- Sub-1% Rates: One of the greatest economic tragedies in Canada’s history is unfolding before our eyes. When we talk about how low mortgage rates are, it can’t be stressed enough that no one wanted this to be the reason for it. But if there’s one silver lining, it’s variable-rate borrowing costs. 1 in 5 borrowers took out a variable-rate mortgage last year and a few lucky borrowers hit the jackpot. We’re aware of some customers who got variable mortgages last November at effective rates (i.e., factoring in cash rebates at the time) of prime – 1.46%. That’s a record discount. Essentially they’re now enjoying borrowing costs under one per cent (0.99%). Unfortunately, we likely won’t see such discounts again until the overnight rate climbs meaningfully above zero. That could take 18-30+ months years if history is a guide.

- Is Your Job Essential? Some lenders are now evaluating borrower income based on whether the applicant’s job is considered “essential,” as determined by the government (here’s Ontario’s definition, for example). Increasingly, mortgage applicants who don’t work in these sectors are having to prove their employer will continue to pay them during the COVID lockdown.

- Credit Impact: We’re hearing from big banks that mortgage payment deferrals will not harm customer credit scores—so long as the customer remains in good standing. But don’t take anything for granted. If you defer your payments, have the lender confirm to be sure—and get it in writing or record the phone call.

- 60,000: That’s how many online mortgage payment deferrals Scotiabank has approved in just five days. Inquiries to its mortgage call centre “are up more than 500%,” the banks says. CEO Brian Porter also said the bank has put aside “$5 billion of allowances for credit losses.”

- Remote Signings Stop: Leading title company FCT is halting in-person remote signings due to COVID-19. FCT closes switches and refinances for numerous lenders and is an essential cog in the mortgage wheel. The company will now reportedly use “virtual witnessing” of mortgage closing documents. Not all lenders may accept that process, however, which could potentially result in funding delays. Ask your broker or lender if your closing will be affected.

- Record Debt: TD Securities says Canada’s budget deficit could top $180 billion due to all these Covid-relief efforts. As a result, Canada’s federal debt-to-GDP will likely break its 1996 high of 100%. If taxes eventually go up to pay for it, that could further weigh down interest rates longer term. More likely, the government will just keep printing money, something that old school economists believe could eventually add premiums to Canadian bond yields.

- Default Drivers: DBRS says there’s a 79.9% correlation between unemployment and people not making their mortgage payments. It adds there’s a 49.1% correlation between annual home price decreases and mortgage defaults (from 1990 to 2019).

- Mortgage Liquidity Improves: If mortgage rates are to start dropping again, lenders need better access to cost-effective funding. And that’s what they’re starting to get:

- The Bank of Canada bought $1 billion of mostly 5-year government bonds today. It’s the BoC’s first foray into what’s known as “quantitative easing,” something we didn’t even see during the 2008 financial crisis.

- The extra that banks pay to fund 5-year debt in the bond market shrunk 10 bps today, a big positive.

- The BoC bought $235 million of Canada Mortgage Bonds (CMBs) in the open market yesterday.

- CMB spreads—i.e., the extra investors demand—for essentially risk-free CMBs have stopped increasing, at least for now.

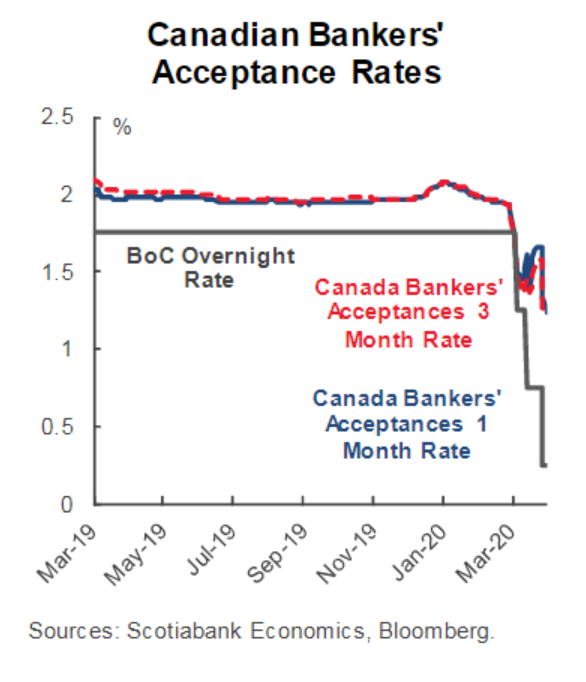

- Bankers acceptance (BA) yields are slowly drifting lower (BAs are a vital short-term funding source and they tend to correlate with variable-rate mortgage discounts). As we speak, however, they’re still well above normal given the 150 bps of BoC cuts.

