew my mortgage this year and I’m thinking of buying a new-build as well. I can only hope that the rates go lower and lower!

I wrote a blog page about buying new homes in Edmonton, it has a ton of financing tips for new home purchasers. (Note, it’s for a school web project!)

http://mgill25.dmitstudent.ca/Insider-Tips-New-Build-Edmonton/