Unfortunately, despite heroic measures by the government to boost liquidity, these spreads could potentially worsen if/as the market sees further devastation in labour, oil and corporate credit markets.

log in

log in

14 Comments

Hi Spy team, I love this website. Thanks for what you do here.

I’m currently 2 years into a 5 year term, on a fixed rate of 3.29% with ScotiaBank. My penalty to break the mortgage is $10,300. Chunky.

I have Prime -1.11% locked in with HSBC on variable, and 2.49% on fixed. I will be refinancing, so adding the penalty amount onto my principal and that total will become my new principal with HSBC. The principle after 3 years isn’t lower than my current mortgage if I go with the 2.49% fixed. It’s a lot better with the variable option obviously, so I will be going variable.

As my penalty is so large I was wondering if you expect Scotia’s 3 year posted rate to rise in the next 30 days?

Clearly things are volatile and uncertain, but was interested in your view. Any advice is appreciated.

Thanks!

Thanks Jim, Nice job on the P – 1.11% (1.34%), assuming you’re well suited to a variable. Wish I could tell you about Scotia’s 3yr posted but it’s really impossible to say. I trust your mortgage is big enough to more than offset the penalty and switch costs in three years, even if rates unexpectedly jump a bit.

My brother in UK is down to 0.1% variable, whilst I’m stuck with 3.99 fixed. The irony is being on disability my income is secure! Have to see the sunny side of life.

Love this site! I got prime -0.85 when we took out our mortgage 3 years ago! 2 years left on our term. So glad I didn’t lock into a fixed when rates started climbing shortly after our purchase. I now stand to save close to 4k in interest costs over the term by going variable back in 2017. Could be even greater savings if rates drop to zero or go negative!

Thanks Eric, Great call on the P – 85. Even if prime never drops below 2.45% you’re a champ at 1.60%.

Thanks The Spy. Mortgage is $460/$470k without/with the penalty. If I make the same payments over the next 3 years, I’m much better off with the variable and have plenty of room to still be better off when the variable rate rises.

It seems like the right thing to do, however is painful to take the penalty hit 🙂

Who if any offer a rate hold ( not a pre-approval )with a soft credit pull.

To Rob:

I could be wrong but I don’t think anyone does pre-approvals without a hard hit. If you can’t commit to even a credit pull the lender probably doesn’t want you.

ABroker, Rob isn’t opposed to a soft credit pull, he doesn’t want a hard hit that would affect his credit rating. Also, he’s not asking for pre-approvals, he’s asking who offers rate holds (with a soft credit pull).

To ABroker:

Maybe I am misunderstanding this whole process, from what I have read on various websites. I understand that a pre-approval takes a hard it, but I thought that just a rate hold only required a soft credit pull. I don’t want a pre-approval, I just want to be able to take something to my bank for a rate match.

Thank You

People often use rate hold and pre-approval interchangeably. Regardless, to hold a rate you have to submit an application. Like I said I don’t know any lender that guarantees a rate without doing a hard credit pull. There might be some but I don’t know them. This whole thing about soft versus hard credit pulls is overblown anyhow. A mortgage pull is maybe 5 points and you can have unlimited pulls in a 14-45 day period without hurting your credit score.

my current mortgage is up for renewal. would you recommend going with a variable for 5 years or a fixed for 5 years?

Hi Mike, We can’t give one-on-one term recommendations in this forum (others can, but we can’t). Hopefully this article helps a bit: https://www.ratespy.com/fixed-or-variable-rate-the-decision-checklist-02223752

@Mike if you could have locked into prime – 0.75 or prime – 1 then i would have done that. Most lenders now have their variables higher than their fixed. By the information i have read, Banks might go back to prime – 0.75 but that wont be for 3 plus months.